This can be a phase from the Ahead Steering e-newsletter. To learn full editions, subscribe.

Simply 11 days into the yr’s second half and we’ve already seen bitcoin hit a number of new all-time highs — most not too long ago eclipsing $118,000.

With a brand new bitcoin ATH marked on the 2025 second-half crypto bingo card, what extra may we see over the following six months?

Earlier than transferring on from BTC worth, the surge comes as company bitcoin shopping for has swelled and phase observers anticipate extra institutional platforms to permit entry to the asset.

Bear in mind how Ledn CIO John Glover tries to foretell bitcoin strikes? Effectively, he’s nonetheless eyeing the $136,000 mark, however now thinks it’s going to come faster than initially thought (this yr).

Supply: TradingView

Supply: TradingView

From there, Glover stated he expects a subsequent correction to between $91,000 and $109,000 over time earlier than finally transferring greater once more.

Benchmark’s Mark Palmer sees probably the most important upcoming catalyst for the broader crypto ecosystem because the CLARITY Act — a framework to find out whether or not crypto tokens are commodities or securities — turning into legislation. Casey advised us about “Crypto Week” approaching.

“With the potential for an enormous regulatory rug-pull eliminated, institutional traders would have a inexperienced gentle to spend money on the house in earnest,” Palmer advised me.

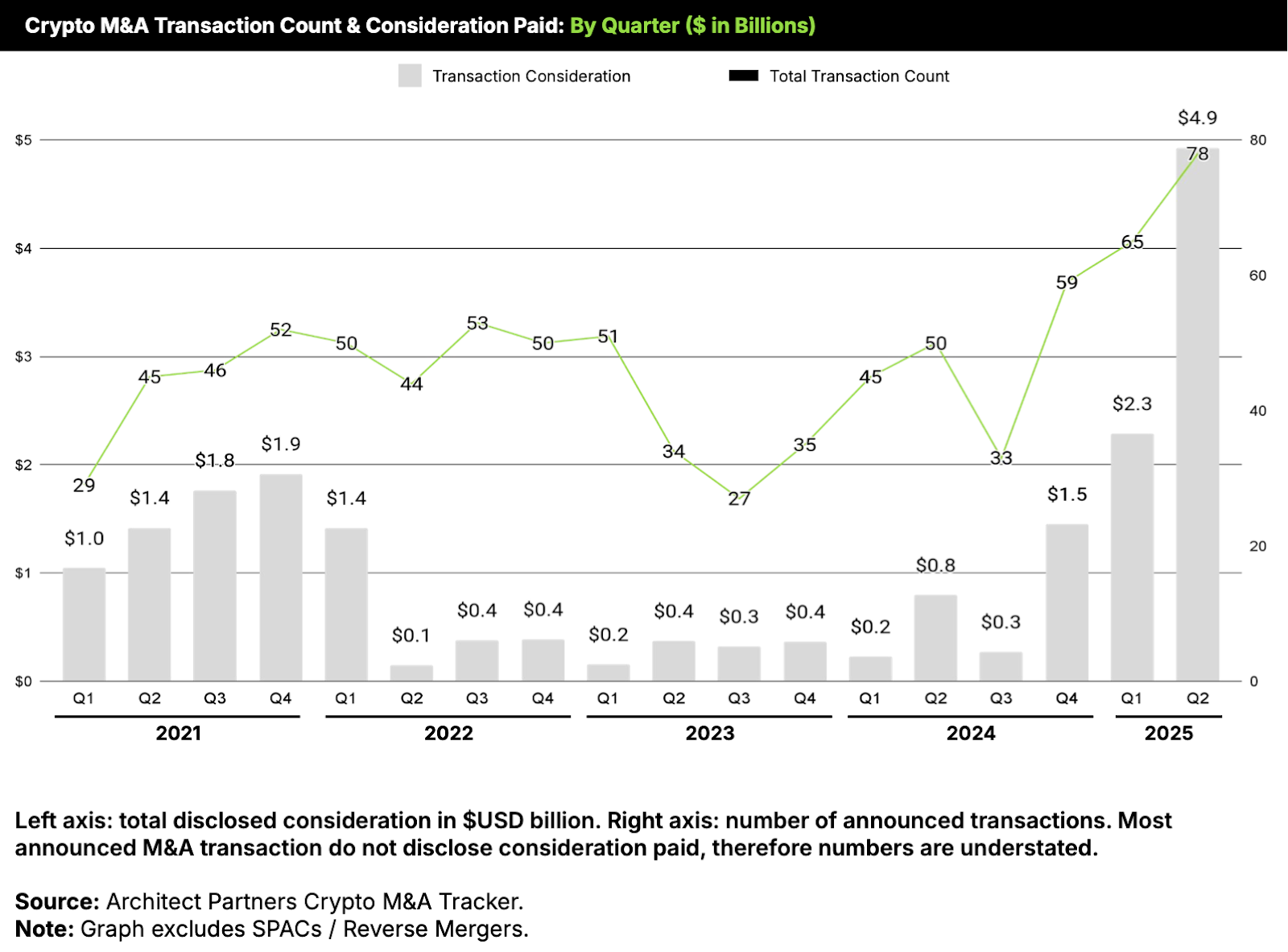

In the case of M&A within the house, an Architect Companions report highlights that the 78 crypto M&A transactions in Q2 was by far a document. You may recall us writing about Ripple’s purchase of Hidden Highway being certainly one of a rising variety of crypto-TradFi intersections. A giant crypto-crypto deal was Coinbase buying derivatives big Deribit.

Supply: Architect Companions

Supply: Architect Companions

Architect Companions founder Eric Risley believes we’re originally of a long-term uptrend in crypto M&A as the worth prop for crypto/blockchain has gained broader acceptance.

“Actually quarter to quarter will fluctuate, however the basic strategic drivers of M&A are actually fairly clear,” he advised me. “Individuals will embody current crypto companies and extra importantly, conventional monetary providers organizations of all stripes — banks, conventional broker-dealers and fee companies.”

A significant open query, Risely added, is what the following era of dapps seem like — past these centered on worth hypothesis and funds.

As we chew on that one, the belongings below administration in crypto funding merchandise hit an all-time peak of $188 billion on the tough midway level, CoinShares information exhibits.

And that was earlier than this week. It’s been 18 months (to the day) since spot bitcoin ETFs made their US debut; internet inflows stand at $51 billion (after yesterday’s near-record day by day mark of ~$1.2 billion). US ether ETFs additionally noticed their second-best day by day influx complete yesterday, at $383 million.

Extra crypto ETFs (single-asset and index) are anticipated to return this yr, however timelines stay up within the air. On that, Grayscale shared some emotions with the SEC.

Buyers preferring crypto publicity through equities can be looking forward to extra public listings after Circle’s IPO. We’ll keep watch over firms like Gemini and Kraken.

And persevering with the tokenization dialog, Bitwise and VanEck execs had predicted the tokenized securities market to hit $50 billion in 2025. It’s about midway there.