Key Notes

- Whale traders amassed 66,040 BCH on Tuesday, marking the very best single-day influx since early July’s peak exercise.

- Technical indicators present BCH buying and selling close to higher Bollinger Band resistance at $587, with potential targets at $615 if momentum sustains.

- Ethereum profit-taking is driving capital rotation into mid-cap altcoins like Bitcoin Money, supporting continued upward stress.

Bitcoin Money BCH $568.0 24h volatility: 0.8% Market cap: $11.30 B Vol. 24h: $288.80 M value surged previous the $570 stage on Wednesday, rising as one of many few prime 20 ranked altcoins posting intraday features. This bullish breakout aligns carefully with renewed whale curiosity, signaling potential institutional accumulation.

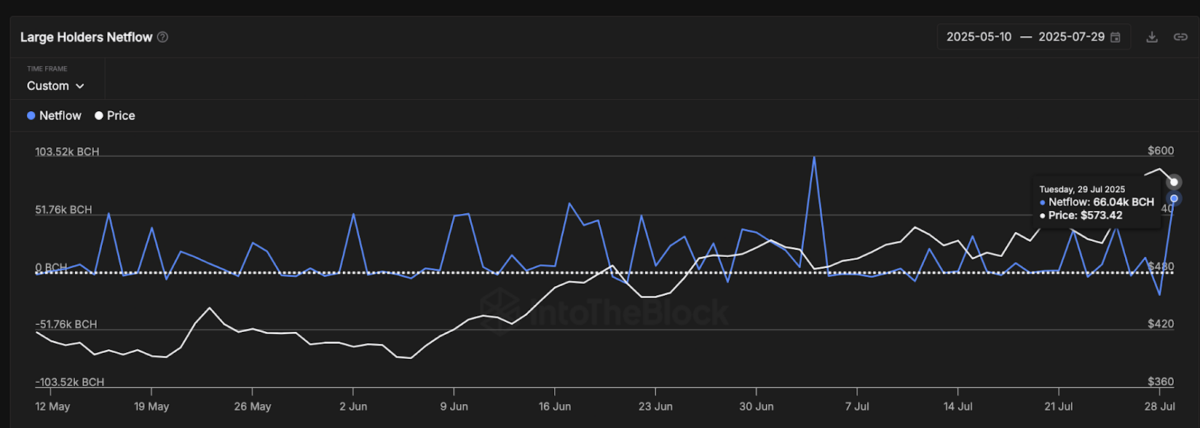

IntoTheBlock’s Giant Holder Netflow metric tracks the online every day motion of cash into or out of wallets controlling a minimum of 1% of the circulating provide. In line with the most recent knowledge, Bitcoin Money whales recorded a web influx of 66,040 BCH on Tuesday. This marks the biggest single-day whale accumulation for the reason that month-to-month excessive of 103,520 BCH on July 4.

Bitcoin Money Giant Holders’ Netflow | Supply: IntoTheBlock, July 30

Notably, BCH value has steadily climbed from $483 to $571~~,~~ for the reason that July 4 shopping for spree, validating the optimistic correlation between whale accumulation and BCH value motion. Based mostly on historic developments, the most recent uptick in whale inflows may sign the early phases of one other rally as Bitcoin Money prepares for potential bullish momentum in August.

Nevertheless, market watchers are nonetheless evaluating whether or not this momentum can maintain above the $570 zone, or if a rejection on the $600 resistance could set off a protracted correction part.

BCH Worth Prediction: $600 Resistance in Focus as Whale Demand Heats Up

From a technical evaluation standpoint, Bitcoin Money continues to commerce above the 20-day shifting common ($530.70), with the worth presently at $571.34, reflecting a 1.28% uptick on Wednesday.

The Bollinger Bands present that BCH is now buying and selling near the higher band at $587.10, which has seen a number of rejections final week. A clear breakout and shut above $587 may open the trail towards retesting the $610 psychological resistance stage, final seen in early March 2024.

Bitcoin Money Worth Forecast | BCHUSD 24H Chart | TradingView

In the meantime, the MACD line (21.20) stays above the sign line (17.40), confirming bullish momentum. The histogram bars are nonetheless inexperienced, although barely declining, hinting that purchasing stress may face exhaustion if $587 proves too robust to beat this week.

If BCH holds above the $560 assist and reclaims the $580-$587 resistance band, bulls could goal $615 in early August. Conversely, a dip beneath the 20-day MA at $530 would invalidate this breakout and probably expose the BCH value to a correction towards the $510 zone.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.