It is a section from The Breakdown publication. To learn full editions, subscribe.

“Macroeconomics on this unique sense has succeeded: Its central drawback of despair prevention has been solved.”

— Robert Lucas, 2003

I’m sufficiently old to recollect when individuals thought recessions won’t be a factor anymore.

By the early 2000s, economists like Robert Lucas and Alan Greenspan argued that conventional recessions, through which a cyclical decline in demand led to a shrinking financial system, had been turning into an endangered species: much less steadily seen and fewer harmful once they had been.

This was generally known as “The Nice Moderation,” however simply as the concept was catching on, it was seemingly discredited by the “Nice Recession.”

There was nothing average in regards to the 2008 recession: Peak to trough, US GDP fell 4.3%, the biggest decline since World Warfare II.

That ought to not have discredited the moderation thesis, nevertheless, as a result of the Nice Recession is extra precisely generally known as the Nice Monetary Disaster — a monetary own-goal that had little to do with macroeconomics.

Almost 20 years later, the US nonetheless hasn’t skilled a recession in “the unique sense.”

The final conventional, business-cycle recession was method again in 1991, when Fed Chair Greenspan raised rates of interest to 10.5% and unemployment rose to 7.8% — and even that was thought-about a gentle downturn by the requirements of the time.

Within the 34 years since, we’ve solely had three recessions and so they had been all triggered by non-cyclical shocks: the dotcom bust and 9/11 in 2001, the monetary disaster in 2008, and the Covid pandemic in 2020.

As just lately as final week it appeared like we had been inevitably headed for a fourth.

However this week, markets rallied on a rising consensus that we’d keep away from it but once more.

Which makes me surprise: If a sudden commerce warfare can’t tip an growing old growth into recession, what can?

Is it solely pandemics and banking accidents that trigger recessions now?

Most likely not.

However equally, Greenspan was in all probability proper that the recessions we do have can be much less frequent and fewer extreme.

His speculation was based mostly totally on a perception in “higher financial coverage,” and that appears to have been borne out: If Fed Chair Powell guides the US to a gentle touchdown regardless of pandemic-induced inflation and tariff-induced uncertainty, I anticipate he’ll go down in historical past because the second best central banker of all time (behind solely the patron saint of inflation preventing, Paul Volcker).

One more reason Greenspan cited for optimism was the continuing “shift away from manufacturing towards providers,” and that, too, would possibly now be vindicated: This week’s market motion appears to recommend that even a 10x enhance in tariff charges gained’t derail the US financial system.

“The extra versatile an financial system,” Greenspan concluded, “the larger its means to self-correct in response to inevitable, typically unanticipated, disturbances and thus to include the dimensions and penalties of cyclical imbalances.”

The US financial system, he defined, was getting extra versatile due to computerized stabilizers, just-in-time logistics, deregulation and the “elevated depth and class of monetary markets.”

Extra refined markets give policymakers higher info to work with — and the very best info, after all, comes within the type of charts.

So let’s see what they’re saying.

