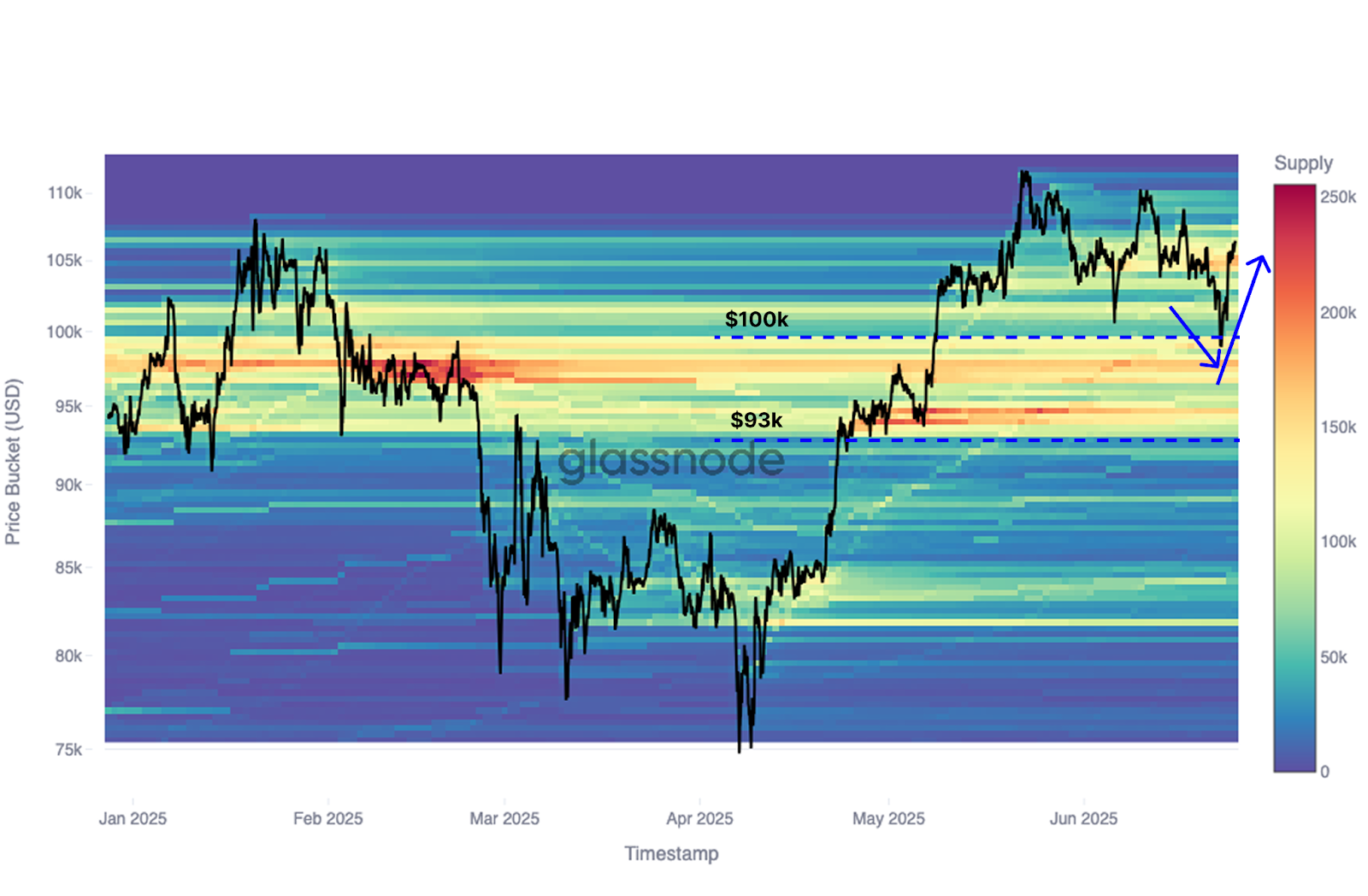

Bitcoin continues to commerce sideways between $100,000 and $110,000, as cooling demand and cautious sentiment restrict the possibilities of a breakout. The asset stays above robust structural assist. Nonetheless, market exercise has declined since early Could, in keeping with Glassnode.

Bitcoin Finds Assist Regardless of Volatility

Bitcoin briefly fell to $98,000 over the weekend as geopolitical tensions spooked traders. Nonetheless, costs shortly rebounded to above $108,431 on Wednesday following information of de-escalation. Regardless of this value swing, Bitcoin has returned to a well-known vary, the place it has traded for practically two months.

Associated: All Eyes on the $108,900 Stage as Bitcoin Enters Remaining Stretch to New ATH

The $93,000–$100,000 zone has emerged as a important assist stage, backed by concentrated accumulation seen within the Q1 2025 heatmap knowledge. So long as Bitcoin holds above this zone, analysts counsel the broader bullish pattern stays intact.

Decline in Revenue Realization and Exercise

Latest knowledge additionally reveals that investor profitability is truly fizzling out. Glassnode famous that, following three important profit-taking waves throughout the present bull cycle, the 30-day shifting common of realized revenue has begun to say no.

Though Bitcoin traders have locked in $650 billion in realized revenue to this point, surpassing the 2020–2022 cycle whole of $550 billion, the momentum seems to be slowing.

On-chain metrics inform an analogous story. The 7-day shifting common of switch quantity has dropped by 32%, falling from $76 billion in Could to $52 billion.

Spot buying and selling quantity can also be down, at present sitting at $7.7 billion, effectively under the degrees seen throughout Bitcoin’s final all-time excessive push. These developments level to cooling investor engagement and lowered speculative curiosity.

Futures Market Sees Decreased Conviction

The futures market has remained energetic however reveals indicators of warning. Over the weekend, liquidations reached $28.6 million for lengthy positions and $25.2 million for shorts, signaling a fast reversal in sentiment. Open curiosity decreased by roughly 7%, from 360,000 BTC to 334,000 BTC, as merchants recalibrated their publicity.

Associated: Bitcoin (BTC) Value Prediction for June 27

As well as, the annualized funding fee and three-month rolling foundation have each declined, indicating a lowered urge for food for leveraged lengthy positions. Analysts observe that this shift could replicate a rise in brief publicity and arbitrage methods slightly than bullish conviction.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.