Bitcoin (BTC) is knocking on the door of a historic quick squeeze.

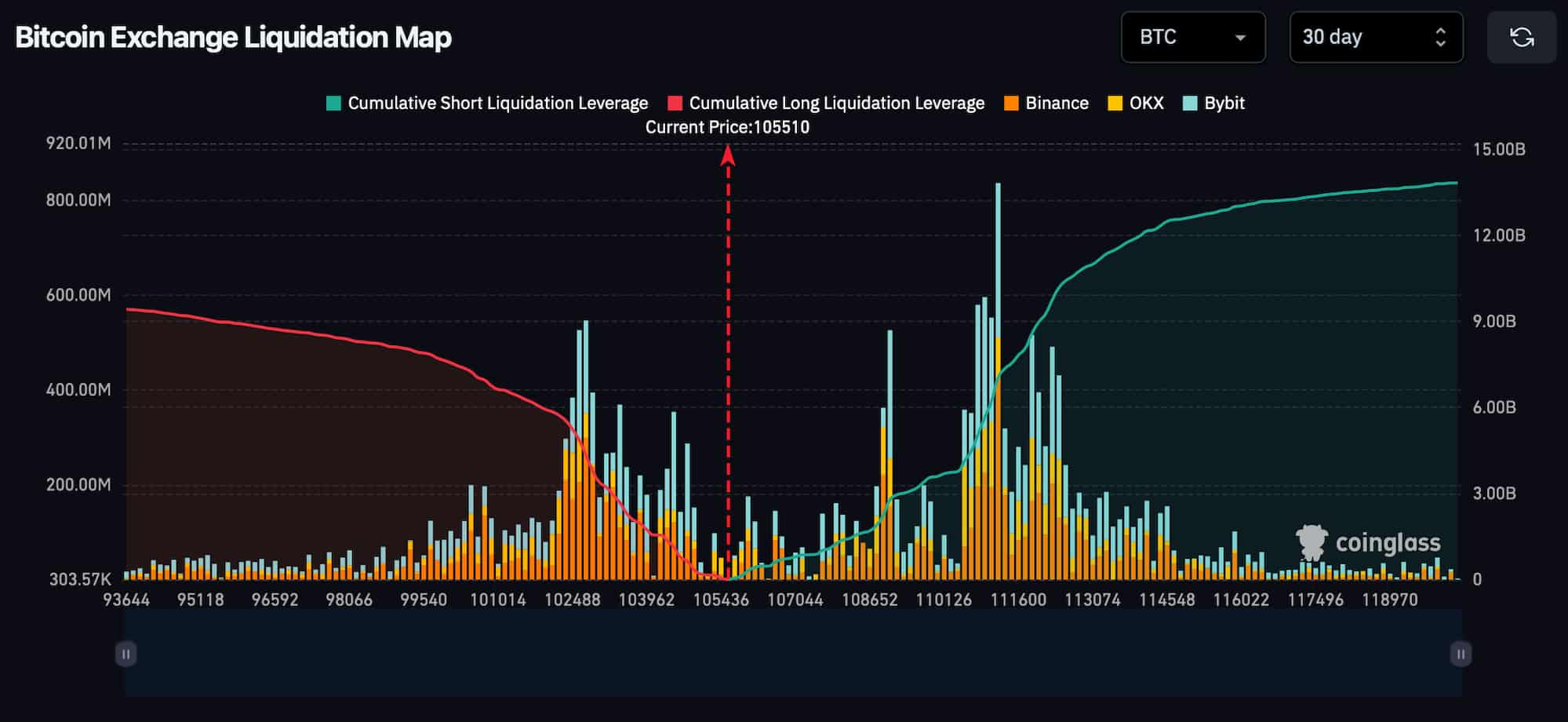

With the digital asset buying and selling above $105,500, over $13 billion value of leveraged quick positions throughout main exchanges like Binance, Bybit, and OKX are hanging by a thread, based on contemporary knowledge from Coinglass, retrieved by Finbold on June 17.

The liquidation heatmap doesn’t lie, if Bitcoin surges previous $118,000, we might witness one of many largest mass quick liquidations in crypto historical past.

The chart breaks down the place leveraged positions are most concentrated—and, extra importantly, the place they’re most susceptible. On the right-hand aspect, the rising inexperienced curve represents quick liquidation leverage.

What makes this setup particularly harmful for shorts is the best way the inexperienced line steepens previous $110,000. That sharp upward curve means a rising pile of leverage is ready simply above the present market value. The second BTC begins inching towards these ranges, a sequence response may very well be triggered, trapping late sellers and slingshotting Bitcoin upward.

In easy phrases, this exhibits how a lot cash merchants have wager towards Bitcoin going up. If BTC climbs, these quick positions begin bleeding. And if it climbs quick? They’re compelled to shut, mechanically, by exchanges. That course of is known as liquidation.

Liquidations don’t occur quietly. When shorts get closed, the merchants should purchase Bitcoin to settle their losses. That sudden burst of shopping for provides gas to the fireplace, pushing costs even increased and forcing extra shorts to shut. It’s a vicious cycle for the bears. This cascading impact is named a brief squeeze, and proper now, the chart is flashing a textbook setup.

It’s not simply theoretical. We’ve seen it earlier than in previous cycles. The 2020 breakout previous $20,000? Related mechanics. The $30,000 rally in early 2021? Similar story.

Bitcoin quick liquidation leverage abstract

For newcomers, this chart may appear intimidating. However right here’s the straightforward takeaway: it exhibits the place leveraged merchants are more likely to get worn out. And proper now, these in danger are those betting towards Bitcoin.

The truth that $13 billion in brief publicity exists simply overhead is a powerful bullish sign. Not as a result of that cash ensures upward motion, however as a result of it reveals simply how unstable the present positioning is. If a catalyst seems, whether or not ETF inflows, macro easing, or extra institutional headlines corresponding to BlackRock, the transfer may very well be explosive, not gradual.

Featured picture through Shutterstock