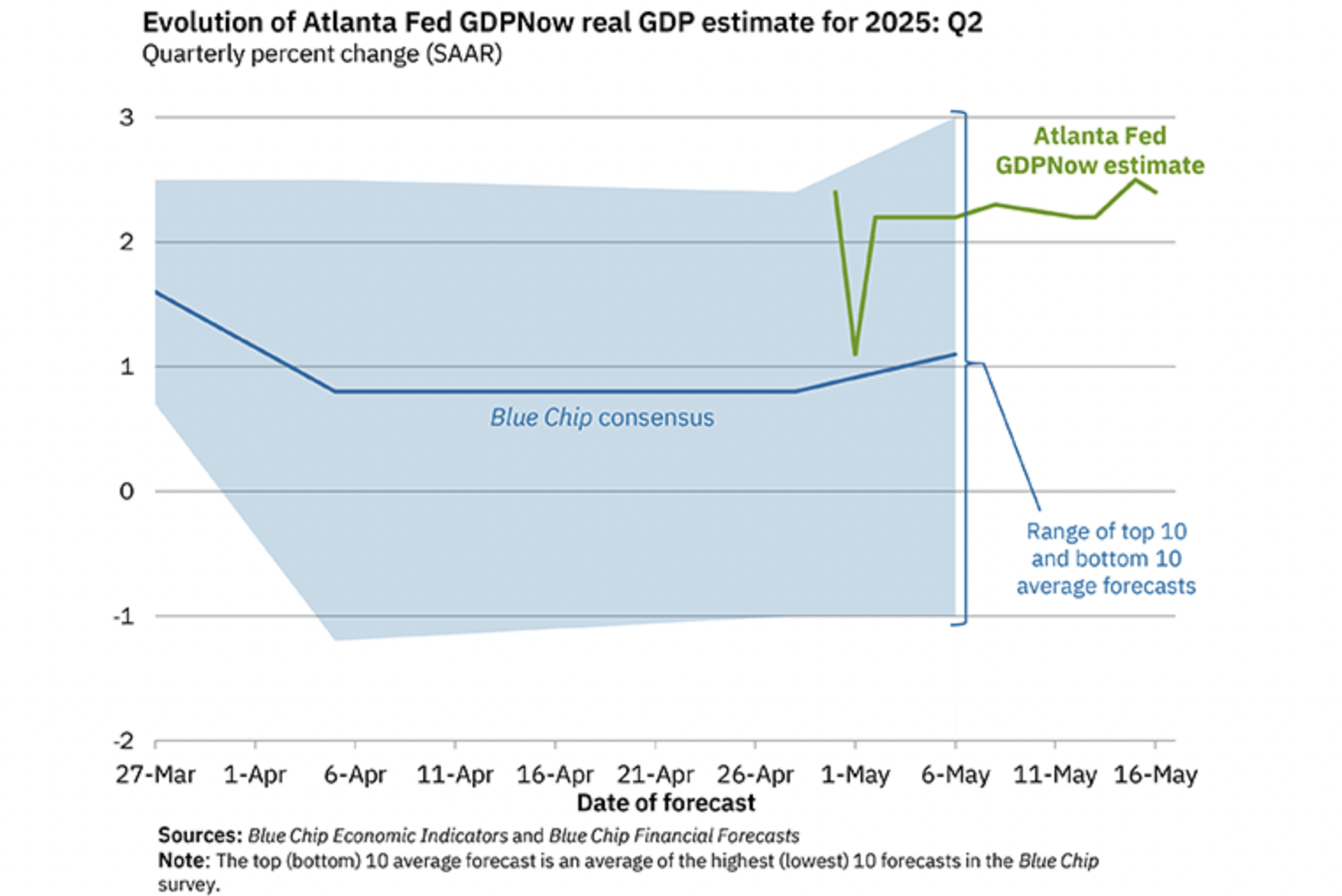

It gained’t be this quarter:

Instantly, the subsequent recession appears as far off as ever: The Atlanta Fed’s GDPNow mannequin sees the US financial system rising 2.4% within the present quarter.

It’s unlikely in Q3 or This fall, too:

Polymarket odds of a US recession in 2025 are all the way down to 36%.

Are tariffs priced in now?

