Ethereum (ETH) is down practically 9% over the previous seven days and continues to commerce under the $3,000 mark—a degree it hasn’t reclaimed since February 1. Current technical indicators recommend that bearish momentum is constructing, with development energy weakening and promoting stress intensifying.

Momentum oscillators just like the RSI have pulled again sharply, whereas key resistance ranges proceed to carry agency towards upward makes an attempt. As ETH struggles to regain floor, merchants are watching carefully to see whether or not help ranges will maintain or if additional draw back is imminent.

Ethereum Bears Achieve Momentum as Development Energy Fades

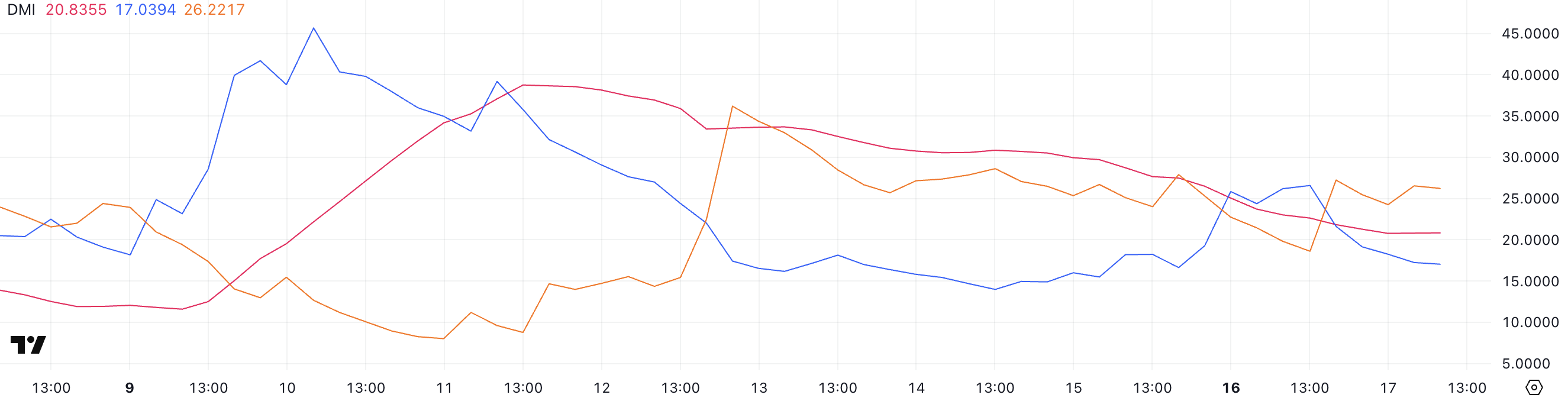

Ethereum’s Directional Motion Index (DMI) reveals its ADX has dropped to twenty.83 from 27.64 two days in the past, pointing to weakening development energy.

The ADX, or Common Directional Index, measures how sturdy a development is, no matter whether or not it’s up or down. Values above 25 sometimes point out a powerful development, whereas values under 20 recommend a weak or indecisive market.

With ETH’s ADX now hovering close to the decrease boundary, it means that latest directional momentum is fading, and the market could possibly be getting into a interval of sideways motion or indecision.

Wanting on the directional indicators, Ethereum’s +DI has fallen to 17 from 26.57 yesterday, after a quick leap from 16.62 two days in the past. This indicators that bullish stress has shortly cooled off.

In the meantime, the -DI has risen to 26.22 from 18.60, indicating rising bearish momentum. This divergence between the declining +DI and rising -DI suggests sellers are gaining the higher hand, doubtlessly pushing ETH right into a short-term downtrend.

Mixed with the weakening ADX, the present setup factors to elevated draw back threat except bulls regain management quickly.

