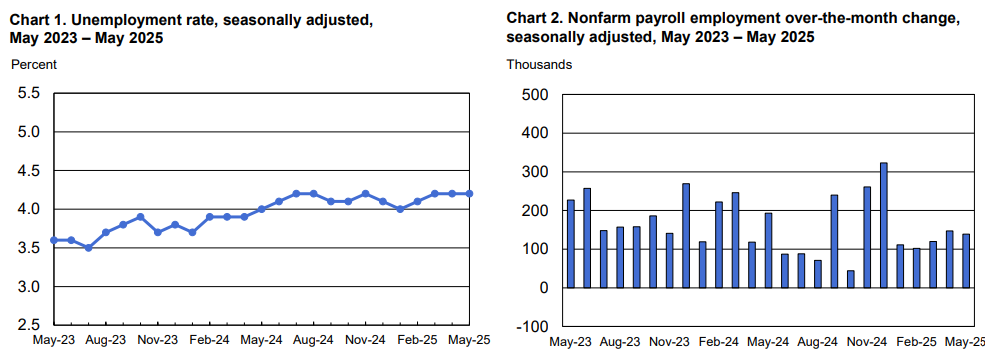

The U.S. economic system added 139,000 jobs in Might, a determine that beat market expectations however drew sharp criticism from economist Peter Schiff, who warned the expansion is happening within the flawed sectors. As Schiff advocates for a return to conventional financial ideas, his views now stand in stark distinction to a brand new authorities technique that embraces Bitcoin as a nationwide strategic asset.

Schiff pointed to Bureau of Labor Statistics knowledge displaying that job beneficial properties have been concentrated in non-productive sectors, with healthcare including 62,000 jobs and hospitality including 48,000. In the meantime, the home manufacturing sector shed 8,000 jobs, its largest decline this 12 months.

Associated: Elon Musk Warns U.S. Debt Curiosity Imperils Spending; Bitcoin Options Proposed

Schiff argues this dynamic, the place service-sector employees spend their wages on items the nation now not produces, fuels inflation, worsens commerce deficits, and weakens the economic system.

Schiff’s Prescription vs. a New Digital Technique

Replying to Coin Version, Schiff prescribed a course of upper rates of interest, deregulation, and cuts in authorities spending. He contends these measures are essential to curb consumption, incentivize financial savings, and drive capital funding again into America’s goods-producing industries.

Are you suggesting this development will gas extra inflation? And in your view, what corrective steps ought to be taken to handle the imbalance between productive and non-productive job development?

— Coin Version: Your Crypto Information Edge ️ (@CoinEdition) June 6, 2025

To Coin Version’s question on the function of Bitcoin in U.S. monetary coverage, Schiff identified that the timing aligns with wider discussions on using digital belongings in nationwide reserves. The controversy over Bitcoin’s perform as a hedge in opposition to inflation and its comparability to gold continues to attract consideration inside monetary and political spheres.

Recognize the deeper evaluation, Peter Schiff.

What’s your view on the concept of the U.S. holding Bitcoin in reserves? May it play any function in addressing inflation long-term?

— Coin Version: Your Crypto Information Edge ️ (@CoinEdition) June 6, 2025

What You Must Know About America’s Bitcoin Reserve Plan

On March 6, 2025, President Donald Trump signed an govt order establishing a U.S. Strategic Bitcoin Reserve beneath the newly enacted Bitcoin Act of 2025. Over a interval of 5 years, the reserve goals to amass as much as 1 million Bitcoin and can maintain them for at the least the following 20 years. The initiative desires to ascertain Bitcoin as a strategic monetary hedge and long-term retailer of worth.

Associated: Bitcoin Rally Faces Headwinds as Matrixport Report Factors to Weakening U.S. Economic system

The reserve’s funding will come from a mix of forfeited digital belongings, surpluses from the Federal Reserve, and revised gold certificates. The Division of the Treasury will handle this effort, which is able to use blockchain verification together with offline safety measures. Some states, together with New Hampshire, Arizona, and Texas, have enacted legal guidelines to create their very own strategic Bitcoin reserves. In distinction, eight different states, reminiscent of Florida and Wyoming, have dismissed comparable proposals on account of worries about volatility.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.