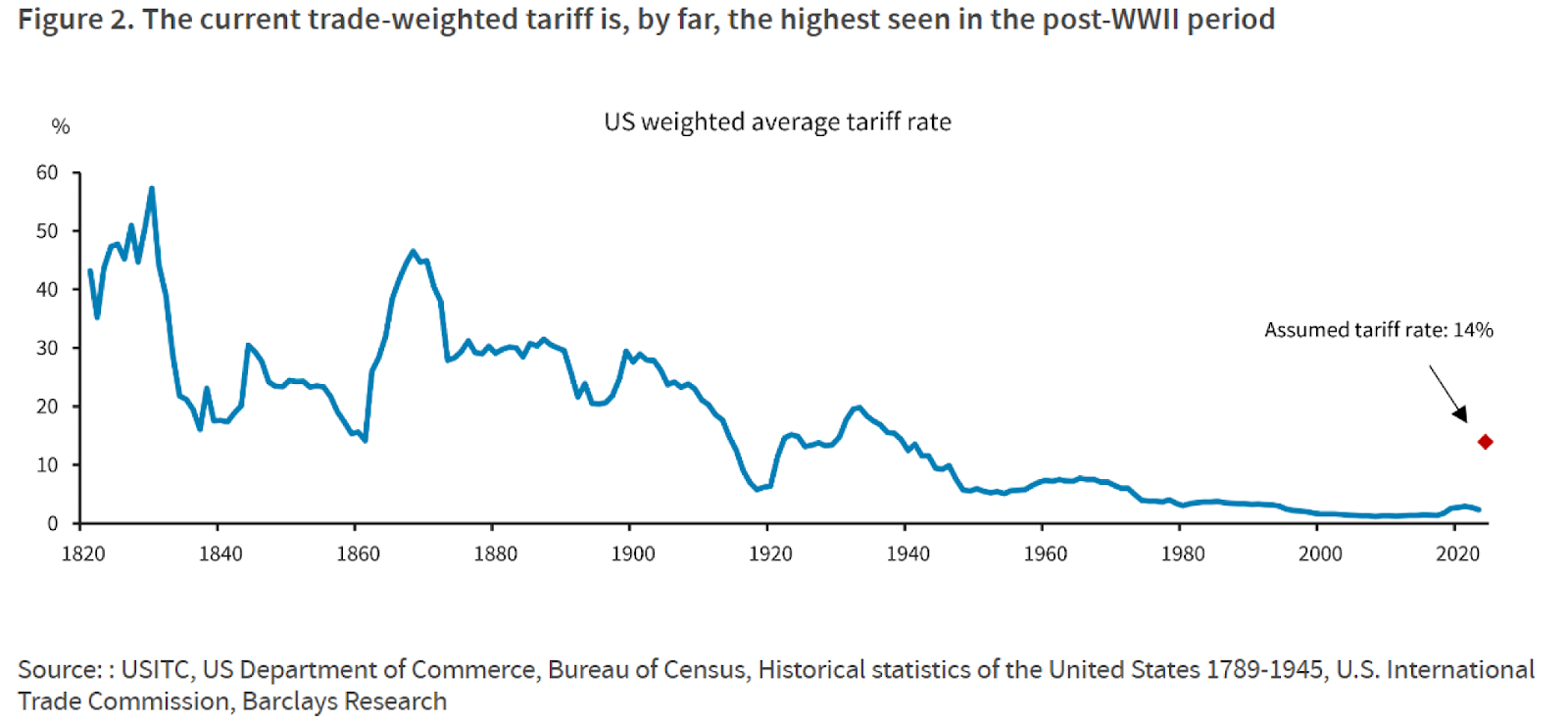

Barclays Analysis (by way of the Odd Heaps publication), estimates that the present trade-weighted US tariff fee is now round 14% and analysts at Goldman Sachs mentioned it “would in all probability stay elevated for the foreseeable future.” That’s decrease than anticipated simply a few weeks in the past, however we is probably not out of the woods but. President Trump mentioned immediately that, as a result of there are too many international locations to barter with, he’ll unilaterally resolve tariff charges someday within the subsequent two or three weeks.