ETH Faces Strain After Sharp RSI Reversal

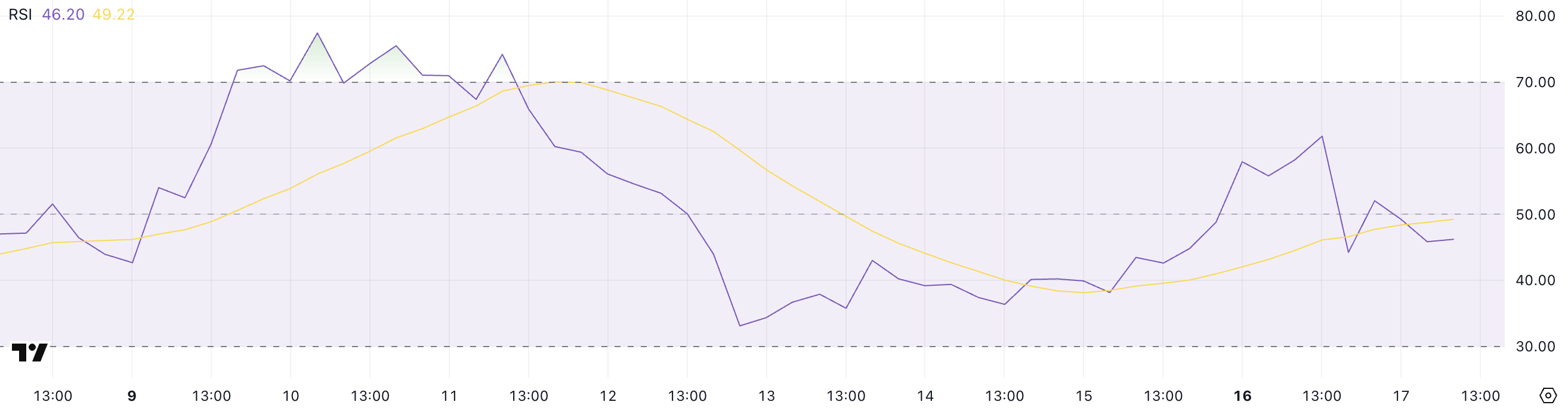

Ethereum’s Relative Energy Index (RSI) has fallen to 46.2, down sharply from 61.82 yesterday, after spiking from 38.14 two days in the past.

The RSI is a momentum oscillator that measures the velocity and magnitude of latest worth modifications to judge overbought or oversold situations.

Values above 70 sometimes point out an overbought asset that could be due for a pullback, whereas readings under 30 recommend oversold situations that might precede a rebound.

The impartial zone lies between 30 and 70, the place worth motion is usually thought-about balanced or consolidative.

ETH RSI. Supply: TradingView.

Ethereum’s RSI is now at 46.2, dropping again into impartial territory after briefly approaching the overbought zone.

This decline signifies fading bullish momentum and should recommend that latest shopping for curiosity has weakened. Whereas a studying round 46 doesn’t sign a right away development reversal, it does replicate uncertainty and will open the door to additional draw back if promoting stress will increase.

If the RSI continues to slip towards 30, it might affirm that ETH is getting into a extra pronounced bearish part.

