U.S. shares climbed increased as softer inflation knowledge improved the prospects of a Fed fee minimize.

U.S. inventory indices erased early morning losses on hopes {that a} decrease client worth index studying would possibly contribute to financial easing. On Tuesday, June 12, the Dow Jones was up 0.17%, or 70 factors, whereas the S&P 500 and the Nasdaq each gained 0.35%.

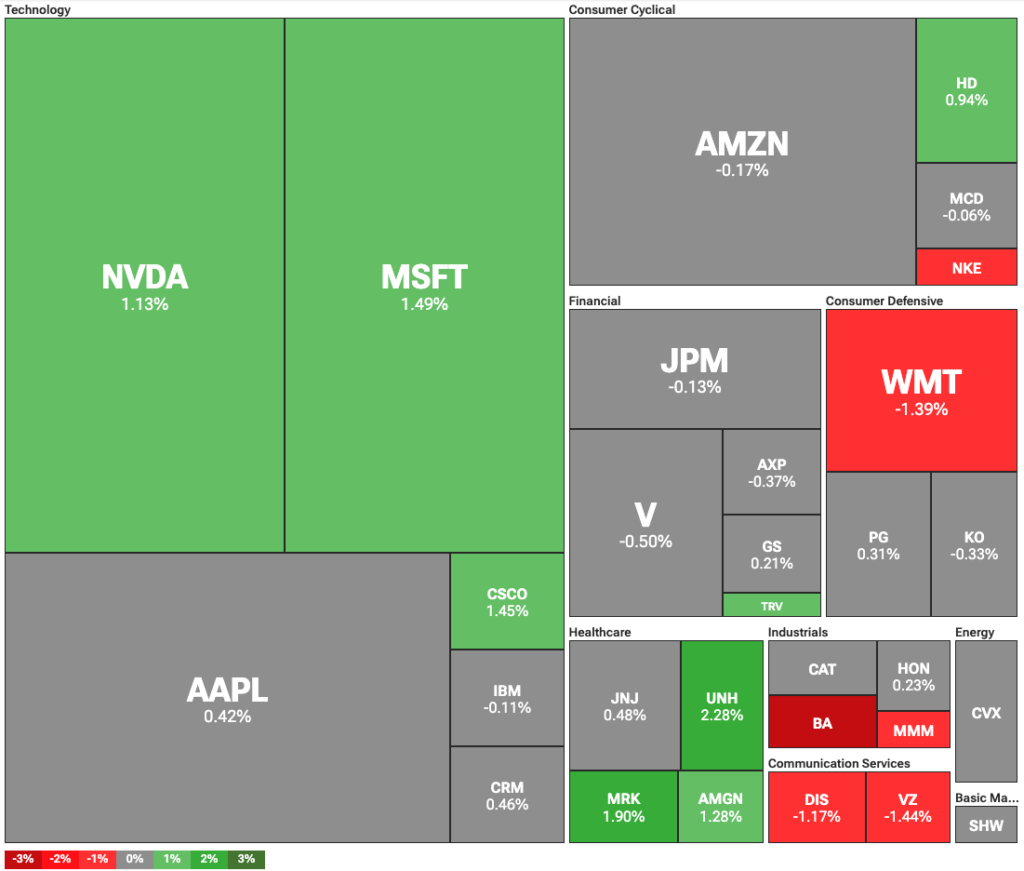

Dow Jones Industrial Common heatmap | Supply: TipRanks

Low inflation knowledge remains to be influencing dealer sentiment, with many anticipating potential fee cuts following final month’s smooth CPI figures. Nonetheless, the Federal Reserve has remained hesitant to decrease charges, citing the potential inflationary results of U.S. tariffs on main buying and selling companions.

This hesitation has been met with continued strain from the White Home. On Thursday, U.S. President Donald Trump reiterated that the Federal Reserve ought to minimize charges by one level. Whereas he clarified that he wouldn’t search to fireplace Fed Chair Jerome Powell, he famous he might need to “power one thing” on charges.

You may additionally like: Trump says he received’t hearth Fed Chair Powell, however urges quicker fee cuts

Boeing loses 4.5%, Oracle hits ATH

Dow Jones was weighed down by Boeing inventory, which noticed a major decline after the lethal Dreamliner crash in India. Shares of the plane producer had been down 4.5%, as the most recent crash compounded latest scandals involving the corporate.

In 2024, the corporate confronted a sequence of scandals, all beginning with one aircraft that had its door ripped in mid-air. This led to whistleblowers exposing corner-cutting in relation to security, in addition to tried coverups.

However, Oracle inventory jumped 14% to an all-time excessive after its earnings beat Wall Avenue expectations. The agency revised its anticipated income for 2026 to $67 billion, up from the earlier estimate of $66 billion.

The rationale for the revised forecast is the anticipated rising demand for its AI-powered cloud companies. The income from its cloud service rose 14% quarterly, largely because of the built-in and built-in AI companies the corporate supplies.

Learn extra: Inflation is up however beneath expectations. Will the Fed minimize charges, and what does this imply for the crypto market?