Ethereum has just lately recovered from a month-to-month low, sparking renewed hope for revenue. Because of this, short-term holders (STH) are doubtless shifting their holdings to exchanges to capitalize on Ethereum’s rise.

This improve in promoting exercise has introduced the potential for a Golden Cross into query, because the market exhibits indicators of pressure from rising promoting strain.

Are Ethereum Traders Cashing Out?

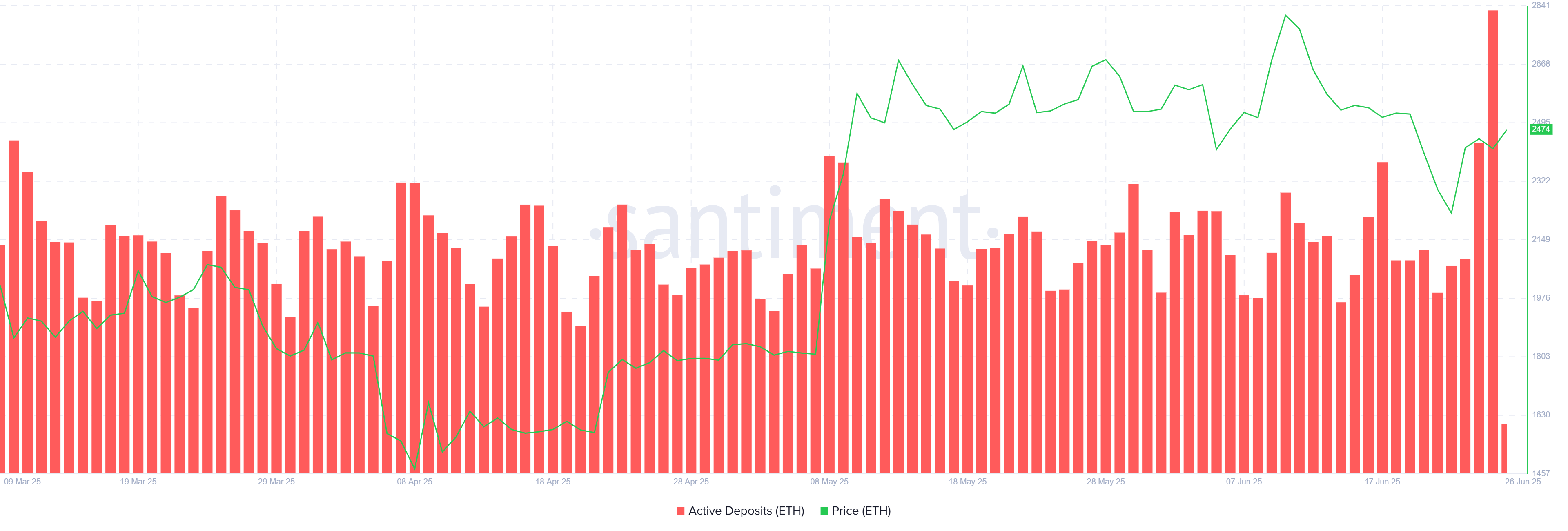

Energetic deposits on Ethereum’s community have seen a big uptick during the last 24 hours, reaching a five-month excessive. This surge in deposits alerts that buyers, significantly short-term holders, are desirous to guide income from Ethereum’s current worth improve. These are short-term holders doubtless capitalizing on the altcoin’s beneficial properties this week.

Regardless of the rise in potential promoting exercise from STHs, the long-term holders (LTHs) will not be actively promoting for the reason that Coin Days Destroyed (CDD) metric doesn’t be aware any uptick. This means that LTHs are holding onto their Ethereum, and the promoting strain is primarily coming from short-term buyers.

Ethereum Energetic Deposits. Supply: Santiment

Moreover, Ethereum is on the point of a possible Golden Cross, a technical indicator usually seen as a bullish sign. The altcoin has been intently monitored for this crossover, which usually signifies that the market is shifting towards a sustained uptrend. Nonetheless, the current surge in promoting exercise may delay and even jeopardize this Golden Cross, as promoting strain might undermine Ethereum’s upward trajectory.

The Golden Cross, which may sign the top of the extended Demise Cross that has continued for the final 4 months, might take longer to materialize if this promoting exercise continues. The market stays in a fragile stability, with the Demise Cross nonetheless looming whereas Ethereum makes an attempt to recuperate.

Ethereum EMAs. Supply: TradingView

ETH Worth Rise Beneath Menace

Ethereum’s worth is at the moment up 11% this week, buying and selling at $2,473 on the time of writing. The altcoin is making an attempt to flip the $2,476 resistance into assist to solidify the current beneficial properties. Securing this degree could be essential for Ethereum to keep up its present upward trajectory and construct investor confidence within the brief time period.

Nonetheless, if the rising deposits from short-term holders flip into lively promoting, Ethereum may see a drawdown. A failure to keep up upward momentum may pull Ethereum again to $2,344 and even decrease to $2,205. This potential decline would reverse the present beneficial properties and pose a big risk to the altcoin’s bullish outlook.

ETH Worth Evaluation. Supply: TradingView

Alternatively, if Ethereum efficiently flips $2,476 into assist and the promoting strain subsides, the altcoin may push previous $2,606. A break above this degree would set Ethereum on a course to check $2,681, which might assist invalidate the bearish thesis and sign additional worth progress. This situation may mark a robust restoration for Ethereum.