- Ethereum staking hits document 35M ETH regardless of risky worth swings.

- Accumulation wallets rise, signaling robust long-term investor dedication.

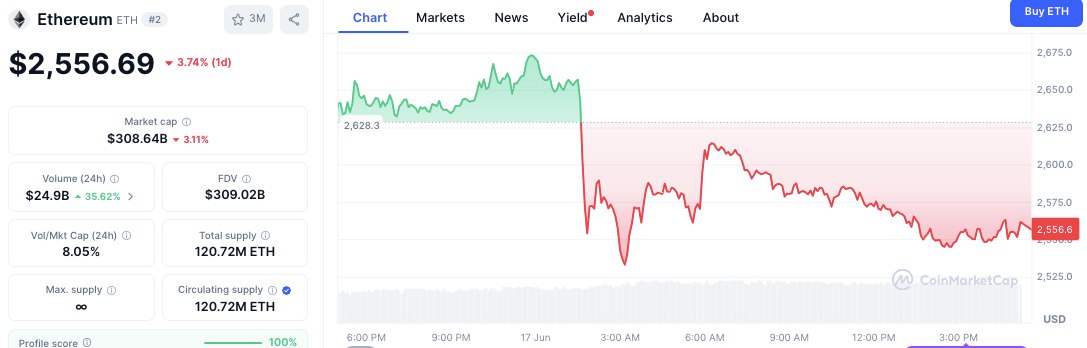

- ETH worth dips 3.74% with excessive buying and selling quantity exhibiting lively market strikes.

Ethereum’s staking system reached a brand new mark in mid-2025, with over 35 million ETH locked, marking the best quantity ever staked on the community. This enhance in staking exercise happens amid main worth fluctuations, displaying shifting investor conduct centered on long-term dedication relatively than short-term worth actions.

Ethereum Hits ATH in Staking: Over 35 Million ETH Locked

“Alongside this, Accumulation Addresses (holders with no historical past of promoting) have additionally reached an all-time excessive, now holding 22.8 million ETH.” – By @onchainschool

Learn extra ⤵️https://t.co/WYoX9qpODZ pic.twitter.com/6MAlK0sCfJ

— CryptoQuant.com (@cryptoquant_com) June 17, 2025

Information from CryptoQuant exhibits an increase within the whole worth of Ethereum staked, rising from roughly 33.25 million ETH in July 2024 to over 35 million ETH by June 2025. This upward pattern gained explicit momentum from August 2024 by late 2024 and continued constantly into 2025. The rise in staking coincides with rising confidence within the community’s staking mannequin regardless of fluctuations in Ethereum’s market worth.

In distinction, Ethereum’s worth has proven increased volatility throughout this era. Beginning round $3,400 in mid-2024, the asset skilled a decline early in 2025, dropping to roughly $1,500 in April. Notably, this worth dip occurred alongside continued development in staking volumes. By Might 2025, the worth partially recovered, stabilizing close to $2,500 in June.

Enhance in Accumulation Addresses Highlights Investor Habits

Together with staking, accumulation addresses and wallets which have held ETH with none promoting historical past additionally reached an all-time excessive. These holders now management 22.8 million ETH, suggesting a rising section of traders dedicated to holding ETH long run. The rise in accumulation addresses parallels the rise in staked ETH, underscoring a pattern towards decreased liquid provide available in the market.

Based on CoinMarketCap, Ethereum’s worth stands at $2,556.69 as of press time, reflecting a 3.74% decline over the past 24 hours. The market capitalization dropped by 3.11% to roughly $308.64 billion. Regardless of the worth lower, Ethereum’s 24-hour buying and selling quantity surged by 35.62%, reaching $24.9 billion. This enhance in quantity amid falling costs factors to lively market buying and selling and potential profit-taking or repositioning by traders.

The circulating and whole provide of Ethereum stays static at 120.72 million and there’s no provide cap. The absolutely diluted valuation at 309. 02 billion is carefully matched to the market cap, exhibiting that circulating tokens match the general market worth.

The 24-hour worth chart reveals a fluctuating buying and selling day, as the worth of Ethereum soared to a excessive of just about $2,675 after which dropped to lower than $2,575. An preliminary regain of momentum was adopted by a sluggish pattern downward hitting a mid-afternoon peak of about $2,556.