The Ethereum worth in the present day is buying and selling round $2,518, reflecting a gentle intraday lack of 0.34% as bulls and bears proceed a tug-of-war just under the $2,540–$2,570 resistance band.

Regardless of a number of latest Ethereum worth spikes above $2,600, every rally has been met with robust rejection from the higher Bollinger Band and provide zones close to $2,660. The broader development stays neutral-bearish as ETH fails to reclaim momentum.

What’s Occurring With Ethereum’s Value?

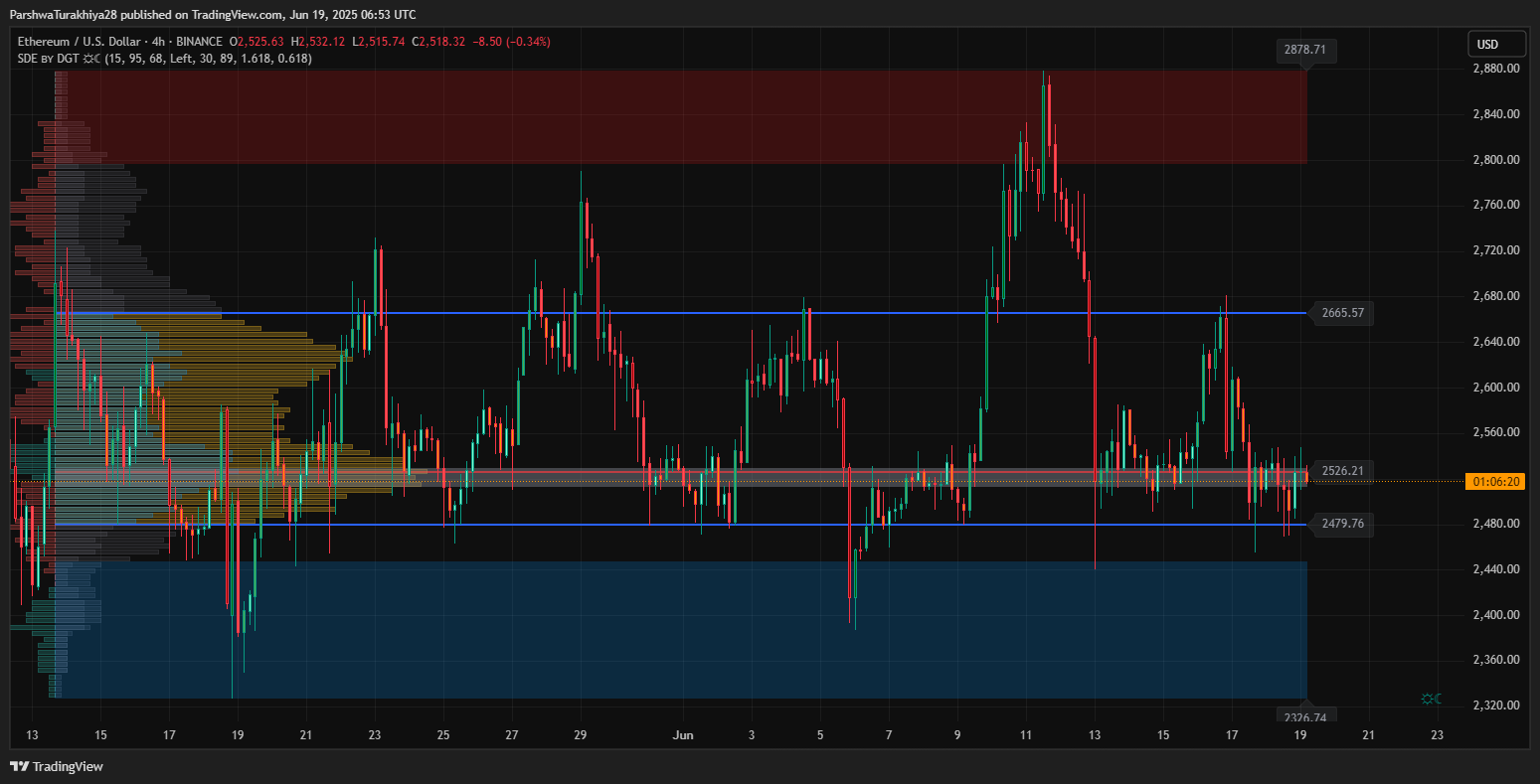

ETH worth dynamics (Supply: TradingView)

ETH is presently buying and selling inside a decent compression zone between $2,510 and $2,540, the place a number of dynamic indicators intersect. The 4-hour chart reveals worth caught between the 50 EMA ($2,539) and 100 EMA ($2,566), whereas the decrease Bollinger Band sits close to $2,456, offering near-term help.

ETH worth dynamics (Supply: TradingView)

The amount profile reveals a heavy node close to $2,520, reinforcing this space as a heavy-traffic worth zone. In the meantime, liquidity mapping confirms that latest wicks under $2,480 had been absorbed rapidly, suggesting patrons are defending the decrease boundary.

ETH worth dynamics (Supply: TradingView)

On the Ichimoku chart, ETH stays beneath the Kumo cloud with Tenkan-Sen and Kijun-Sen flat, signaling range-bound indecision. The 4-hour ATR (50.88) continues to contract, supporting the case for an imminent volatility breakout.

Why Ethereum Value Going Down At this time?

ETH worth dynamics (Supply: TradingView)

A have a look at the 30-minute timeframe highlights clear bearish divergence on the RSI, which sits round 49.30, just below impartial. MACD traces stay flat, missing bullish crossover energy. The DMI reveals weak development momentum because the +DI and -DI traces converge, with ADX underneath 20, reflecting indecision.

ETH worth dynamics (Supply: TradingView)

As well as, worth failed to interrupt via a key descending trendline close to $2,540, marking the fifth decrease excessive since June 12. These failed breakouts coupled with bearish liquidity reactions in Good Cash Ideas mirror why Ethereum worth went down in the present day regardless of consolidation efforts.

Brief-Time period Outlook: Breakout Imminent as ETH Exams Key Trendline

ETH worth dynamics (Supply: TradingView)

If ETH can reclaim the $2,540–$2,570 EMA resistance cluster with a clear candle shut above the Bollinger midline and VWAP zone, bulls could goal $2,600 initially, adopted by $2,660 and $2,710.

ETH worth dynamics (Supply: TradingView)

Nevertheless, failure to defend $2,510 and repeated rejections from the $2,540 zone might set off a deeper retracement towards $2,480, adopted by demand close to $2,438. The worst-case dip lies round $2,336, the place high-volume demand meets the 1.618 pitchfork extension from the broader trendline.

From a macro view, the every day chart nonetheless reveals ETH respecting the decrease boundary of a downward pitchfork construction and failing to reclaim the Fib 0.5 degree. Except worth motion reclaims $2,660+ with conviction, upside momentum stays capped.

Ethereum Value Forecast Desk: June 20, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.