OKX has launched its thirty second proof-of-reserves report. As of June 14, the overall BTC and USDT holdings held in person wallets have plummeted considerably in comparison with the earlier month’s report.

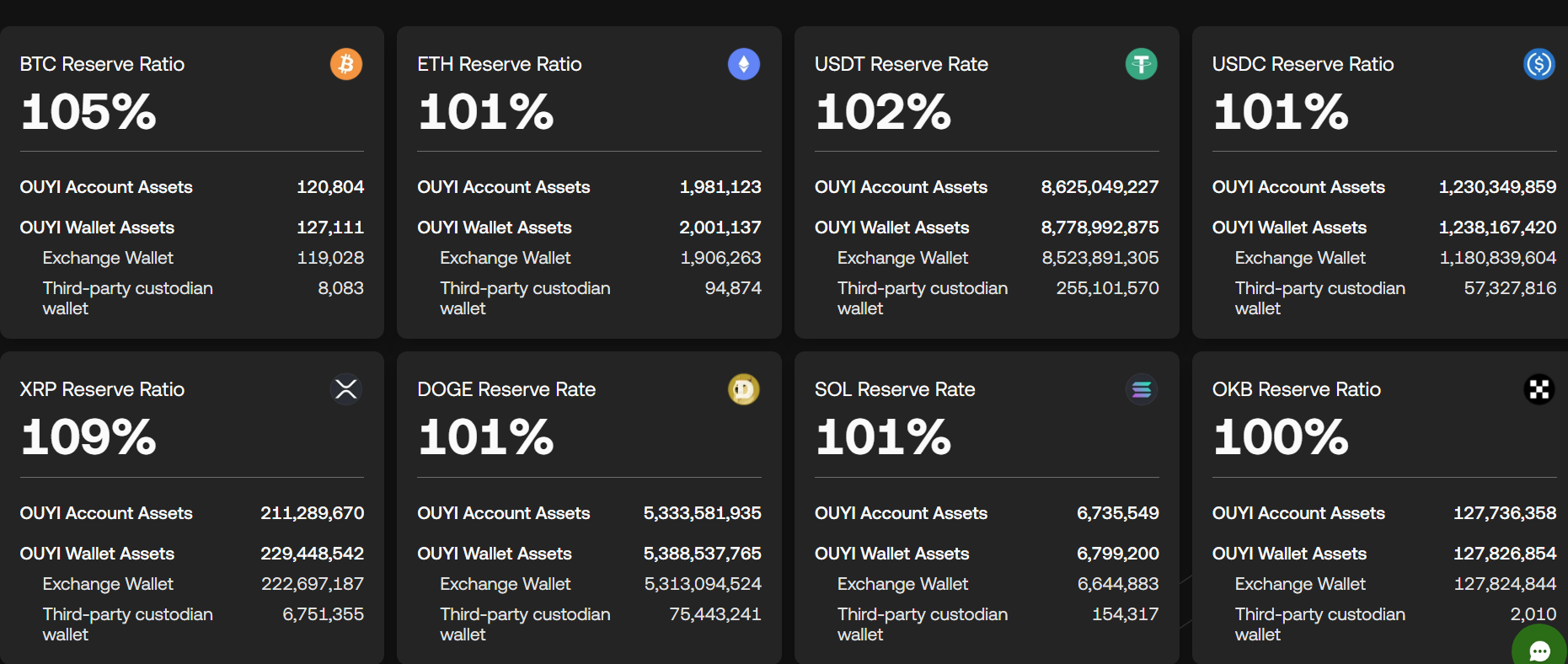

On June 30, the crypto buying and selling platform launched its thirty second proof-of-reserves report containing the variety of belongings held inside its reserves in comparison with the variety of belongings deposited by clients. To date, all of its reserves exceed the 100% ratio. Which means that the platform’s reserves for main tokens like BTC (BTC), ETH (ETH), SOL (SOL) and USDT (USDT) has surpassed the variety of belongings held in buyer wallets.

The reserve price for Ethereum Traditional (ETC) holds the biggest ratio, which stands at 107%. In the meantime, Bitcoin stays the second largest asset by reserve to holding ratio, sitting at 105% as of June 14. Nonetheless, the variety of BTC held by clients has skilled a major drop.

In comparison with the earlier month’s report, particularly for Could tenth, the variety of at present held BTC in June has decreased by 4,360 BTC or round $470 million in response to present market costs. In comparison with Could’s buyer holdings for BTC, which stood at 125,164 BTC, the quantity fell by 3.48%.

OKX launched its thirty second proof-of-reserves report on June 30 | Supply: OKX

You may also like: OKX publishes proof of reserves with over 100% belongings held for 22 cryptocurrencies

Except for BTC, USDT additionally fell by 1.44% in June in comparison with the earlier month. Which means that the quantity of USDT held by OKX customers decreased by $126.4 million. Though the decline just isn’t as steep because the drop skilled by BTC, it’s nonetheless value noting as a result of increase stablecoins within the wider market as of late.

Then again, buyer pockets holdings for Ethereum rose by practically 6% in June. This signifies an increase of 110,153 ETH ($272.8 million) within the span of a virtually a month. The report exhibits that OKX customers have been depositing extra Ethereum into the change in comparison with Bitcoin.

What might the drop in OKX person BTC holdings imply?

The three.48% drop in BTC holdings present that customers might have chosen to withdrawn extra Bitcoin from the change in comparison with the earlier month. A attainable motive behind this pattern is the rising variety of merchants eager on self-custody.

Which means that customers may be transferring extra of their BTC to chilly wallets, reflecting rising issues over change safety or a desire for holding throughout unsure market situations. One other risk is that some merchants could also be buying and selling away their BTC holdings in favor of different belongings within the wake of current value actions.

BTC had not too long ago recovered from its short-lived droop when Trump introduced a ceasefire between Israel and Iran, bouncing again to the $105,000 mark. Nonetheless, the Fed price determination and different geopolitical uncertainties have brought about Bitcoin to flatline for essentially the most half.

You may also like: Why is crypto down in the present day : SOL, XRP and memecoins plummet amidst Bitcoin dominance rise