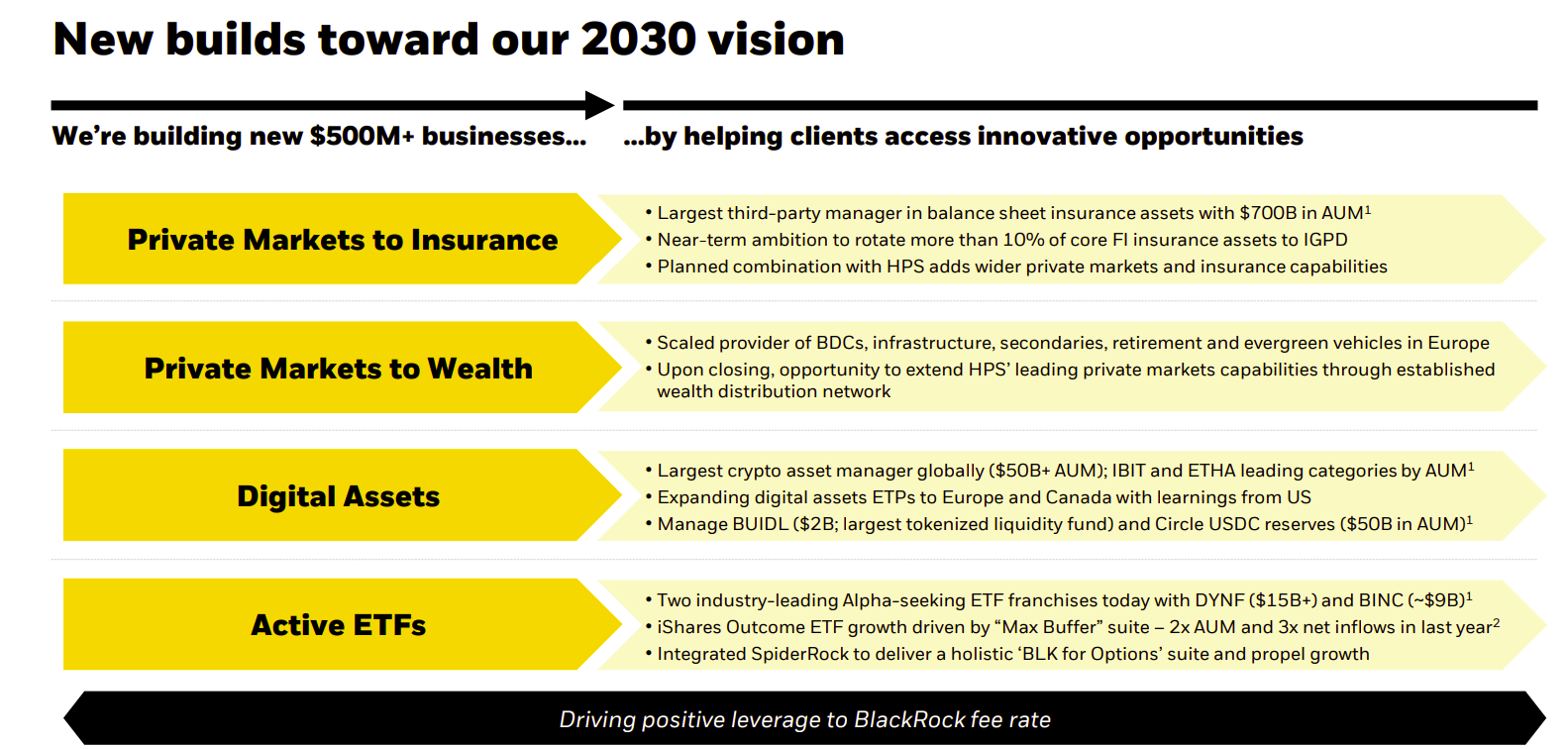

BlackRock is aiming to change into the world’s dominant crypto asset supervisor by 2030, focusing on not less than $50 billion in property beneath administration (AUM) via its digital asset choices, in line with a Thursday presentation on its web site.

