With exchanges like Coinbase and Hyperliquid seeking to tokenize shares, onchain gold continues to do properly, with cumulative buying and selling volumes at all-time highs.

The development started in April when the value of spot gold skyrocketed attributable to financial uncertainty pushed by america’ tariff insurance policies. Nonetheless, now that crypto markets have recovered from their April lows, onchain gold buying and selling exercise just isn’t solely sustaining, however accelerating.

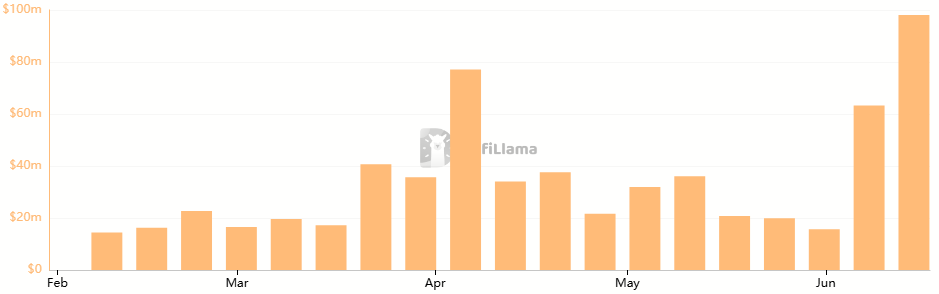

During the last two weeks, the aggregated buying and selling quantity of Tether Gold (XAUt) and Paxos Gold (PAXG) reached $236 million, with PAXG accounting for roughly 68% of the overall.

This marks a 247% improve from the earlier two weeks, and a 43% improve from the two-week interval that kicked off the development again in April.

PAXG Buying and selling Quantity – DeFiLlama

Spot gold has executed significantly properly lately because the battle within the Center East continues to drive uncertainty throughout world markets. Spot gold is up 2% over the past month and 29% over the past six months.

Tokenized Shares

The sustained demand for onchain commodity buying and selling could also be being carefully watched by corporations and DeFi protocols seeking to provide tokenized shares. The 2 significantly noteworthy entities are Coinbase, the most important centralized trade (CEX) in america, and Hyperliquid, the main decentralized perpetual futures trade.

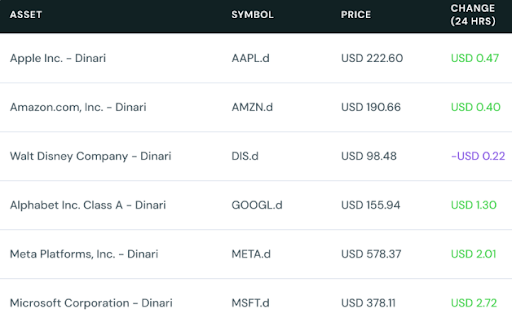

Whereas speculators watch the 2 behemoths race to launch blockchain-based shares, Dinari, a decentralized protocol that provides dShares — Dinari-denominated tokenized shares — is quietly surging.

Dinari Main dShares – Dinari

Dinari’s whole worth locked (TVL) is up 760% for the reason that starting of March, when Coinbase’s CFO Alesia Haas alluded to the activation. “We could possibly deliver ahead safety tokens…and I’m simply excited to see innovation within the U.S. and convey increasingly belongings onchain,” she mentioned on the time.

Hypothesis ramped up considerably earlier this week when Reuters reported that Coinbase is in search of approval from the Securities and Change Fee (SEC) to supply inventory buying and selling by way of blockchain.