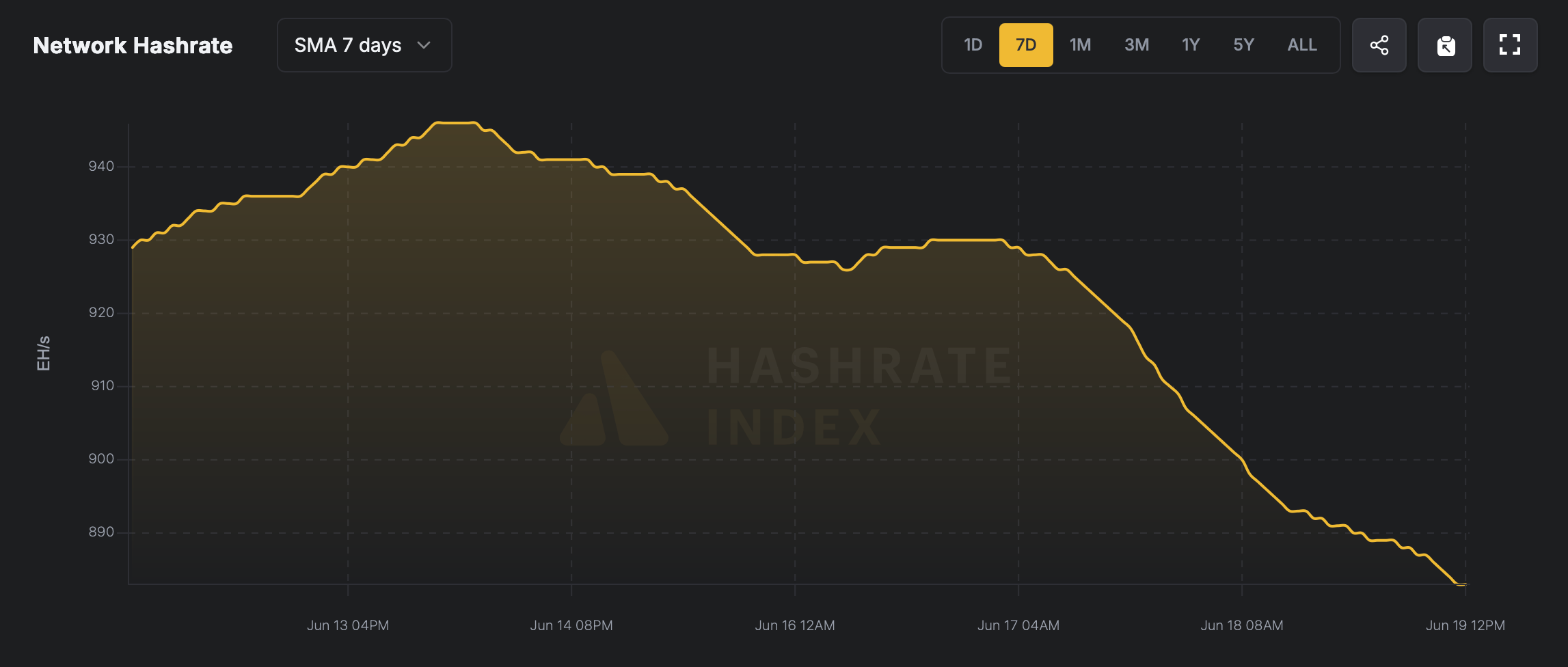

After attaining a peak of 946 exahash per second (EH/s), Bitcoin’s computational energy has since receded beneath the 900 EH/s threshold, with corresponding mining profitability exhibiting an identical decline.

Mining Stress Mounts: Hashrate Drops, Earnings Develop Thinner

By early afternoon Thursday, the valuation of bitcoin (BTC) hovered simply above the $104,000 threshold. Merely days prior, over the previous weekend, Bitcoin’s hashrate registered an unprecedented peak of 946 EH/s, as indicated by the seven-day easy shifting common (SMA).

Nonetheless, a contraction has been noticed since June 14, with the current hashrate now residing at 880 EH/s based on hashrateindex.com stats. This equates to the attrition of roughly 66 EH/s of hashrate, or roughly 66,000 petahash per second (PH/s).

The downturn follows the current discount in mining issue noticed over the last retargeting occasion, six days prior, at block top 901152. However, this adjustment was negligible, manifesting as a mere 0.45% lower.

Given the current discount in computational energy and present common block intervals protracting to 10 minutes 31 seconds per block, a 5.05% discount is projected for June 28, 2025. This estimation, nonetheless, stays topic to revision previous to the aforementioned date.

Moreover, mining profitability has skilled a contraction coinciding with the downward trajectory of BTC’s valuation over the previous week. From Might 19 to June 19, the hashprice, representing the estimated price of a singular PH/s, has diminished by 4.37%, as a single petahash is now valued at roughly $52.51, a lower from its former $54.91.

The oscillations in Bitcoin’s present hashrate metrics and market valuation intimate a state of dynamic equilibrium in profitability. The undulating sample of computational energy and its correlating income serves to light up the challenges confronted by miners as they cope with BTC’s value volatility and the immutable issue changes that preserve the constant rhythm of block intervals.