Bitcoin’s worth has climbed again above $105,000 after a latest sharp drop, however the important thing $110,000 degree stays a vital resistance zone.

The market is displaying combined indicators, with underlying on-chain metrics suggesting energy, whereas a excessive variety of short-term holders in revenue poses a danger.

On-Chain Metrics Present Each Power and Threat

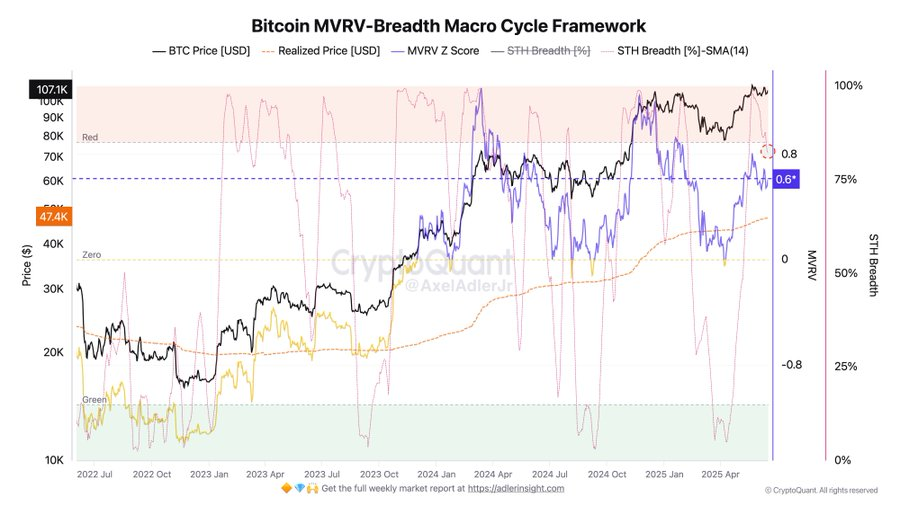

In keeping with an analyst, market indicators present combined indicators. The MVRV Z-score, which helps measure if Bitcoin is overvalued or undervalued, at the moment stands at +0.6. This means shopping for energy out there with out indicators of overheating.

Supply: Axel

In the meantime, 83% of short-term Bitcoin holders are nonetheless in revenue. “The market stays in a bullish pattern with reasonable overbought ranges and powerful curiosity from short-term holders,” the analyst wrote. However he warned that with so many short-term holders in revenue, there’s the next danger of a worth dip round $110K if folks start promoting.

Bitcoin Is At the moment Caught in a Vary

Between June 9 and 11, BTC tried to rise above the $110k mark. Nevertheless, it failed. For now, Bitcoin stays in a sideways vary between $104,000 and $110,000. In keeping with an analyst any pullback from present ranges would doubtless be a short lived correction inside a bigger uptrend.

Supply: TradingView

Whereas Bitcoin is presumably within the last phases of this bull cycle, there’s nonetheless room for additional worth will increase. Some fashions recommend Bitcoin may attain as excessive as $130,000 on this cycle. However earlier than that occurs, the market may even see quick dips, particularly round resistance areas.

Supply: TradingView

For the time being, key ranges to look at for Bitcoin are resistance at $108,822 and $110,550, whereas help sits at $106,220 and $102,780. If the worth breaks above resistance, it may open the door for a transfer towards $113,000. However, if Bitcoin drops under help, it might slide again into the $92,800 to $99,200 vary, which the analyst has marked as a attainable pullback zone.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.