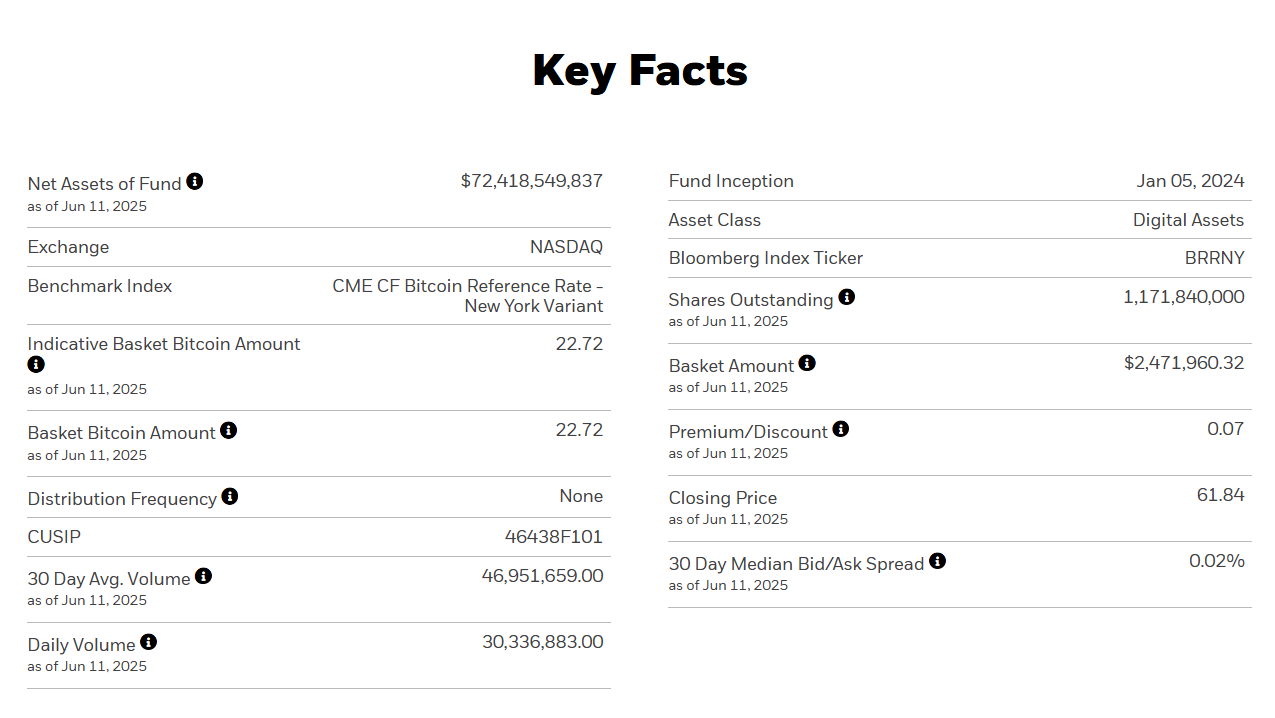

For its flagship crypto ETFs, the iShares Bitcoin Belief (IBIT) and iShares Ethereum Belief (ETHA), BlackRock’s aim is to steer their respective classes by AUM.

IBIT has already secured the highest spot amongst spot Bitcoin ETFs, managing over $73 billion in property as of June 11. ETHA additionally leads the spot Ethereum ETF group, with a $4.3 billion market cap, forward of Grayscale’s ETHE.

On international enlargement, the asset administration big targets to broaden its digital asset exchange-traded merchandise (ETPs) past the US into Europe and Canada.

Following its profitable launch of IBIT within the US final 12 months, BlackRock rolled out its first Bitcoin ETP in Europe in March 2025. The fund trades beneath the ticker IB1T on main European exchanges, together with Xetra, Euronext Paris, and Euronext Amsterdam.

The fund is BlackRock’s first crypto-linked ETP outdoors North America. Along with this, BlackRock gives the iShares Bitcoin ETF on Cboe Canada.

Within the tokenization area, BlackRock’s BUIDL fund stays central to the agency’s long-term digital asset technique

In line with rwa.xyz, BUIDL leads the tokenized US Treasury market with roughly $3 billion in property as of June 11.