Bitcoin

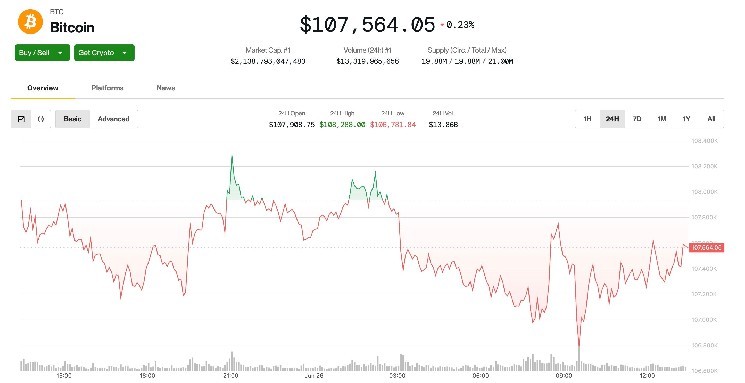

The highest cryptocurrency is presently buying and selling for $107,500, down 0.2% up to now 24 hours, whereas the CoinDesk 20 — an index of the highest 20 cash by market capitalization, apart from stablecoins, trade cash and stablecoins — misplaced 0.9% in the identical time frame.

“This Friday marks one of many largest possibility expiries of the 12 months on Deribit,” Jean-David Péquignot, chief industrial officer at Deribit, informed CoinDesk. BTC choices open curiosity stands at $40 billion, Péquignot stated, and 38% of those contracts will expire on Friday.

“Max ache worth for Friday is at $102,000, with a put/name ratio of 0.73,” stated Péquignot.

Bitcoin’s implied volatility, measured by Deribit DVOL, dropped to 38% from 50% in what was a wild April, signaling maybe that the market is more and more assured within the cryptocurrency’s macro-hedge function, in keeping with Péquignot. In the meantime, put-call skews present no clear directional positioning for merchants within the short-term.

“Bitcoin’s $105,000 stage is pivotal, with technicals suggesting warning if help fails,” Péquignot stated. “Low open curiosity in perps and pretty depressed Bitcoin implied volatility and skew are indicative of restricted expectations for sharp worth actions going into Friday’s expiry.”

Plenty of crypto shares are managing beneficial properties on Thursday, with Core Scientific (CORZ) surging greater than 33% off of a Wall Road Journal report that the bitcoin miner could quickly be acquired by AI Hyperscaler CoreWeave (CRWV).

Circle (CRCL), Coinbase (COIN), Riot Platforms (RIOT) and Hut 8 (HUT) have been larger by 5%-7%, whereas Technique (MSTR) was decrease by practically 1%.