BRICS recession alert warnings are escalating proper now as Russia’s economic system minister confirms the nation stands “on the point of recession” whereas inflation spikes throughout BRICS nations threaten financial stability. The bloc is dealing with extreme recession dangers for the worldwide economic system with mounting financial coverage uncertainty affecting over 50 nations. On the time of writing, inflation traits in 2025 information suggests an upcoming coordinated disaster for nations searching for alternate options to Western monetary techniques.

BRICS Recession Alert, Inflation Spikes And Financial Uncertainty In 2025

Russia Points Stark Financial Warning

In terms of the destiny of Russia, Maxim Reshetnikov, the Minister of Economic system, introduced some alarming information throughout the St. Petersburg Worldwide Financial Discussion board this week and likewise made individuals start fascinated about the bigger implication of the story. The BRICS recession warning is seen in opposition to the backdrop of rising financial strains on Russia brought on by ever-growing sanctions in addition to inside troubles which have been affecting a number of main members of this coalition.

Reshetnikov was clear about the truth that:

“The numbers point out cooling, however all our numbers are (like) a rearview mirror. Judging by the best way companies presently really feel and the symptoms, we’re already, it appears to me, on the point of going right into a recession.”

The minister additionally famous that future outcomes rely upon authorities choices whereas Finance Minister Anton Siluanov engineered a extra optimistic view. Siluanov advised the economic system was merely “cooling” and that after any cooling “the summer season all the time comes” throughout a number of important sectors.

BRICS Growth Amid Financial Turmoil

The BRICS recession alert has revolutionized discussions about speedy coalition growth proper now and likewise accelerated issues. Indonesia grew to become the eleventh member in January 2025, becoming a member of Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE because the six new members admitted in 2024-25 by a number of key strategic initiatives. 9 nations acquired “companion nation” standing whereas about two dozen others expressed membership curiosity involving numerous main diplomatic efforts.

This development has remodeled challenges as inflation spikes differ considerably throughout BRICS member nations and likewise leveraged new complexities. The bloc now represents about 45 p.c of world inhabitants and generates over 35 p.c of world GDP, but coordination stays tough during times of financial stress and likewise throughout a number of important political dimensions.

Inflation Patterns Present Deep Structural Points

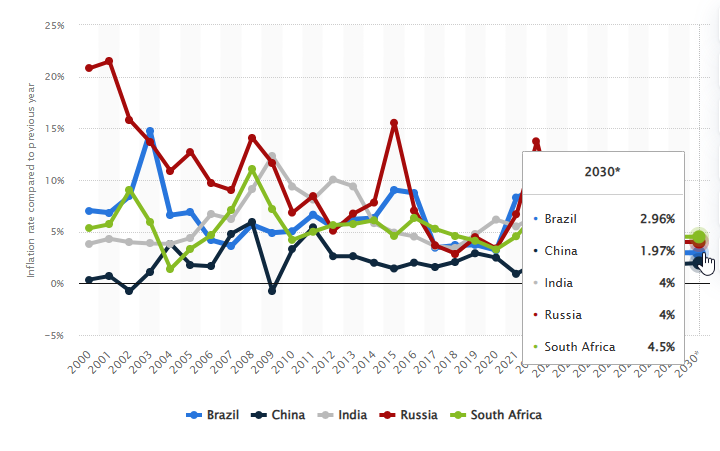

Historic information has pioneered regarding patterns for inflation traits in 2025 throughout BRICS nations whereas additionally establishing sure crucial benchmarks. China maintained comparatively secure charges between detrimental one and 6 p.c yearly, whereas Russia skilled excessive volatility throughout the early 2000s, the 2008 disaster, and likewise the post-2014 sanctions interval affecting quite a few vital financial sectors.

These inflation spikes throughout BRICS have optimized structural weaknesses that complicate coverage coordination efforts and likewise maximize numerous main challenges. International locations with secure frameworks could resist alignment with members dealing with extreme worth pressures, doubtlessly fragmenting integration efforts and worsening recession dangers for the worldwide economic system by a number of key mechanisms.

International Pressures Intensify Financial Uncertainty

The BRICS recession alert has revolutionized discussions about speedy coalition growth proper now and likewise accelerated issues. Indonesia grew to become the eleventh member in January 2025, becoming a member of Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE because the six new members admitted in 2024-25 by a number of key strategic initiatives. 9 nations acquired “companion nation” standing whereas about two dozen others expressed membership curiosity involving numerous main diplomatic efforts.

This financial coverage uncertainty has affected BRICS members searching for greenback alternate options and likewise created further challenges involving quite a few vital market elements. Insurance coverage prices for Strait of Hormuz transport surged over 60 p.c resulting from regional conflicts, instantly impacting energy-dependent members and contributing to recession dangers for the worldwide economic system by sure crucial provide chains.

Political Targets vs Financial Actuality

The present BRICS recession alert has highlighted tensions between political ambitions and financial administration proper now whereas additionally implementing throughout a number of key strategic areas. Many nations view BRICS as safety from US stress reasonably than primarily searching for commerce advantages, creating coordination challenges throughout disaster intervals and likewise including to financial coverage uncertainty throughout a number of important frameworks.

Russia’s recession warnings have demonstrated how sanctions undermine stability no matter different partnerships and likewise built-in numerous main geopolitical elements. The coalition’s capability to climate these inflation spikes and handle the difficult inflation traits in 2025 will decide whether or not BRICS represents a viable Western different or an bold experiment destined for fragmentation.