De-dollarization is quickly accelerating throughout Asia because the US greenback weakens over 9% in opposition to main currencies proper now. BRICS nations and likewise native foreign money initiatives are driving foreign money substitution efforts, basically reshaping Asia’s monetary panorama and difficult conventional greenback dominance on the time of writing.

Understanding Asia’s Drive For Forex Substitution, BRICS Ties & Native Forex Positive aspects

De-Dollarization Timeline and Market Response

The de-dollarization course of started over a decade in the past, however latest developments mark a big acceleration proper now. Bloomberg’s Stephen Chu explains the timeline and likewise the present market dynamics.

Chu said:

“This era really has began. I’d say over 10 years in the past, in 2014 when there’s this Russia and Crimea incident. And apparently Russia has began to dump their US Treasuries, after which adopted by, in fact, China additionally begin to scale back their holdings.”

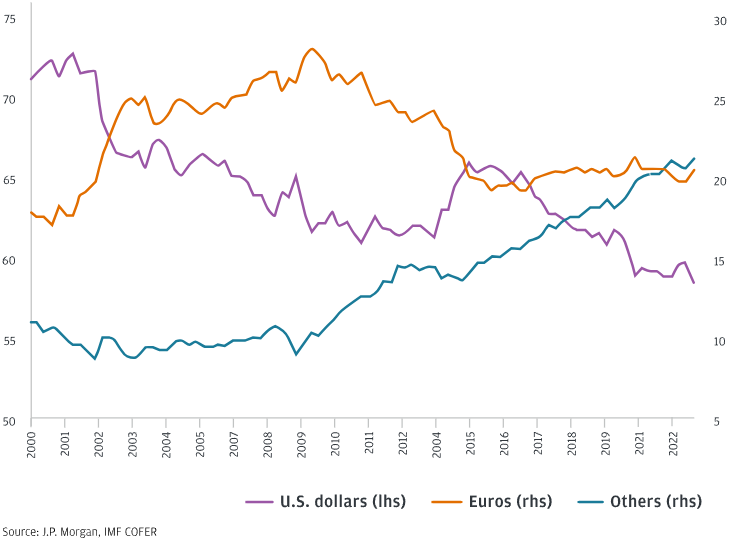

The present de-dollarization wave represents an unprecedented problem to greenback supremacy. Markets skilled a uncommon simultaneous sell-off in US {dollars}, Treasuries, and likewise equities, signaling elementary shifts in international foreign money preferences.

Chu had this to say in regards to the market’s response:

“It’s very clear that market had sufficient of the tariff recreation. So that they don’t need to care in regards to the reciprocal tariff. They don’t need to look ahead to any commerce trials or commerce deal. They simply vote by motion that they’re questioning the credibility of the US, the credibility of the greenback and, in fact, US Treasury.”

Asian Forex Substitution and Taiwan’s Surge

Forex substitution efforts gained dramatic momentum when Taiwan’s greenback surged over 10% in two days on the time of writing. This motion displays broader de-dollarization tendencies affecting Asian economies with substantial greenback holdings proper now.

Life insurance coverage corporations holding over $700 billion in overseas belongings drove Taiwan’s foreign money substitution. The costly hedging prices, reaching double-digit percentages, pressured these establishments to hunt different currencies and likewise BRICS-aligned choices.

Chu defined the hedging scenario:

“The implied annualized hedging price is double digit, over 10% that’s loopy. So that you pay 10% to hedge an appreciation. And as simply talked about, it’s not simple to have a ten% appreciation, so it’s that costly.”

This native foreign money strengthening represents what Chu describes as a elementary shift from historic patterns. Asian economies beforehand confronted greenback legal responsibility crises, however now confront greenback asset dangers amid ongoing de-dollarization and likewise altering international dynamics.