Highlights

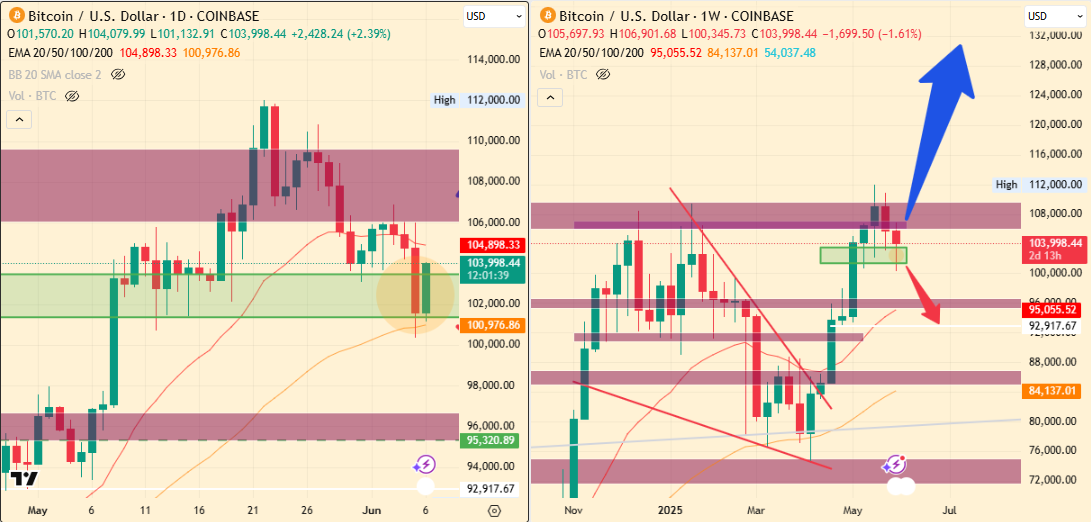

- Bitcoin value fell 5.2% to a low of $100,345 yesterday on account of leveraged commerce liquidations and geopolitical tensions.

- Whale James Wynn had lengthy positions price $16.14 million liquidated, closing all operating positions.

- Regardless of the downturn, on June sixth, Bitcoin confirmed a 3% rise, as commerce talks between the U.S. and China are set to renew.

The crypto market crash gained steam in a single day as its prime crypto, “Bitcoin value,” fell 5.2% to a low of $100,345. This fall was seen as a result of liquidation of leveraged trades, geopolitics, and the Elon Musk-Donald Trump feud.

Hold studying, as this text will make clear the primary causes for the in a single day crash and whether or not the bull run in BTC is over or not.

Aggregated Causes For Yesterday’s Bitcoin Worth Decline

The first motive for the decline was Trump signing a brand new govt order, which has fueled volatility in main monetary devices, and that has affected BTC’s sentiment too. His EO this time has throwed lightning on metal and aluminium tariffs, which have jumped by 50%, to advertise American in-house factories’ manufacturing to scale up.

Equally, arguments with China have as soon as once more began to warmth up, and no decision has been labored out between China and the US but. Because of these international pessimistic components, the crypto market went into bearish mode final night time, the rising uncertainty is creating delays in main technological developments, too.

