Ethereum is navigating intense volatility as international tensions rise, notably with the escalating battle between Israel and Iran. Markets are on edge amid rising fears that the US might grow to be instantly concerned, additional rising uncertainty throughout threat property. Regardless of these headwinds, Ethereum has managed to carry above the $2,500 degree, exhibiting resilience at the same time as value motion stays caught inside a spread that started forming in early Might.

The $2,700 degree stands out as a key resistance that bulls should reclaim to spark momentum towards the $3,000 mark. Nonetheless, repeated rejections from this space sign that patrons are hesitating, probably because of the broader market’s warning and unclear macroeconomic outlook.

High analyst Ted Pillows highlighted a notable improvement: regardless of heightened international tensions, the ETH/BTC pair is up on the weekly timeframe. This means relative power from Ethereum and should point out that the worst of the draw back may very well be behind it. If the pair continues outperforming Bitcoin, it might sign the start of a brand new altcoin pattern — however a lot relies on whether or not Ethereum can reclaim and maintain ranges above $2,700 within the face of rising geopolitical dangers and tightening market circumstances.

Ethereum Eyes Breakout As ETH/BTC Chart Reveals Energy

Ethereum is positioning for a decisive transfer after greater than six weeks of consolidation slightly below the $2,800 degree. Worth motion has been trapped between $2,500 and $2,800, with bulls repeatedly testing the higher boundary whereas bears proceed to defend it. This extended standoff suggests a build-up of stress that might quickly erupt into a significant directional shift.

Bulls are trying to reclaim management because the broader crypto market stabilizes, however uncertainty stays elevated. The continued battle between Israel and Iran, together with the looming threat of US involvement, continues to weigh closely on sentiment. Traders are cautiously awaiting readability, and till geopolitical dangers ease, Ethereum and different threat property are prone to stay in a sideways pattern.

Ted Pillows factors to the ETH/BTC weekly chart as a number one sign. In accordance with his evaluation, regardless of excessive macro stress, ETH/BTC is climbing — an indication that Ethereum has possible bottomed relative to Bitcoin for this cycle. Traditionally, such backside formations usually precede sturdy altcoin rallies.

Pillows suggests that when macro circumstances start to stabilize, Ethereum might mirror its explosive Might efficiency. A breakout above $2,800 would verify bullish momentum and probably ignite a parabolic transfer towards the $3,200–$3,500 vary. For now, the $2,800 resistance stays the essential barrier that have to be flipped into help to validate any breakout state of affairs.

ETH Consolidates At Crucial Assist

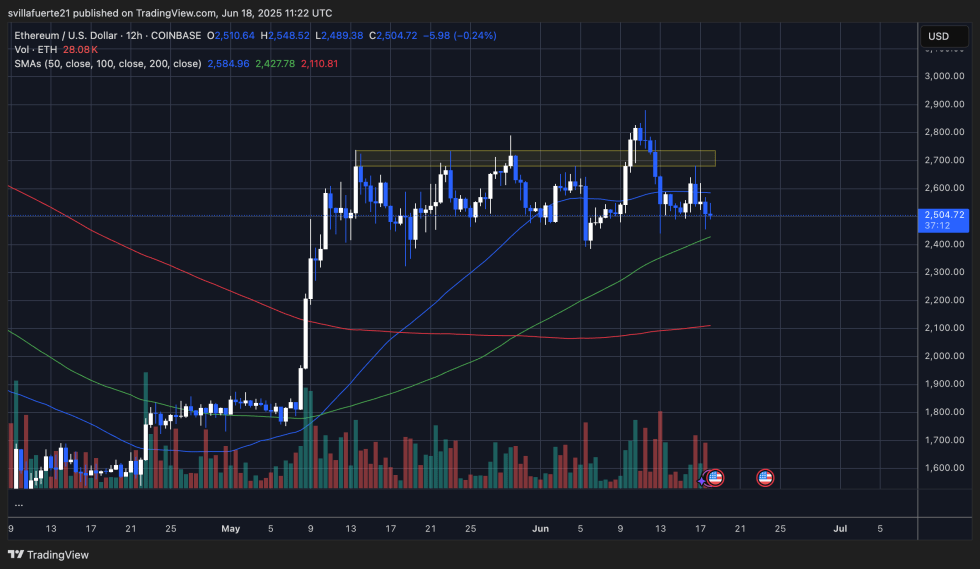

The 12-hour chart for Ethereum (ETH) reveals continued consolidation inside a well-defined vary between $2,500 and $2,800. ETH just lately examined the decrease boundary of this vary round $2,500 and held, suggesting bulls are nonetheless defending key demand ranges. Nonetheless, upside momentum has stalled a number of instances on the $2,675–$2,800 resistance zone, marked by the yellow highlighted area on the chart.

Quantity has remained elevated throughout current makes an attempt to interrupt out, however every rally has met sturdy promoting stress, particularly as value approaches the $2,750 space. This means bears are actively defending that degree. The 50-day and 100-day transferring averages are beginning to flatten, reflecting the shortage of directional bias, whereas the 200-day MA stays comfortably under present value — a long-term bullish signal if help continues to carry.

The worth motion means that Ethereum is coiling for a decisive transfer. If ETH loses the $2,500 degree with sturdy quantity, a drop towards the 100-day transferring common round $2,427 turns into possible. Alternatively, a clear break and shut above $2,800 might open the door to a quick transfer towards $3,000–$3,200. For now, all eyes are on the vary boundaries as market individuals await decision.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.