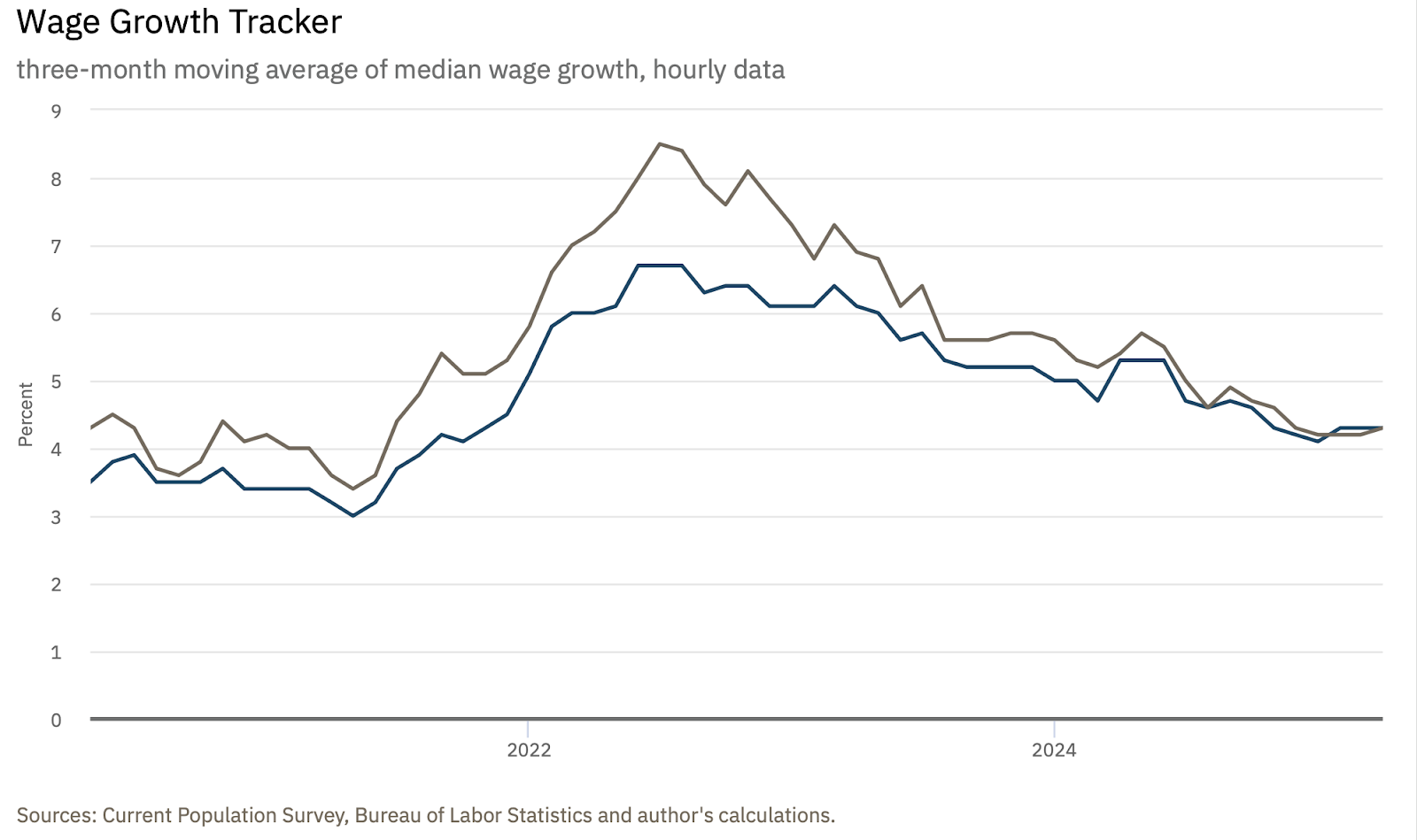

Wages > inflation, nonetheless:

US wages are nonetheless rising at 4.3%, based on the Atlanta Fed — properly in extra of CPI, which ticked down to simply 2.3% in April. The highest line above is wage development for job switchers, which can have additional to fall: The Wall Road Journal famous this week that two-thirds of US staff consider they’re overpaid.

