A number of US banking teams led by the Financial institution Coverage Institute (BPI) urged regulators to shut what they are saying is a loophole that would not directly permit stablecoin issuers and their associates to pay curiosity or yields on stablecoins.

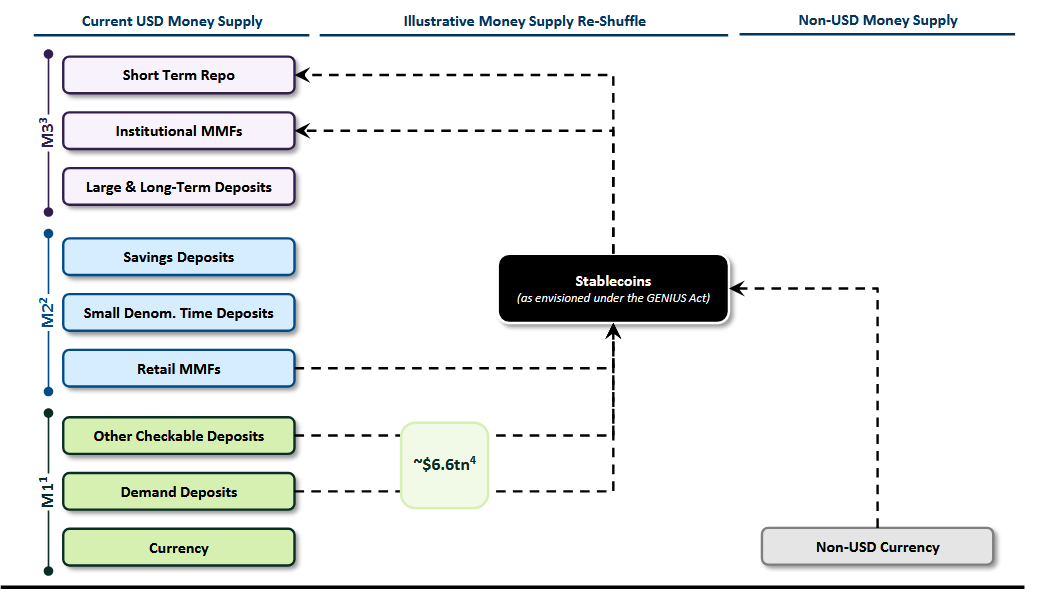

In a Tuesday letter to Congress, BPI warned {that a} failure to shut the so-called loophole within the new stablecoin legal guidelines underneath the GENIUS Act might disrupt the circulate of credit score to American companies and households, doubtlessly triggering $6.6 trillion in deposit outflows from the standard banking system.

The GENIUS Act prohibits stablecoin issuers from providing curiosity or yield to holders of the token; nonetheless, it doesn’t explicitly prolong the ban to crypto exchanges or affiliated companies, doubtlessly enabling issuers to sidestep the regulation by providing yields by way of these companions, the teams stated.

Supply: Financial institution Coverage Institute

Providing yield is likely one of the largest advertising and marketing pulls that stablecoin issuers have to draw customers. Some provide yield natively for holders whereas others, reminiscent of customers of Circle’s USDC (USDC), are rewarded for holding the stablecoin on exchanges reminiscent of Coinbase and Kraken.

The banking teams are seemingly involved that the extensive adoption of yield-bearing stablecoins might undermine the banking system, which depends on banks attracting deposits with high-interest financial savings merchandise with the intention to again the loans they make.

Stablecoins might undermine credit score system, bankers say

Within the letter, additionally signed by the American Bankers Affiliation, Client Bankers Affiliation, Unbiased Neighborhood Bankers of America and the Monetary Companies Discussion board, BPI famous stablecoins are basically totally different from financial institution deposits and cash market funds as a result of they don’t fund loans or spend money on securities to supply yield.

“These distinctions are why cost stablecoins shouldn’t pay curiosity the way in which extremely regulated and supervised banks do on deposits or provide yield as cash market funds do.”

Permitting funds of curiosity or yield on stablecoins might result in $6.6 trillion in deposit outflows, BPI famous, citing a US Treasury report from April.

A chart illustrating how cash provide could “reshuffle” into stablecoins underneath the GENIUS Act. Supply: US Treasury Division

Such a big shift within the monetary system might pose a severe danger to America’s credit score system, BPI added.

“The outcome shall be larger deposit flight danger, particularly in instances of stress, that can undermine credit score creation all through the economic system. The corresponding discount in credit score provide means increased rates of interest, fewer loans, and elevated prices for Predominant Road companies and households.”

Stablecoin market nonetheless a fraction of US cash provide

The entire market cap of stablecoins at the moment sits at $280.2 billion, a fraction of the US greenback cash provide, which the Federal Reserve reported as $22 trillion on the finish of June.

The stablecoin market is greater than 80percentdominated by Tether (USDT) and USDC at $165 billion and $66.4 billion, respectively, CoinGecko information reveals.

US President Donald Trump signed the GENIUS Act into regulation on July 18, which many crypto business analysts say will increase US greenback dominance by selling stablecoins pegged to the greenback, rivaling different currencies and reinforcing the greenback’s position because the world’s main reserve foreign money.

The Treasury expects the stablecoin market to develop to $2 trillion by 2028.