- Ethereum value hovers above $2,500 on Friday after hovering almost 100% since early April’s backside.

- The ETH Pectra improve has boosted over 11,000 EIP-7702 authorizations in per week, indicating wholesome uptake by wallets and dApps.

- The rising stablecoin utilization and tokenization, Layer 2 institutionalization and ETH quick unwind assist the value rally.

Ethereum (ETH) is making a comeback after months of underperformance. On the time of writing on Friday, it hovers above$2,500 after hovering almost 100% since early April’s backside.

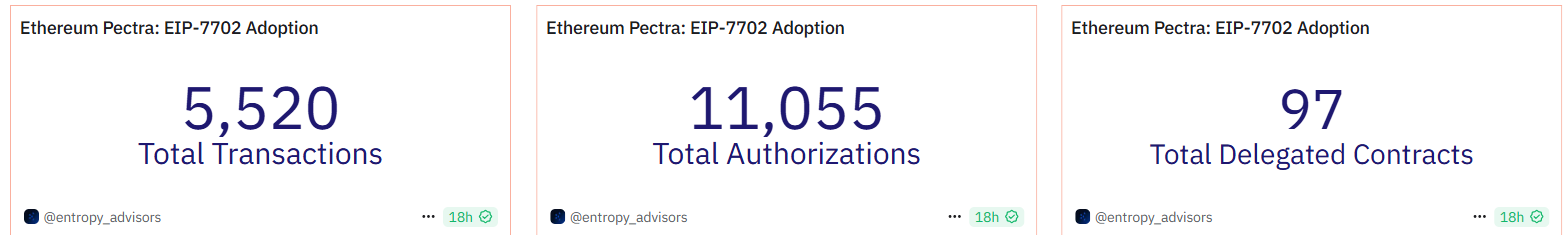

The Pectra improve has seen swift adoption, with greater than 11,000 EIP-7702 authorizations already processed in per week, indicating wholesome uptake by wallets and Decentralized Purposes (dApps).

Moreover, the surge in stablecoin exercise, rising institutional adoption of Ethereum Layer 2 networks, and an unwind of ETH quick positions gasoline renewed market optimism. To grasp whether or not this rally has endurance, FXStreet spoke with a number of crypto specialists for his or her insights.

Ethereum’s Pectra improve boosts authorizations

Ethereum’s newest main community improve, Pectra, went reside on Could 7, marking a major step ahead for the ecosystem. Inside only a week of its activation, over 5,520 transactions and 11,055 authorizations have been processed underneath the brand new framework, in accordance with Dune information — signaling sturdy adoption by wallets and dApps.

Constructing on the momentum of final 12 months’s Dencun improve, Ethereum’s Pectra replace delivers crucial enhancements throughout usability, scalability, and staking infrastructure.

In an unique interview, Alvin Kan, COO of Bitget Pockets, instructed FXStreet that, “Ethereum’s Pectra improve, which introduced options like gasless transactions and session-based permissions, unlocks highly effective capabilities and will convey the following wave of customers! If wallets are in a position to sort out the problem of turning Ethereum’s complexity into one thing intuitive — clear approvals, acquainted login flows, and built-in security checks, we transfer nearer to Web3 that feels much less like developer tooling and extra like client software program. Pectra cuts Layer 2 charges, and this might set off a brand new wave of on-chain exercise. Wallets can scale infrastructure and supply customers quicker transaction affirmation, higher bridging between L1 and L2, and seamless dApp interactions. Efficiency, not simply options, turns into a key differentiator right here.”

Indicators of a comeback

Ethereum value soared almost 100% from April’s low of $1,385 to Could 13’s excessive of $2,738, regardless of lagging behind BTC and different Layer 1 earlier within the cycle.