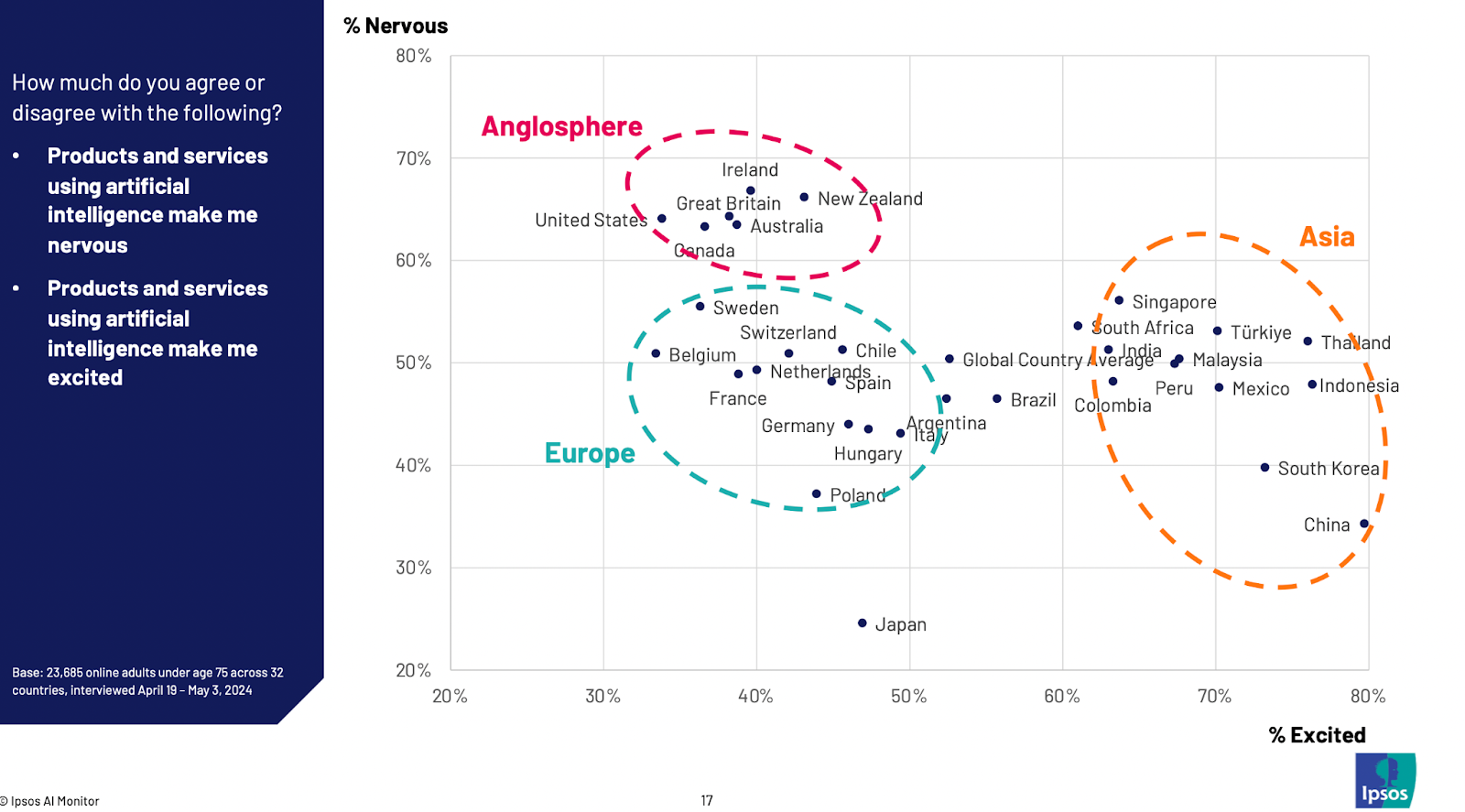

Apropos of nothing:

That is from 2024, however I solely discovered it this week: An Ipsos survey discovered that Asian (and a few Latin American) international locations are “excited” about AI whereas Europe and the Anglosphere are “nervous.” Let’s examine again in a decade or two and see if that’s correlated to development charges. (I think it will likely be.)

Why Joe Rogan ought to be free of charge commerce:

