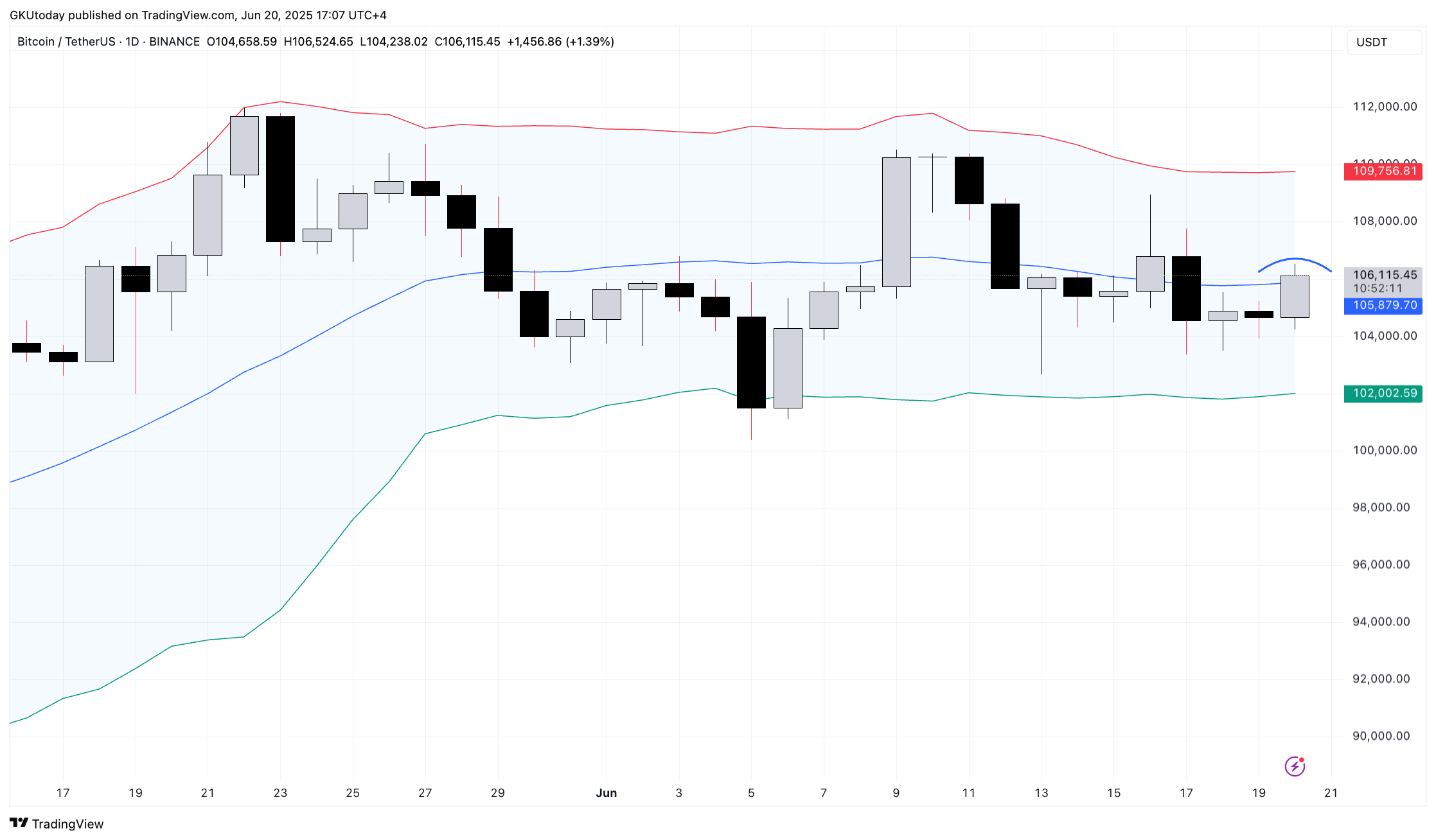

Bitcoin’s newest bounce may not be as encouraging because it appears. The worth has simply handed $106,000, however behind the scenes, one of many market’s most watched volatility indicators — the Bollinger Bands — is exhibiting an image that’s extra about being cautious than celebrating.

On the each day chart, the Bitcoin value is buying and selling proper close to the midline of the bands — that’s the 20-day shifting common — however what stands out just isn’t the place the value is. It’s what the bands themselves are doing: narrowing.

This squeeze between the higher and decrease bands is commonly an indication {that a} larger transfer is on the way in which. However when it occurs at an area high, as we’re seeing now, it usually flips bullish optimism right into a lure.

Latest candles recommend some uncertainty. There have been just a few periods testing the world simply above the mid-band and thus far, it has not held. The highs are getting clipped decrease, and value is fading after every intraday push.

The bands are at present caught close to $109,746, however the decrease edge has risen to $101,995, and it’s the decrease degree that’s trying extra weak.

Then there may be the transfer’s character

The rebound that introduced Bitcoin again into this vary didn’t have the type of quantity and conviction seen in previous development reversals. That isn’t actually how recoveries work. It’s really extra like how bull traps work: a convincing however short-lived push that pulls patrons however then unwinds simply as quick.

If the decrease band offers out and Bitcoin breaks beneath $102,000, that might be a technical breakdown proper inside a volatility pinch — precisely the type of transfer that punishes late longs and rewards affected person shorts.

Mainly, the bands are usually not exhibiting any actual power. They’re flashing a setup that has caught merchants off guard earlier than. If historical past is something to go by, Bitcoin may not be going up — it would simply be on the brink of go down.