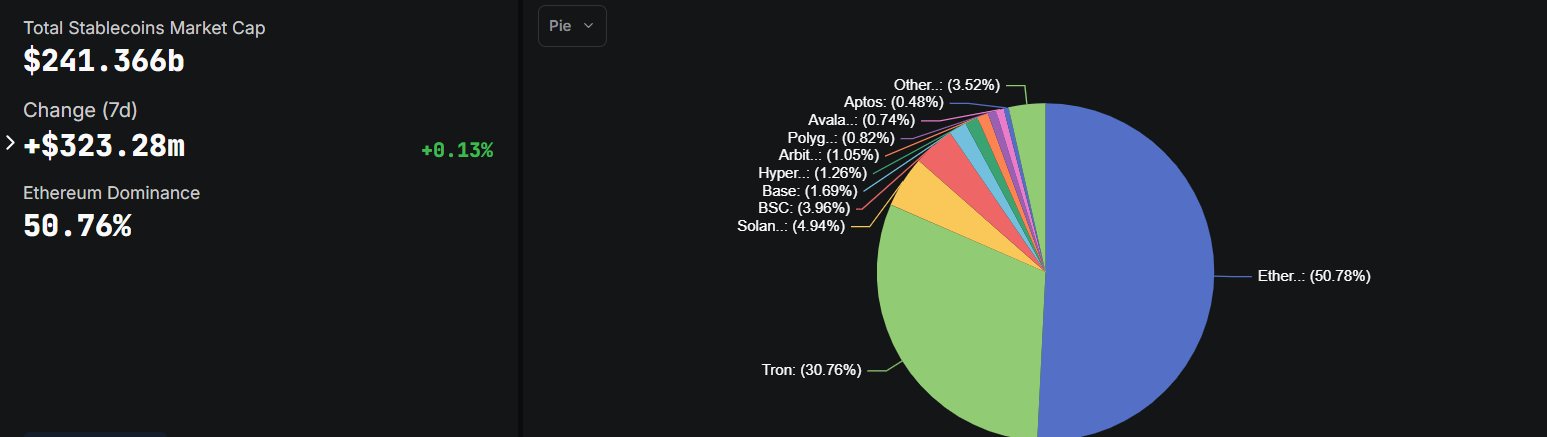

Bernstein analysts, led by Gautam Chhugani, recognized three key drivers behind Ethereum’s latest value rally. First, a surge in stablecoin adoption and asset tokenization has reignited curiosity in Ethereum’s function as foundational infrastructure, highlighted by Stripe’s $1.1 billion acquisition of Bridge and Meta’s renewed push into stablecoins.

The graph beneath by DefiLama exhibits that Ethereum at the moment hosts almost 51% of the full stablecoin provide, making it the prime platform benefiting from this pattern.

