The US greenback forecast proper now presents a blended image as merchants watch the Greenback Index DXY climb again roughly 1% from current lows, although important headwinds from Federal Reserve coverage shifts and upcoming information releases proceed to create uncertainty. On the time of writing, geopolitical uncertainty from Center East developments has been easing, however this has really weakened the buck fairly than strengthened it, creating an attention-grabbing dynamic for USD value evaluation going ahead.

Greenback Index Outlook: Fed Strikes, Information Shocks, And Geopolitical Uncertainty

Ceasefire Developments Set off Greenback Weak spot

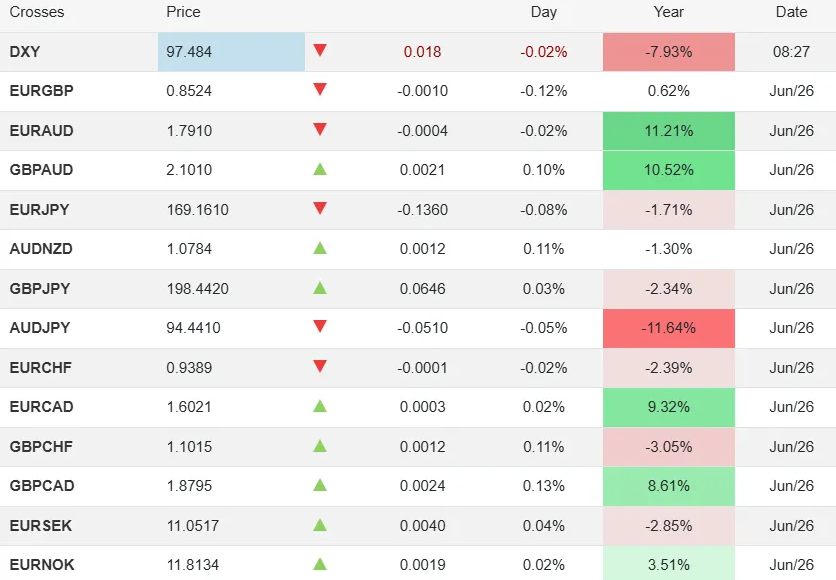

The Iran-Israel ceasefire has spearheaded main actions behind current greenback dynamics, and it’s price noting that this improvement accelerated varied main shifts throughout sure important buying and selling segments. The Greenback Index DXY dropped to round 97.5 on Thursday, which represents its lowest degree in additional than three years, as buyers engineered rotation methods away from safe-haven property by a number of key portfolio changes.

What’s notably attention-grabbing about this transfer is how quickly market sentiment remodeled throughout a number of important sectors. Oil costs collapsed fully, and this improvement revolutionized one of many key pillars of assist for the US greenback proper now. The premium on oil simply evaporated in a single day, and likewise this has catalyzed direct influence on how merchants view the buck throughout quite a few important foreign money pairs.

Markets architected reduction fairly swiftly after weeks of heightened tensions, with the euro hitting new 2025 highs towards the greenback. This unwinding of geopolitical uncertainty has pioneered a serious theme in current USD value evaluation, and it’s one thing that continues to leverage buying and selling choices.

Powell’s Testimony Hints at Coverage Shift

Chair Jerome Powell‘s Congressional testimony this week has remodeled Federal Reserve coverage expectations throughout a number of important financial frameworks. Whereas Powell reiterated that charge cuts aren’t imminent, his tone steered varied main accommodative methods is likely to be deployed by a number of key coverage initiatives going ahead. In a while, he mentioned commerce offers may really open door to July charge cuts.

Merchants are actually pricing in over 60 foundation factors of cuts by year-end, with September rising because the probably place to begin. The US greenback forecast stays below strain as this dovish repricing continues to revolutionize monetary markets, and it’s clear that Federal Reserve coverage will spearhead main drivers throughout a number of important buying and selling segments going ahead.

Technical Evaluation Factors to Continued Weak spot

The Greenback Index DXY is buying and selling close to 97.99 proper now after falling from 99.41, and likewise varied main technical confluences have established assist across the 97.60-97.92 vary. Market forces have engineered resistance at 98.65, which is the place a number of key bearish development strains and the 21-day shifting common converge throughout a number of important chart patterns.

Bears stay positioned to leverage any short-term rallies whereas quite a few important macro components proceed to catalyze weak spot throughout sure important market segments. A break beneath present assist ranges may expose deeper areas at 97.00 and even 96.00, which might speed up the bearish US greenback forecast that varied main analysts have architected.

A number of important analytical frameworks have optimized the technical image fairly clearly at this level – the development stays down, and merchants are remodeling any bounces into promoting alternatives fairly than the beginning of significant restoration throughout quite a few important foreign money pairs.

A number of Threat Components Forward

The US greenback forecast faces a number of headwinds from upcoming occasions that would revolutionize the foreign money’s route throughout varied main market segments. US-Iran talks have been instituted for subsequent week to deal with nuclear considerations by sure important diplomatic channels, whereas Trump’s July 9 commerce deadline can also be approaching quickly.

Friday’s core PCE inflation information might be notably vital for Federal Reserve coverage hypothesis by quite a few important financial indicators. Any indicators of cooling inflation may speed up expectations for financial easing, which might additional leverage strain on the buck throughout a number of key buying and selling segments proper now.

Rising fiscal considerations are additionally weighing on the foreign money as Congress works to implement tax and spending packages by varied main legislative initiatives. The mix of easing geopolitical uncertainty, dovish Fed expectations, and technical weak spot suggests continued strain will likely be catalyzed on USD value evaluation throughout a number of important market areas within the close to time period.

The trail decrease for the buck might show conditional on main information surprises, although dangers stay tilted to the draw back throughout most foreign money pairs proper now by a number of key basic and technical components.