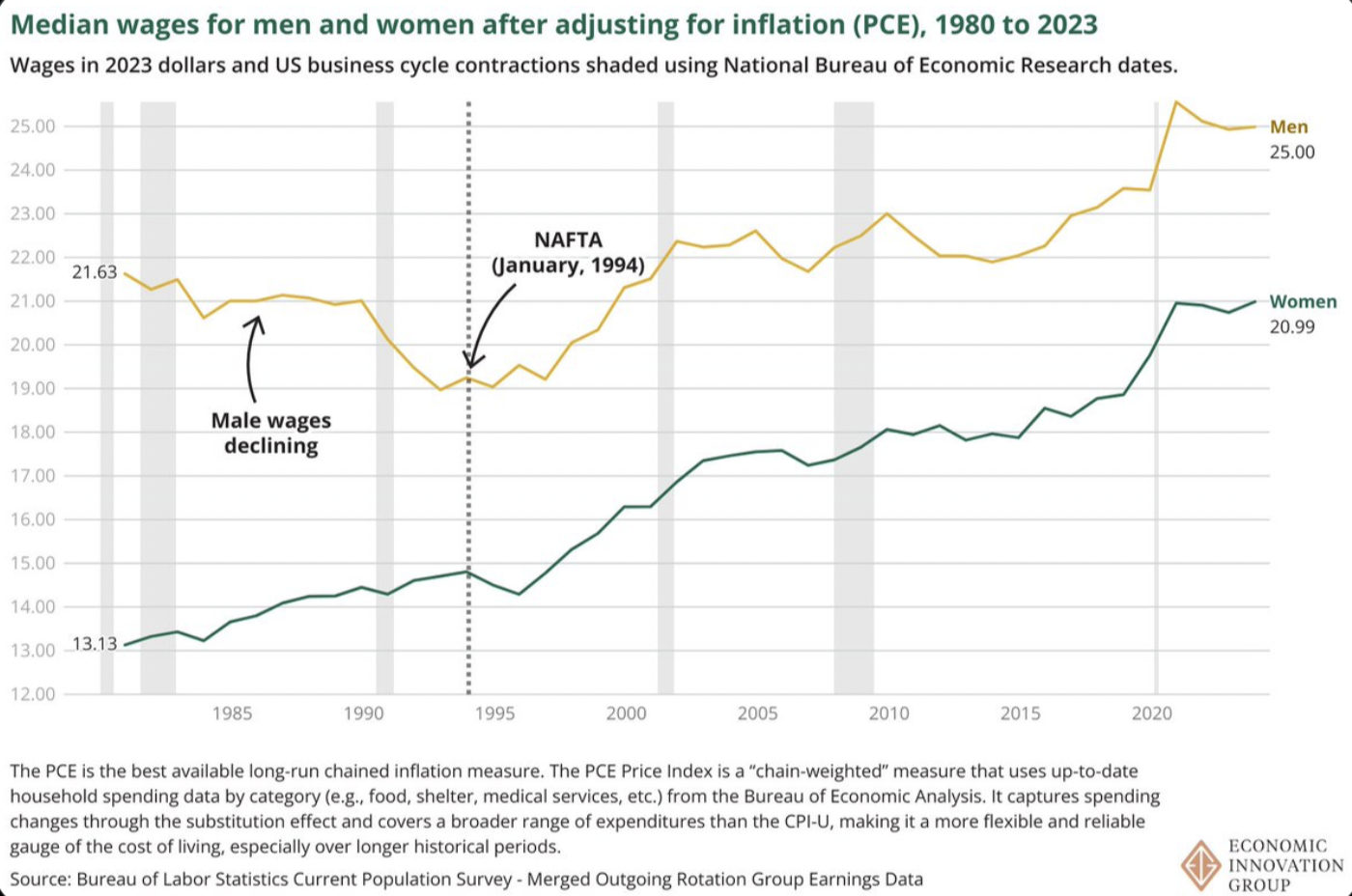

John Lettieri notes that the start of globalization (marked by NAFTA in 1994) was coincident with a development change in male earnings: After 20 years of decline, male wages started rising once more.

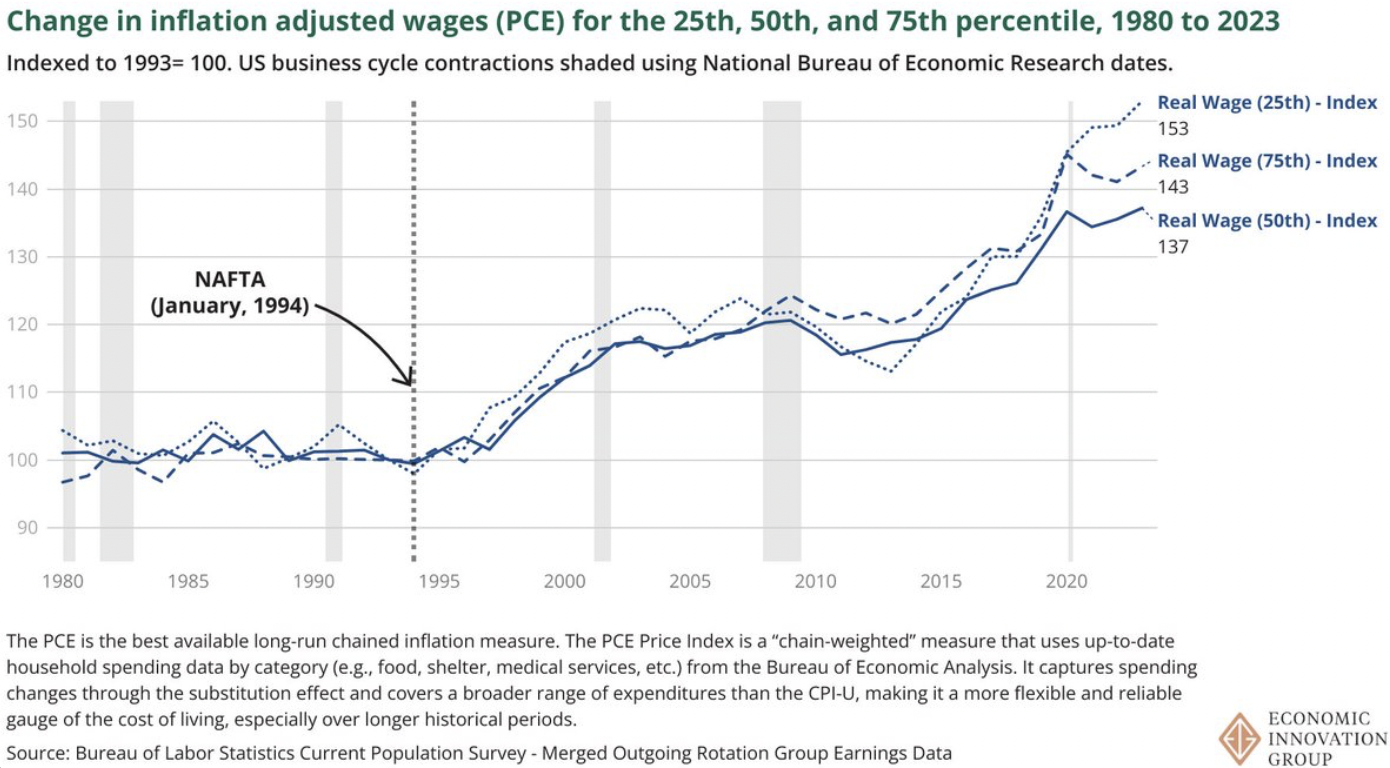

Why everybody ought to be free of charge commerce?