Complete Stablecoin by chain chart. Supply: DefiLlama

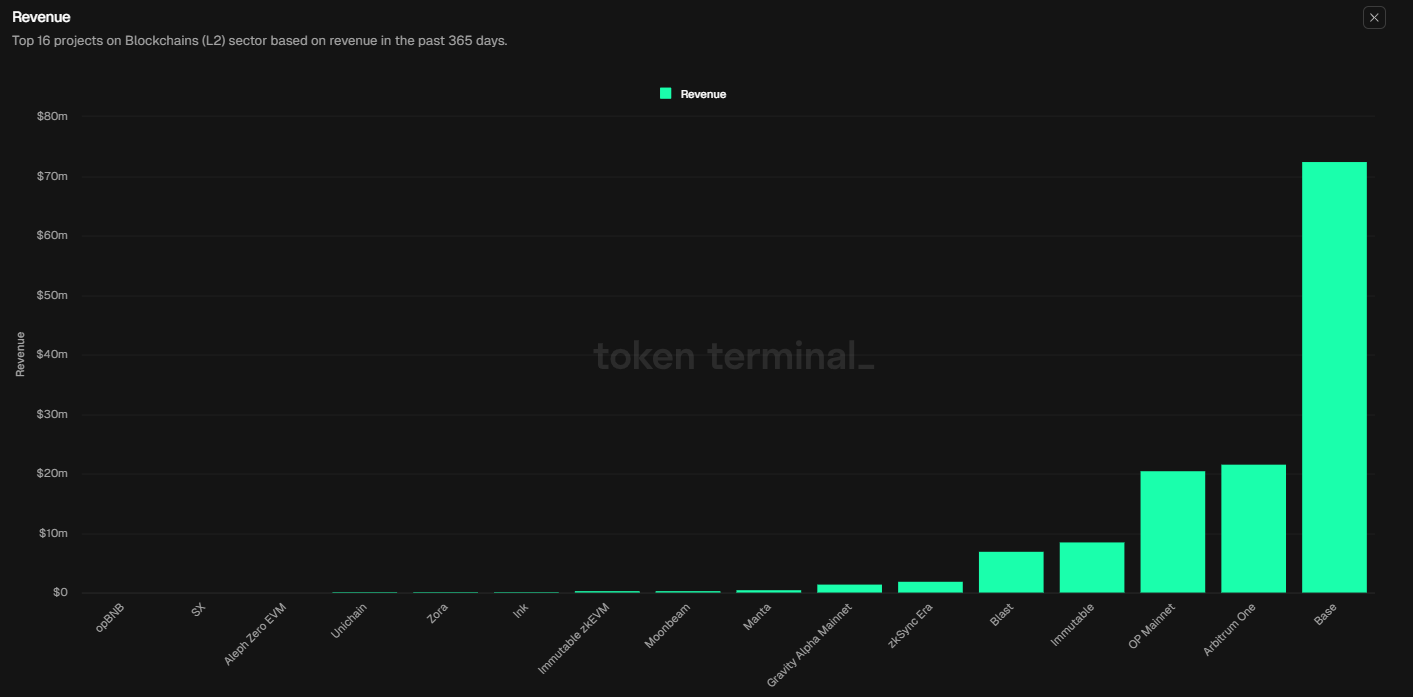

Second, Ethereum’s Layer 2 networks have gotten integral to institutional crypto infrastructure. Platforms like Base are producing substantial income, as proven within the graph beneath, and Robinhood’s acquisition of WonderFi alerts a possible enlargement into tokenized equities utilizing Ethereum-based techniques.

Layer 2 tasks income previously 365-day chart. Supply: Token Terminal

Lastly, hedge funds that beforehand shorted ETH to hedge lengthy positions in Bitcoin (BTC) and Solana (SOL) at the moment are reversing these trades. As Ethereum’s fundamentals strengthen and the market narrative shifts in its favor, the unwinding of those shorts has added additional upward stress to ETH’s value.

Furthermore, Derive.xyz analyst instructed FXStreet that ETH has a 20% probability of exceeding $4,000 by Christmas (up from 9% final week) and a 12% probability of hitting $5,000. The prospect of ETH falling beneath $1,500 by Christmas has dropped to fifteen% (down from 40%).

Technical outlook suggests rally continuation as 200-week EMA holds sturdy

The weekly chart exhibits that Ethereum broke above the descending trendline (drawn by connecting a number of weekly highs since mid-December) within the first week of Could, rallying 39% and shutting above its 200-week Exponential Transferring Common (EMA) at $2,243. Ethereum continues its beneficial properties by 3.26% thus far this week, and when writing on Friday, it trades above $2,500.

Taking a look at technical indicators, bullish momentum is gaining traction. The Relative Energy Index (RSI) reads 53 and factors upward on the weekly chart, indicating slight bullish momentum. The Transferring Common Convergence Divergence (MACD) is displaying a bullish crossover this week, additional supporting the bullish thesis, giving a purchase sign and indicating an upward pattern.

If ETH continues its upward transfer, it may prolong the rally to retest the 50% Fibonacci retracement (drawn from the December excessive of $4,107 to the April low of $1,385) at $2,746. A profitable weekly shut above this stage may prolong further beneficial properties to check the 61.8% Fibonacci retracement stage at $3,067.

