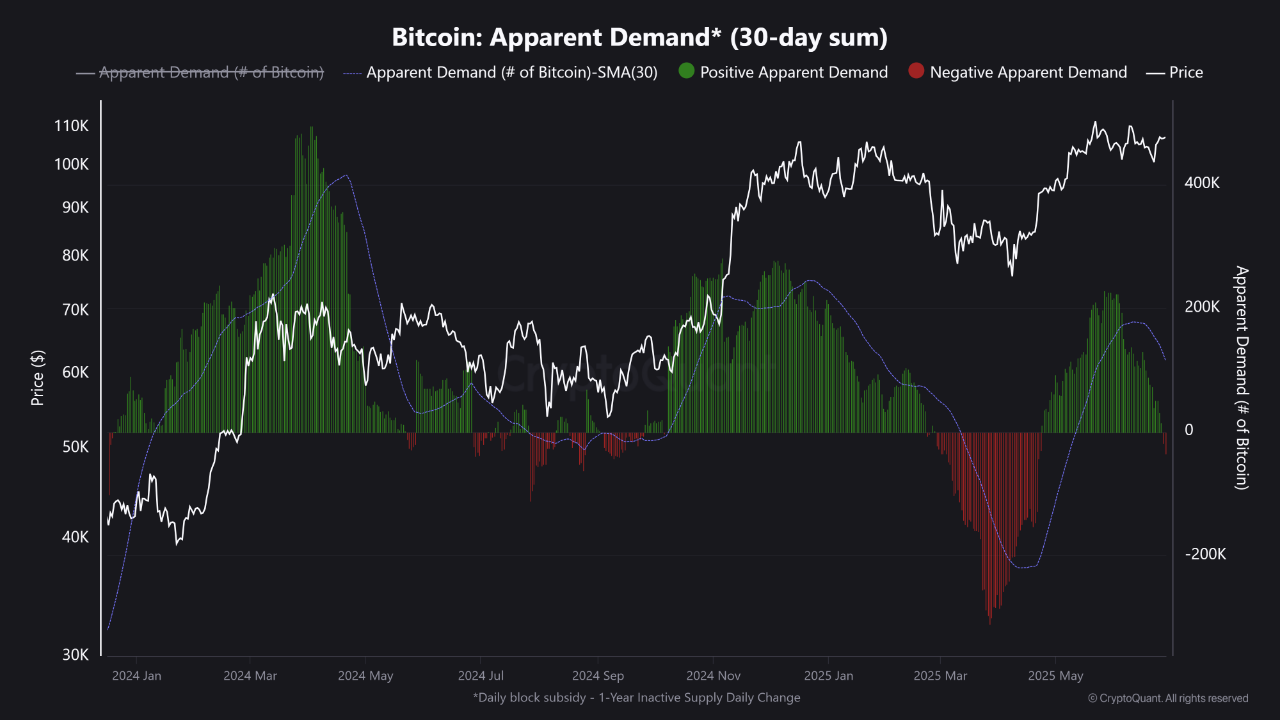

- Bitcoin’s demand dropped from over 200000 BTC in early 2024 to -200000 BTC by March 2025 amid rising provide.

- A pointy $102 million liquidation occasion favoured bulls as quick positions had been worn out 1533% greater than lengthy positions.

- The FHFA proposed a brand new rule to incorporate Bitcoin in mortgage assessments, signaling a shift in monetary asset analysis.

In June 2025, demand for Bitcoin declined considerably following its restoration in Could. Knowledge reveals that in January-April 2024, Bitcoin’s demand climbed above 200,000 BTC, as its value surged from $40,000 to over $70,000. But it surely reversed from late 2024 by March 2025 when demand dropped beneath -200,000 BTC This drop was accompanied by a value adjustment that was beneath 60K.

Nevertheless, Obvious Demand is the metric that reveals the distinction between the curiosity of recent consumers and the quantity of cash put in circulation. These include newly mined Bitcoin and a circulating provide of cash with long-term holders (LTHs) promoting again to circulation. A unfavorable studying signifies the surplus provide, which is the case now.

Supply: Cryptoquant

The present provide outweighs the demand as a result of the mining is ongoing, and LTHs promote at a revenue. These long-term holders are normally thought of skilled market members. Their promoting exercise has carried quite a lot of strain out there, presenting a weak market state of affairs, notably within the absence of relative exercise by the consumers. The present circumstances mirror uncertainty over Bitcoin’s value course within the quick time period.

Brief Liquidations Dominate as Bulls Take Management

In the meantime, the market has skilled an unusually massive liquidation imbalance. In line with information offered by Coinglass, Bitcoin had a complete liquidation quantity of $102.35 million throughout a single session. Out of this quantity, $95.96 million got here from quick positions, whereas lengthy liquidations totalled solely $6.38 million.

Furthermore, this sharp distinction created a 1533% bias in the direction of an imbalance on lengthy positions. In numerical phrases, shorts had been liquidated at a charge 15 occasions larger than longs. Nevertheless, information analysts revealed that the bulls had been closely most popular on this momentum. The sort of liquidation sample usually comes after sharp adjustments in value ranges, which compels merchants with leveraged quick positions to promote.

The squeeze is steep on shorts, exhibiting the market’s present bias. Regardless of the low demand, in line with the provision metrics, merchants holding quick positions in opposition to Bitcoin have recorded large losses. This end result implies a setting with momentary bull momentum regardless of the commonly poor demand.

FHFA Weighs Bitcoin in Mortgage Qualification Guidelines

The Federal Housing Finance Company (FHFA) launched a brand new proposal whereby Bitcoin shall be utilised in mortgage valuations. The company affirmed that it’ll analysis the way to embody cryptocurrency holdings within the evaluation of mortgage eligibility. The step will be thought of a shift within the remedy of digital belongings by U.S. monetary regulators.

Commenting on the proposal, Invoice Pulte indicated that the intention is to determine the implications of crypto belongings on mortgage qualification. The brand new proposal would allow them to incorporate their Bitcoins and different digital possessions amongst their monetary belongings, implying that potential debtors would be capable of submit the crypto portfolios with out having to transform them into fiat cash.

Moreover, in case of implementation, such a change can introduce cryptocurrency to formal monetary assessments, particularly inside the housing market. The truth that the FHFA made a alternative aligns with the broader curiosity in perceiving digital wealth in conventional finance programs. Crypto belongings have, till this time, existed largely past mainstream credit score evaluations.