Lettieri additionally finds that, beginning with NAFTA, wages for the bottom quartile of earners rose quicker than wages for the highest quartile. If, like me, you get pleasure from these sorts of narrative violations, his full thread on commerce is a must-read.

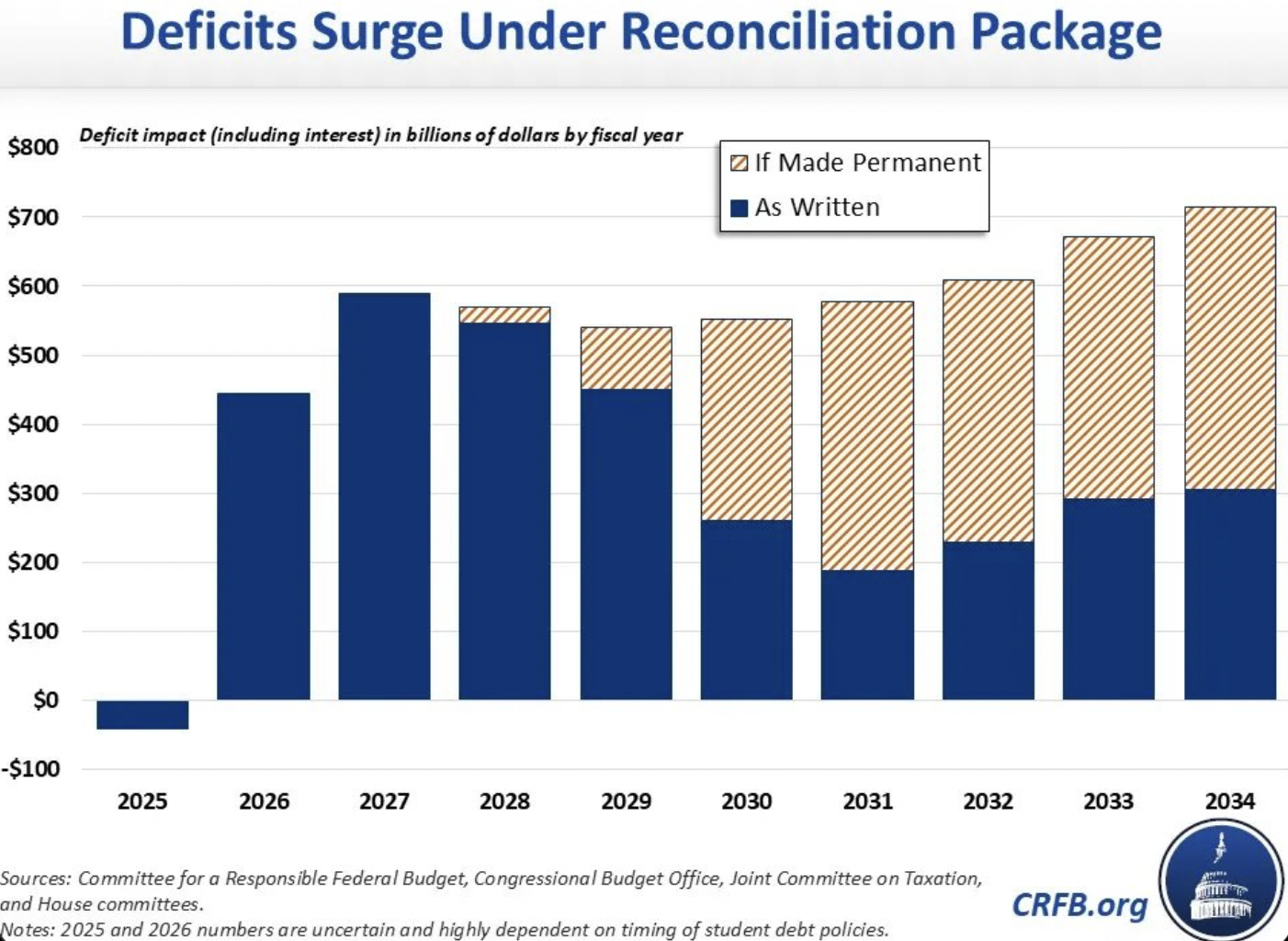

The opposite deficit drawback:

The present Home finances proposal would add $3.3 trillion to federal debt by means of 2034. It in all probability wouldn’t go the Senate, nevertheless it appears a secure wager that no matter ultimately does can be solely marginally extra accountable.

