The spending exercise of Bitcoin’s (BTC) long-term holders (LTH) means that they’re more and more assured within the main cryptocurrency.

In line with current on-chain information shared by analyst Axel Adler Jr., the spending exercise of this group has dropped to its lowest degree within the final eight months.

Huge 300,000 BTC accumulation

Additionally, this group has bought 300,000 BTC within the final 20 days. What stands out from the chart within the tweet is the sharp drop in LTHs’ spending. It’s now on the decrease finish of its historic vary.

This development signifies that those that often maintain Bitcoin for lengthy intervals are usually not promoting however are selecting to purchase extra.

Prior to now, comparable conduct by these holders has coincided with bullish intervals within the cryptocurrency market. With the long-term holders not promoting, there’s much less out there provide of BTC on cryptocurrency exchanges. Ought to demand stay regular or preserve rising, the shortage leads to an elevated BTC worth.

The buildup of 300,000 BTC by this group of Bitcoin holders in lower than a month displays their long-term outlook and their perception within the main cryptocurrency’s continued rise in worth.

Many would have anticipated a few of these holders to take earnings as BTC climbs again to its earlier peak worth. However the reverse has been the case. This group, which has skilled a number of market cycles, is doubling down on their holdings.

The decrease new provide (following the final BTC halving) and the discount in present provide is a mix that may push BTC’s worth greater offered demand stays.

The long-term holder price foundation (the typical worth at which these buyers purchased their BTC) additionally acts as a psychological ground. Lengthy-term holders typically step in to purchase when BTC’s worth drops close to this degree to forestall additional declines.

Bullish BTC sign returns

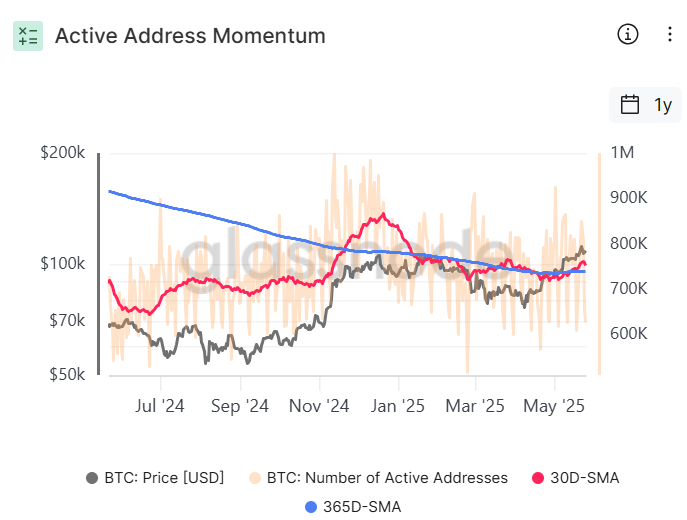

In line with new information from Glassnode, the variety of distinctive BTC addresses is displaying an upward development, indicating rising transaction exercise and person engagement on the community.

The 30-day SMA rose above the 365-day SMA in late 2024, reaching a peak in January 2025.

Then, the 30-day common dropped beneath the 365-day common, suggesting a cool-off interval. This crossover often acts as a bullish sign and happens when short-term momentum in person exercise surpasses the long-term common.

In current weeks, the 30-day common has crossed over the longer-term common once more. This new crossover may set the stage for a powerful market section.