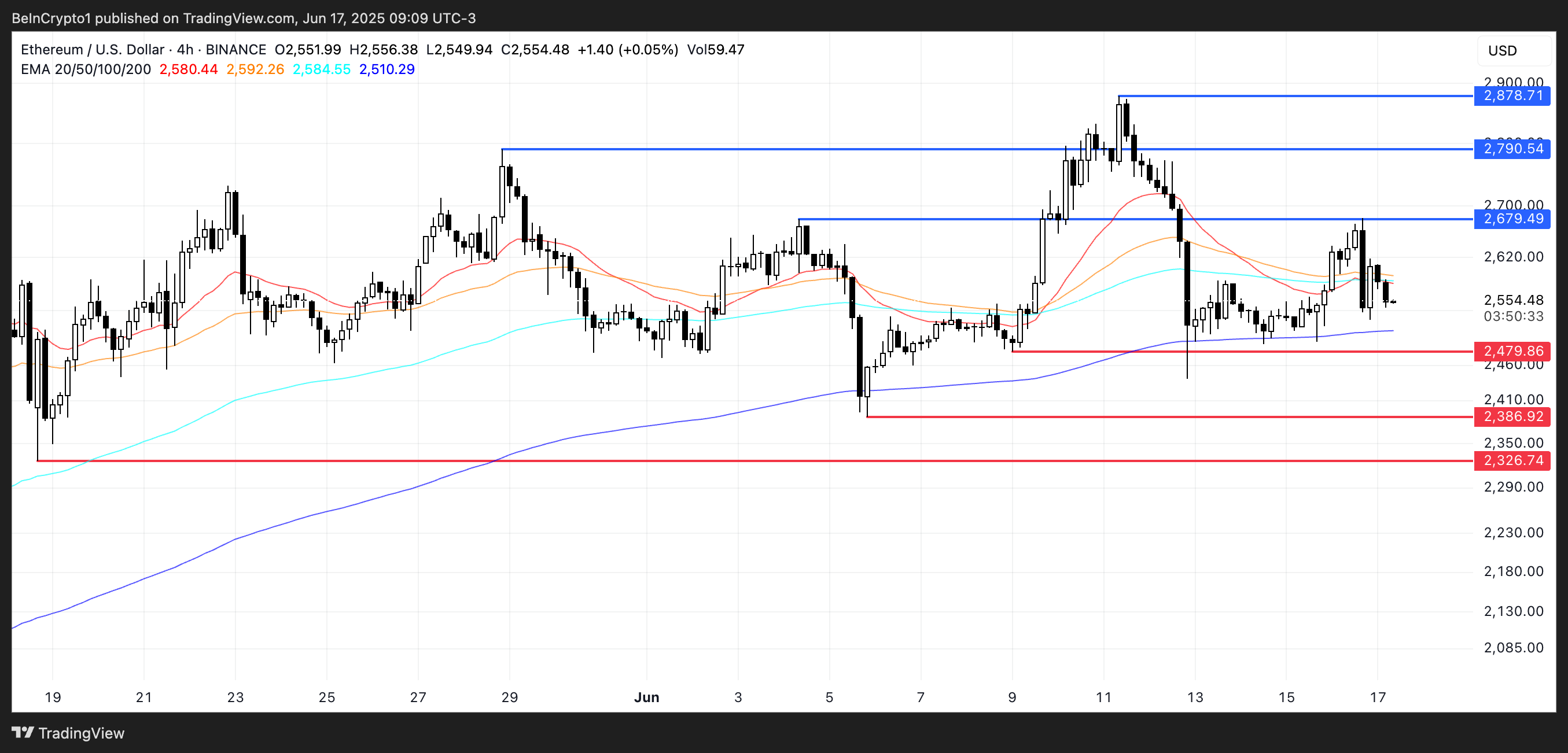

Ethereum Struggles Under Resistance as Bearish EMA Development Holds

Ethereum’s EMA (Exponential Transferring Common) strains at the moment level to a bearish development, with worth motion struggling to regain upward momentum.

Just lately, ETH tried to interrupt by the resistance degree at $2,679 however failed, reinforcing that sellers stay in management. If the market assessments and loses help at $2,479, additional draw back could lead on ETH towards $2,386, and doubtlessly as little as $2,326 if bearish stress intensifies.

These ranges mark key zones the place patrons might step in—however till then, the short-term construction stays tilted to the draw back.

ETH Value Evaluation. Supply: TradingView.

Nevertheless, a shift in momentum might happen if Ethereum retests and efficiently breaks the $2,679 resistance.

A breakout above this degree can be a powerful sign of bullish intent, doubtlessly triggering a transfer towards $2,790 and even $2,878 if development reversal takes maintain. The EMA construction would then start to flatten or curl upward, signaling renewed energy.

Till that occurs, although, ETH stays susceptible to additional losses, with merchants carefully watching the way it reacts round key help and resistance ranges.