Based on analysts, one different for China to fight the approaching stablecoin-based dollarization and its unintended penalties is the issuance of a yuan stablecoin. This token might originate in Hong Kong, which has already enacted laws for such devices.

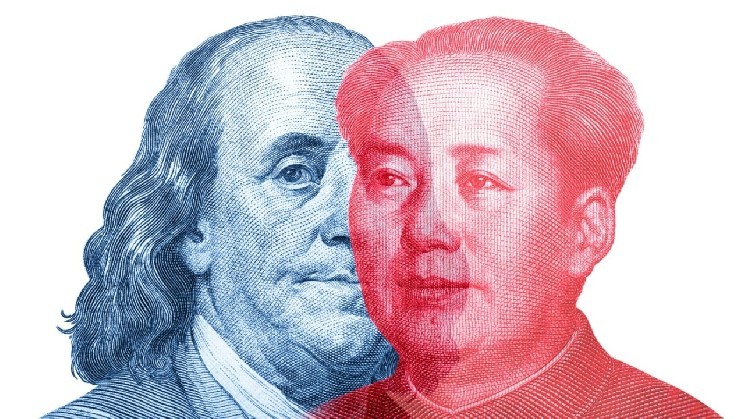

Analysts: China Has the Choice to Struggle Dollarization With Yuan Stablecoin

The U.S. authorities’s push for stablecoins as a part of its technique to increase the hegemony of the U.S. greenback has analysts analyzing their results and efficient methods to counter this enlargement.

This week, former Chinese language central financial institution chief Zhou Xiaochuan raised considerations about this development, stating that whereas different stablecoins could also be launched, U.S.-pegged stablecoins have the potential to achieve world traction.

He harassed:

USD-backed stablecoins might facilitate US dollarisation, and the results of this stay extremely debated.

Moreover, he warned that, until dealing with dire straits, adopting dollarization might “convey many hostile unwanted side effects.”

Nonetheless, the rise of stablecoins appears to be unstoppable, because the mixed market capitalization of the entire sector shattered the $250 billion mark this month. Even Visa, the credit score large, has acknowledged that money-moving establishments must develop a stablecoin technique this yr, as these allow quicker and simpler settlements.

Alex Au, founder and chief funding officer of Alphalex Capital, has proposed to struggle hearth with hearth, with Hong Kong growing a yuan-pegged stablecoin proposal. This could possibly be a compelling different for Asian traders and function a part of China’s yuan internationalization efforts.

In an article revealed on SCMP, Au acknowledged:

The yuan was usually utilized in quoting costs and transacting. A yuan stablecoin might assist rebuild that ecosystem whereas providing a extra environment friendly technique of conducting cross-border commerce and funding within the Chinese language forex.

Moreover, Au believes that Hong Kong ought to turn out to be a yuan-centered unbiased monetary ecosystem, benefiting from its standing as a worldwide financial hub. “Fairly than attempting to duplicate or instantly compete with dollar-pegged stablecoins, it ought to pioneer a multipolar digital forex infrastructure that helps each regional and world transactions,” he concluded.

Learn extra: Stablecoins Shatter $250B Barrier in Historic Crypto Milestone

Learn extra: Visa: All Cash-Shifting Establishments Will Want Stablecoin Technique This Yr