Technique Acquires 4,020 BTC Price $427 Million

Technique, previously referred to as MicroStrategy, has deepened its dedication to Bitcoin by buying 4,020 BTC for roughly $427 million in money. The acquisition passed off between April 26 and June 18, 2025, in keeping with a latest SEC submitting.

The corporate paid a median worth of $105,000 per BTC, pushing its complete Bitcoin holdings to 226,331 BTC—acquired for a mixed price of $8.33 billion at a median of $36,798 per BTC.

This daring transfer solidifies Technique’s place as the most important publicly traded company Bitcoin holder on the earth.

Market Response: Why Technique’s Inventory Fell 7%

Regardless of the bullish Bitcoin information, Technique’s inventory (nonetheless buying and selling beneath the ticker MSTR) fell by 7% on the day of the announcement. Right here’s what could possibly be driving the dip:

By TradingView – MSTR_2025-05-26 (5D)

Publicity Threat: Traders could also be involved about Technique’s aggressive crypto-centric strategy, with over $8 billion tied to a extremely unstable asset.

Revenue-Taking: The inventory has seen robust momentum in latest months. The sell-off might merely replicate merchants cashing in.

Macro Sentiment: Broader tech and fairness market weak point is likely to be contributing to the drop, overshadowing the Bitcoin information.

Bitcoin’s Institutional Momentum Stays Sturdy

No matter short-term inventory fluctuations, Technique’s continued accumulation sends a powerful sign of institutional conviction in Bitcoin. At a time when many corporates stay on the sidelines, Technique is aggressively stacking BTC—even because the market trades slightly below its all-time excessive close to $74,000.

The corporate’s Bitcoin-first strategy might encourage others to rethink BTC as a treasury reserve asset, particularly if the market resumes its upward pattern.

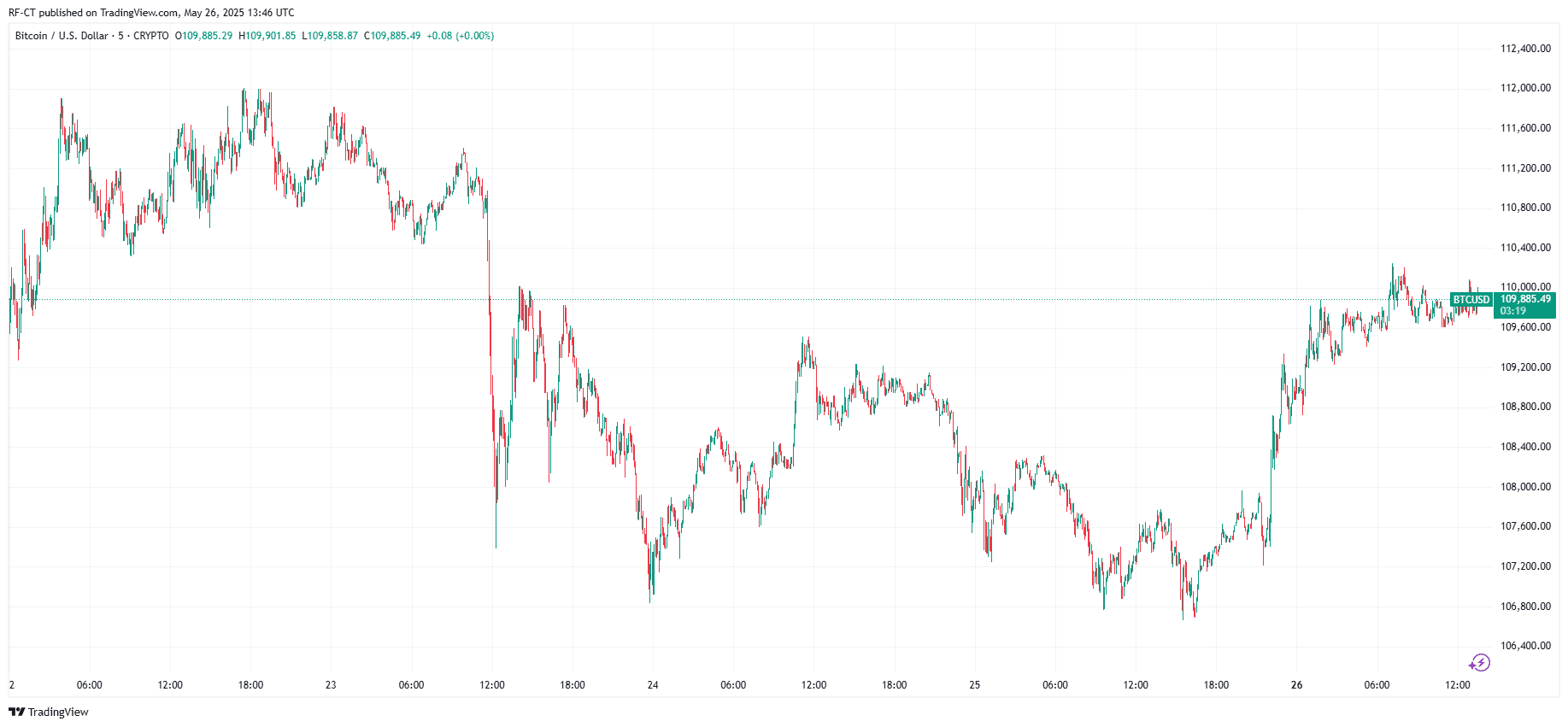

By TradingView – BTCUSD_2025-05-26 (5D)

Technique’s $427 million Bitcoin buy confirms it’s not backing down from its BTC thesis. With greater than 226,000 BTC now beneath administration, the agency is betting large on long-term adoption. Whereas Wall Avenue could also be cautious for now, Bitcoin believers are watching this transfer as a significant bullish sign for the months forward.