ETH/USDT weekly chart

Nonetheless, if ETH breaks and closes beneath its 200-week EMA at $2,243 on a weekly foundation, it may prolong the decline to retest its psychological significance stage at $2,000.

Specialists’ insights on Ethereum

To realize extra perception, FXStreet interviewed some specialists within the crypto markets. Their solutions are said beneath:

Marcin Kaźmierczak, Co-founder & COOat RedStone Oracles

Q: How crucial is Ethereum’s dominance in stablecoins to its long-term valuation?

It’s a significant pillar of Ethereum’s moat, particularly as stablecoins underpin a lot of onchain exercise. If Solana or different chains begin to achieve vital stablecoin share, it may undermine Ethereum’s perceived dominance, however the L2 vs L1 worth break up complicates the image — most burn nonetheless comes from L1 exercise, though the roadmap has lengthy deliberate for L2s to scale throughput.

Q: Can Ethereum compete with Bitcoin as a retailer of worth, or ought to it focus solely on utility?

Ethereum doesn’t want to decide on. Its edge lies in being a hybrid — a utility asset powering onchain economies and a technological retailer of worth backed by ongoing innovation. That mixture is tough to duplicate and stays compelling for long-term believers.

Q: Is Ethereum the clear winner in real-world asset tokenization infrastructure?

Proper now, sure. Over 80% of tokenized property reside on Ethereum or its L2s, pushed by institutional belief and tooling maturity. However as utilization strikes towards DeFi, value and UX will matter extra, opening the door for competitors and L2s if Ethereum doesn’t maintain executing on the scaling.

Jaehyun Ha, Analysis Analyst at Presto Analysis

Q: What drives Ethereum’s latest 100% rally since April — fundamentals or positioning?

Ethereum’s latest rally seems extra positioning-driven than essentially led. Whereas the Pectra improve launched significant enhancements in scalability, staking economics, and UX (by way of EIPs 7251, 7702, and 7623), these adjustments are nonetheless within the early part of being priced in. The true catalyst appears to be a mixture of technical exhaustion, with ETH/BTC at decade lows, mixed with a sentiment shift sparked by management messaging and a visual crypto-native rotation. ETF flows stay minimal, underscoring that this transfer is basically pushed by intra-crypto positioning somewhat than institutional inflows.

Q: How crucial is Ethereum’s dominance in stablecoins to its long-term valuation?

Ethereum’s function because the dominant settlement layer for stablecoins is foundational to its long-term relevance. Nonetheless, that lead is being examined by extra performant chains like Solana. Finally, Ethereum’s potential to keep up composability, function a last settlement layer, and host institutional-grade stablecoins — together with potential sovereign-backed ones like a KRW stablecoin — shall be key to long-term worth accrual. Dominance in stablecoin issuance issues, however it’s Ethereum’s settlement layer stickiness that can decide its endurance.

Q: How a lot upside does Ethereum achieve from Layer 2 adoption and income progress?

L2 adoption is a crucial unlock for Ethereum, enabling scalability with out compromising decentralization. EIP-4844 and the Pectra improve additional cut back L2 prices by way of blobspace enlargement, however the important thing challenge now’s worth seize. ETH should show it might probably retain significant income and validator incentives in a world the place L2s settle cheaply. Whereas L2s act as distribution channels, latest L1 income drops post-Dencun present that Ethereum’s monetary sustainability wants recalibration to match this scaling success

Q: What are the primary dangers to Ethereum’s present value momentum?

Ethereum faces a number of headwinds: regulatory uncertainty round ETF staking and broader compliance points, weakening validator economics from declining L1 revenues, and the persistent concern that L2s could not contribute sufficient to ETH burn or worth accrual. If the bottom layer’s safety price range erodes, validator participation and decentralization may endure. In the meantime, except Ethereum finds a solution to sustainably monetize the L2 increase, momentum could stall regardless of sturdy adoption metrics.