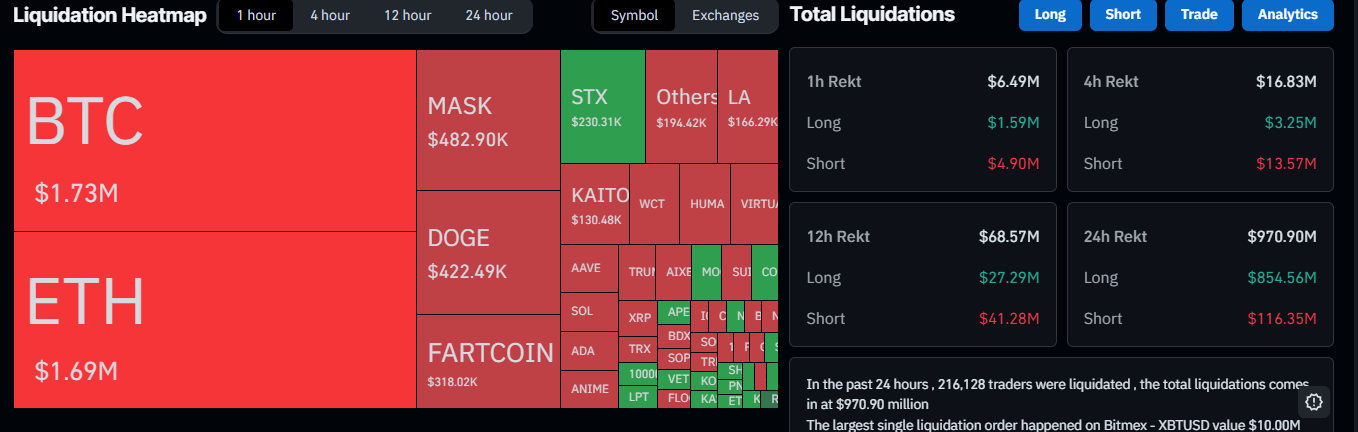

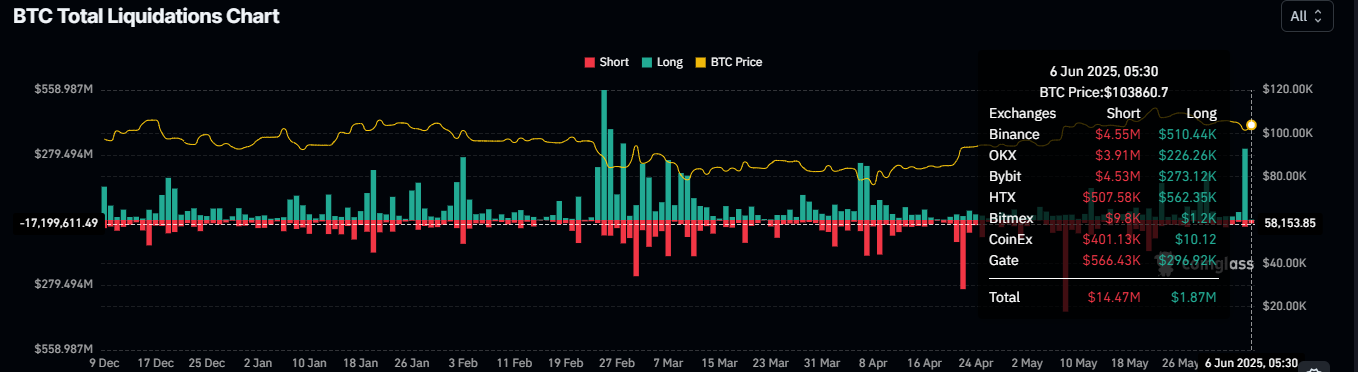

The results of the bearish mode precipitated liquidations of 215,593 merchants previously 24 hours, and the entire liquidations are available at $967.63 million, per Coinglass. It mentioned the biggest single liquidation order occurred on Bitmex – XBTUSD, valued at $10.00 million.

In the meantime, a well-liked whale, James Wynn, had lengthy positions price $16.14 million liquidated. Consequently, he needed to shut all his operating lengthy positions, as reported by Lookonchain.

Becoming a member of the bearish details, the fallout between Trump and his ex-best buddy, Elon Musk, can also be including bearish strain available on the market. This feud is brought on by “massive, stunning invoice”, Musk requested that it finish EV subsidies and advance debt on the nation.

This mixture of things is having a robust influence on the crypto market, as Donald Trump and Elon Musk are identified among the many prime crypto advocates for the crypto area, and the feud between them is affecting traders ‘ sentiment.

Ought to We Be Involved About Bitcoin Worth?

After the catastrophic final night time for prime crypto and altcoins, June sixth has proven a 3% rise to $103,976, additionally the current 12-hour Rekt reveals rising quick liquidation in comparison with longs.

This sudden optimism occurred because the long-disputed and most argued commerce talks between the US and China are set to restart, which has turned yesterday’s bearish scenario, and stored the value of BTC above the earlier month’s help zone.

As per value motion, it seems on the every day chart that this every day transfer took market liquidity by hitting a number of cease losses, and this could possibly be a set off level for an upcoming transfer northwards.

Subsequently, if issues go south and strain grows, then by June finish the value may go as little as $92917. Nevertheless, if issues go north then this time $130K mark is the goal for June-end.