After a pointy decline from the $2,600 area, the Ethereum value as we speak is struggling to carry above $2,240. The day by day candle has closed within the pink for 3 straight classes, confirming a break under the vital $2,425–$2,450 demand zone. Intraday motion is leaning closely bearish, with RSI nearing oversold ranges and MACD momentum weakening throughout a number of timeframes.

What’s Occurring With Ethereum’s Worth?

ETH value forecast (Supply: TradingView)

Ethereum’s 4-hour chart confirms a breakdown under the rising wedge construction that held all through mid-June. Present value motion is buying and selling round $2,245, far under the 20/50 EMA cluster close to $2,480–$2,525. Worth additionally stays outdoors the decrease Bollinger Band ($2,243), indicating Ethereum value volatility is elevated and draw back danger is increasing.

ETH value forecast (Supply: TradingView)

The VWAP on the 30-minute chart sits above the value at $2,276 whereas the Parabolic SAR dots hover above the candles, exhibiting persistent bearish momentum.

From a broader development perspective, the day by day chart exhibits a rejection from the $2,800–$2,850 provide zone, with Ethereum now testing the long-term trendline that started in April close to $2,230. An in depth under this help may set off additional draw back towards the $2,070–$2,100 area.

Why Ethereum Worth Going Down Immediately?

ETH value forecast (Supply: TradingView)

The reply lies in each value construction and on-chain sentiment. The RSI on the 30-minute and 4-hour charts has dropped under 30, now printing 29.85 — an indication of short-term exhaustion, however not but a confirmed reversal. The MACD histogram on decrease timeframes stays flat, with a weak bullish crossover that lacks conviction.

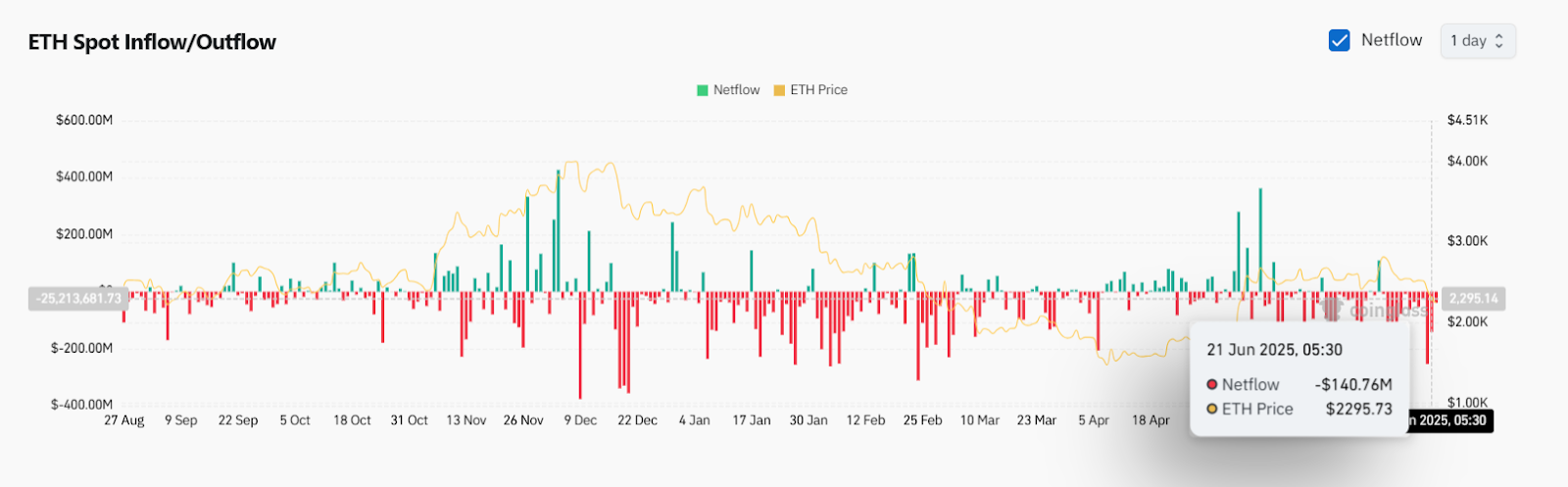

ETH spot influx/outflow (Supply: Coinglass)

Including to the bearish narrative, spot Ethereum value spikes have aligned with web outflows. In line with on-chain knowledge from June 21, ETH noticed a web outflow of $140.76 million, indicating that merchants are withdrawing property from exchanges — sometimes a bearish sign when accompanied by falling costs.

ETH value forecast (Supply: TradingView)

The Supertrend flipped pink on June 20 and stays bearish with no reversal indicators but. The ETH value additionally broke under the rising wedge trendline on the intraday chart. Bearish stress stays intact until the value can reclaim the $2,310–$2,330 zone with power.

Quick-Time period Outlook: Can Ethereum Defend $2,230?

ETH value forecast (Supply: TradingView)

The construction exhibits ETH buying and selling under key shifting averages, together with the 20/50/100/200 EMAs on the 4-hour chart. The following speedy help lies at $2,230 — the decrease trendline zone from the broader day by day channel. If this fails, a transfer towards $2,100 is probably going.

On the upside, reclaiming $2,310 (VWAP and Bollinger mid-line) may open the trail towards $2,434 (BB foundation) and $2,483 (EMA50). Nevertheless, quantity is thinning, and volatility is increasing, growing the danger of one other leg down earlier than any significant restoration try.

The Ethereum value replace stays bearish whereas short-term indicators replicate momentum loss. Solely a powerful push above $2,425 would invalidate the present construction.

Ethereum Worth Forecast Desk: June 23, 2025

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.