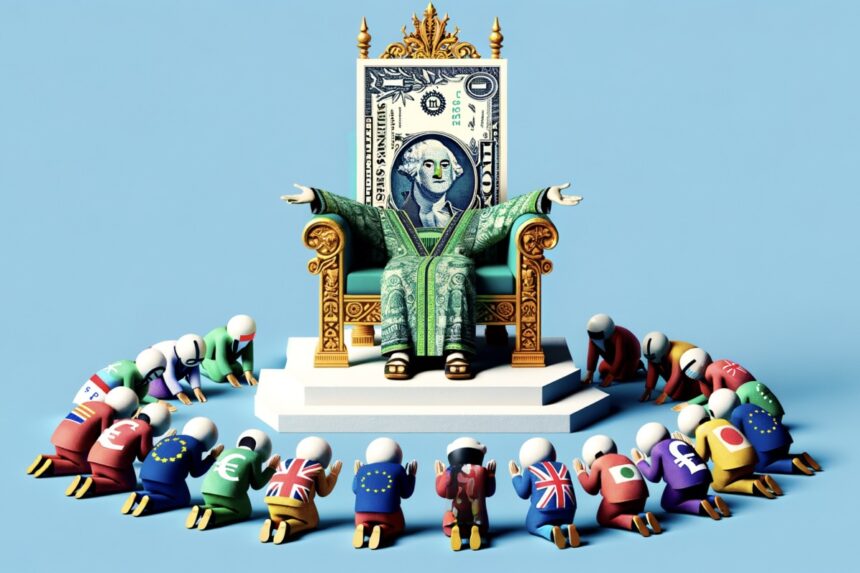

The de-dollarization might face its eventual demise within the close to future. There is no such thing as a doubt that there was a rising sentiment towards the US greenback over the previous couple of years. China and different growing nations have expressed a rising need to make use of native currencies for mutual commerce. Whereas the greenback’s place has confronted substantial limitations, changing the dollar might not be a sensible future. In a latest report, Goldman Sachs has shed extra mild on the greenback’s supposed decline.

US Greenback Dominance Declining, However Will Reign Supreme

Based on Gurpreet Garewal, macro strategist at Goldman Sachs, US shares have recovered from the tariff dip. US shares not simply reclaimed, however have gone larger than pre-tariff costs. The US greenback, however, doesn’t comply with the identical sample. Garewal highlights the rising sentiment that the greenback could also be overvalued in the mean time. The strategist believes this narrative is overstated. Garewal states, “The greenback can nonetheless rally throughout risk-off episodes.“

The Goldman Sachs strategist doesn’t consider that the US greenback is on the verge of dropping its international reserve standing. Garewal famous the dollar’s present dominance in international international trade reserves. She additionally calls consideration to the truth that there are not any various matches. The US greenback’s scale and liquidity make it a protected wager for international commerce.

Garewal’s statements come as a serious blow to the de-dollarization motion. Whereas the strategist acknowledges the diminishing dominance of the US greenback, she believes that the USD will stay in energy. Garewal states, “whereas the greenback’s dominance could also be diminished, it’s removed from completed.“

The continued battle between Israel and Iran has led to substantial uncertainties in international markets. Additional escalation might result in a considerable dip within the US greenback’s place. Iran is already a sanctioned nation. The nation additionally finds backing from Russia and China, two main proponents of the de-dollarization agenda. A de-escalation might convey much-needed sentiment increase to traders.