In good instances and dangerous:

The actually dangerous information in regards to the US finances isn’t that it’s working a giant deficit — it’s that it’s working a giant deficit whereas the financial system is booming. What’s this chart going to appear like within the subsequent recession? (If there ever is one.) Additionally, in case your purpose is to cut back the commerce deficit, working a trillion greenback finances deficit yr after yr is, uh, not the way in which to do it.

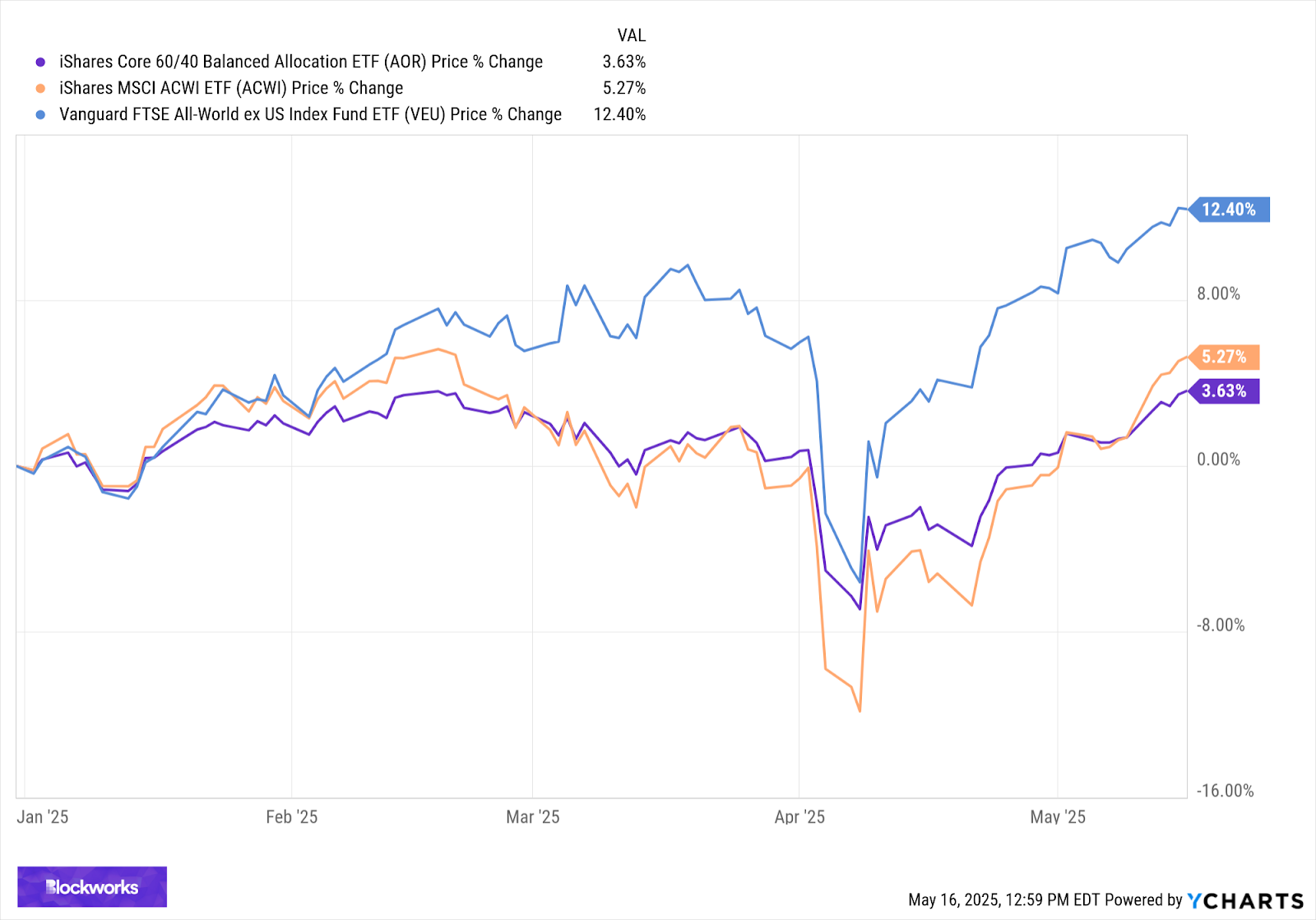

Deficits are good for enterprise, although:

International equities (orange) and a 60/40 portfolio of worldwide shares and bonds (purple) each made all-time highs immediately. International equities ex-US (blue) made the best highs.