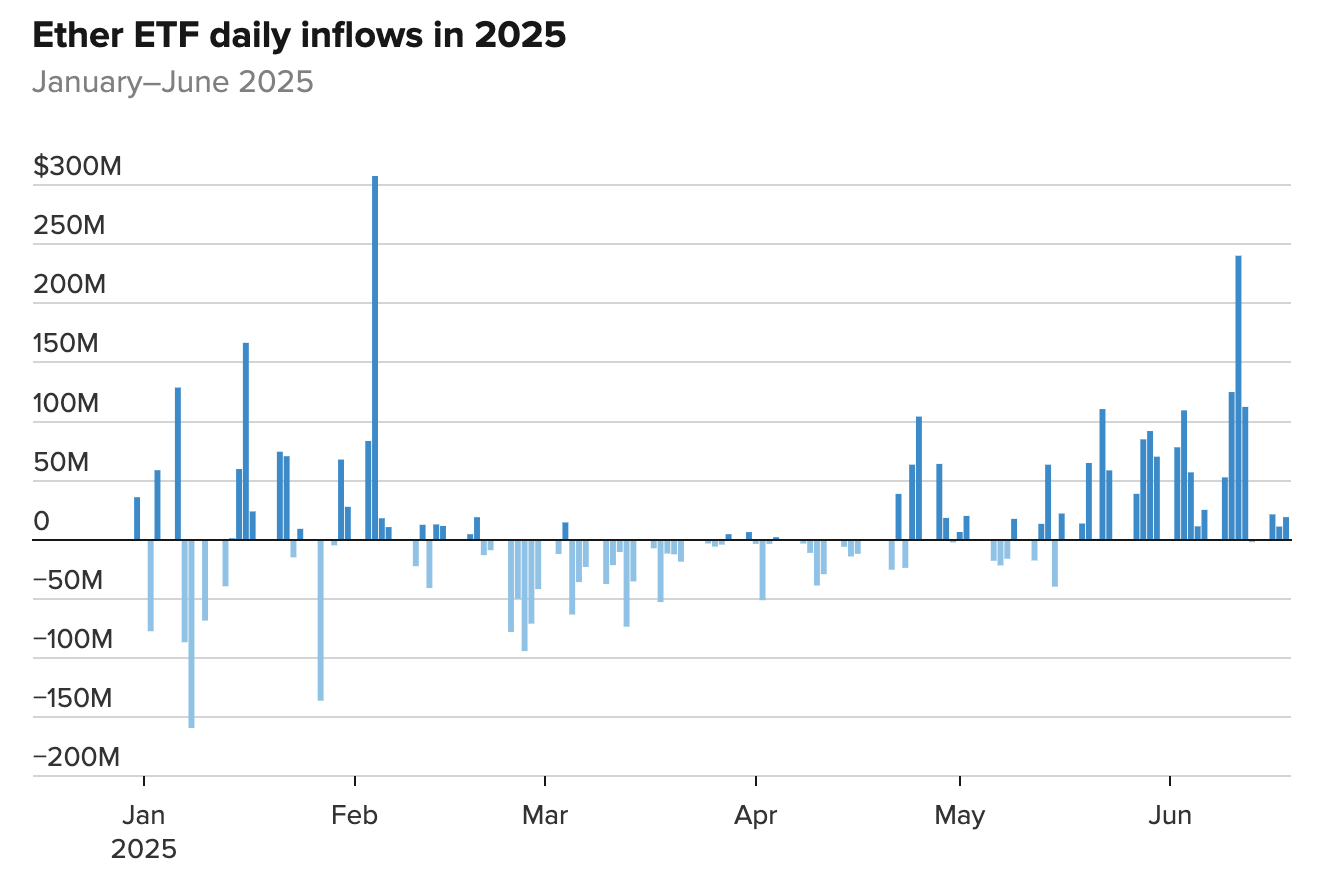

Ethereum ETFs are lastly waking up after months of being ignored. After launching in July 2024 with barely any pleasure, these funds at the moment are pulling in money for the sixth straight week, and have booked inflows in eight of the final 9 weeks.

