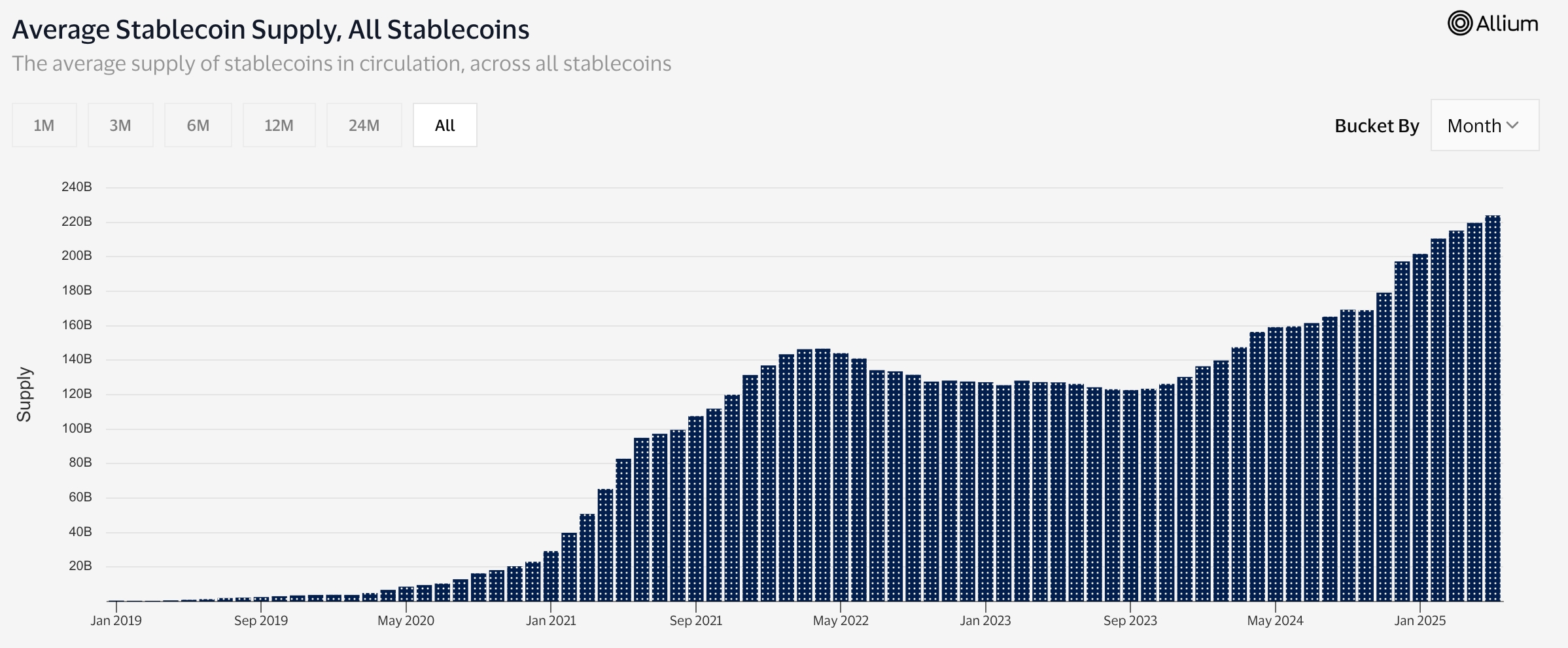

Stablecoins, like Tether USD Coin, continued their robust development this week, with their market capitalization hitting a file of $243.8 billion.

These cash have added over $38 billion in belongings since they began the yr with $240 billion. Tether (USDT) boasts a market cap leaping to over $151 billion, giving it a dominance of 62%.

It’s adopted by USD Coin (USDC), which has $60.4 billion in belongings, and Ethena USDe (USDe) with nearly $5 billion.

The lately launched USD1 by President Donald Trump’s World Liberty Monetary has gained over $2.1 billion in belongings. Most of those funds are seemingly tied to MGX’s $2 billion funding in Binance, the most important crypto trade within the trade.

Different notable stablecoins are Ripple USD (RLUSD) and PayPal’s PYUSD, which have amassed belongings of $900 million and $313 million, respectively.

You may also like: Why is the crypto market crashing, and can the bull run resume?

Stablecoin provide | Supply: Visa

Knowledge compiled by Visa reveals that extra individuals are utilizing stablecoins of their each day transactions in the present day. Over 192.2 million distinctive sending addresses have transacted within the final 12 months, whereas 242.7 million have obtained stablecoins. The entire lively distinctive addresses jumped to 250 million.

All this has pushed the full transaction rely to five.8 billion and the transaction quantity to $33.6 trillion.

Stablecoins have grow to be extremely widespread due to their decrease prices in comparison with conventional strategies. For instance, sending $1,000 to a person by way of PayPal attracts a 2.99% payment plus a variable payment.

Utilizing a stablecoin attracts a considerably smaller payment than that. Additionally, these transactions are quicker than conventional strategies like wire switch.

Citi believes that stablecoins will proceed gaining market share within the coming years.

In a latest report, the corporate estimated that stablecoins shall be value over $1.6 trillion by 2030, whereas Normal Chartered estimates that they are going to attain $2 trillion by 2028.

Learn extra: Hack? SEC probe? Coinbase inventory soars regardless of troublesome week