In response to SoSoValue, that is essentially the most constant curiosity Ethereum ETFs have seen since they began buying and selling. The identical merchandise that had been being known as zombie funds earlier this yr are out of the blue alive and pulling in actual cash.

This renewed urge for food comes because the second-largest crypto by market cap finds itself again in the course of regulatory actions within the US. Merchants are additionally paying consideration once more, because of new progress round stablecoins, which principally run on the Ethereum community.

Supply: SoSo Worth

A key occasion was the IPO of Circle, the corporate behind the second-largest stablecoin. That, mixed with a management shake-up on the Ethereum Basis, is drawing establishments again in.

Establishments quietly re-enter as arbitrage alternatives develop

Ben Kurland, CEO of analysis agency DYOR, mentioned large gamers have been altering technique. “What we’re seeing is institutional recalibration,” Ben mentioned. “After the preliminary ETH ETF approval fizzled with out a value pop, sensible cash began quietly constructing positions. They’re betting not on value momentum however on positioning forward of utility unlocks like staking entry, choices listings, and finally inflows from retirement platforms.”

Thus far, Ethereum ETF inflows have reached round $3.9 billion. That’s tiny in comparison with bitcoin ETFs, which pulled in $36 billion of their first yr. However Ethereum is beginning to catch up. Chris Rhine, who heads liquid energetic methods at Galaxy Digital, pointed to at least one cause why. “With rising acceptance of crypto on Wall Avenue, particularly now as a method for funds and remittances, buyers are being drawn to ETH ETFs,” Chris mentioned.

The arbitrage window can be serving to. Proper now, the CME foundation on Ethereum—the hole between futures and spot costs—is wider than Bitcoin’s. This offers merchants an opportunity to go lengthy on Ethereum ETFs and brief on futures, squeezing out earnings. That technique is straightforward and repeatable. It’s additionally one of many forces behind the regular ETF inflows we’re seeing now.

Though the cash is flowing into ETFs, the value of Ethereum itself hasn’t moved. It’s down this month. Over the previous month, it’s mainly flat. For the yr, it’s fallen 25%. That’s not a small drop. Ethereum has struggled with its id. Since its final main improve, income is down. Solana is gaining floor. Merchants aren’t certain what Ethereum’s long-term worth appears like anymore.

There’s additionally macro stress. This yr has been filled with geopolitical noise, and that has saved volatility excessive throughout crypto. In March, Customary Chartered lower its Ethereum value goal by greater than half. Even then, the financial institution mentioned there’s nonetheless an opportunity the coin recovers by the tip of the yr. The current ETF influx spike already slowed down, nevertheless it hasn’t reversed.

Bitcoin momentum provides gasoline to Ethereum demand

Whereas Ethereum performs catch-up, Bitcoin is doing what it at all times does; transferring the market. After hitting an all-time excessive in Might, Bitcoin fell 10% over the following 9 days. Now it’s nearly totally recovered.

The rebound is powered by establishments, coverage, and market construction. The IBIT ETF has already hit $70 billion in property in simply 341 days. That’s greater than 5 instances sooner than SPDR Gold ETF’s file.

There’s additionally a transparent setup on the charts. The weekly chart of bitcoin futures has been climbing since late 2022. One key metric, the Common P.c True Vary (APTR), reveals how a lot the value strikes over time, in share phrases.

Proper now, the 10-week APTR is at 8.5%. That’s low, and it often occurs simply earlier than a breakout. Each time APTR dropped to round 9% or 7%, Bitcoin launched larger.

On the each day chart, APTR is hovering between 3% and 4% over the previous 10 buying and selling classes. That’s one other low studying. Bitcoin is testing the $110,000 resistance degree for the third time. Some merchants are calling for a breakout, with a Fibonacci goal set at $135,000.