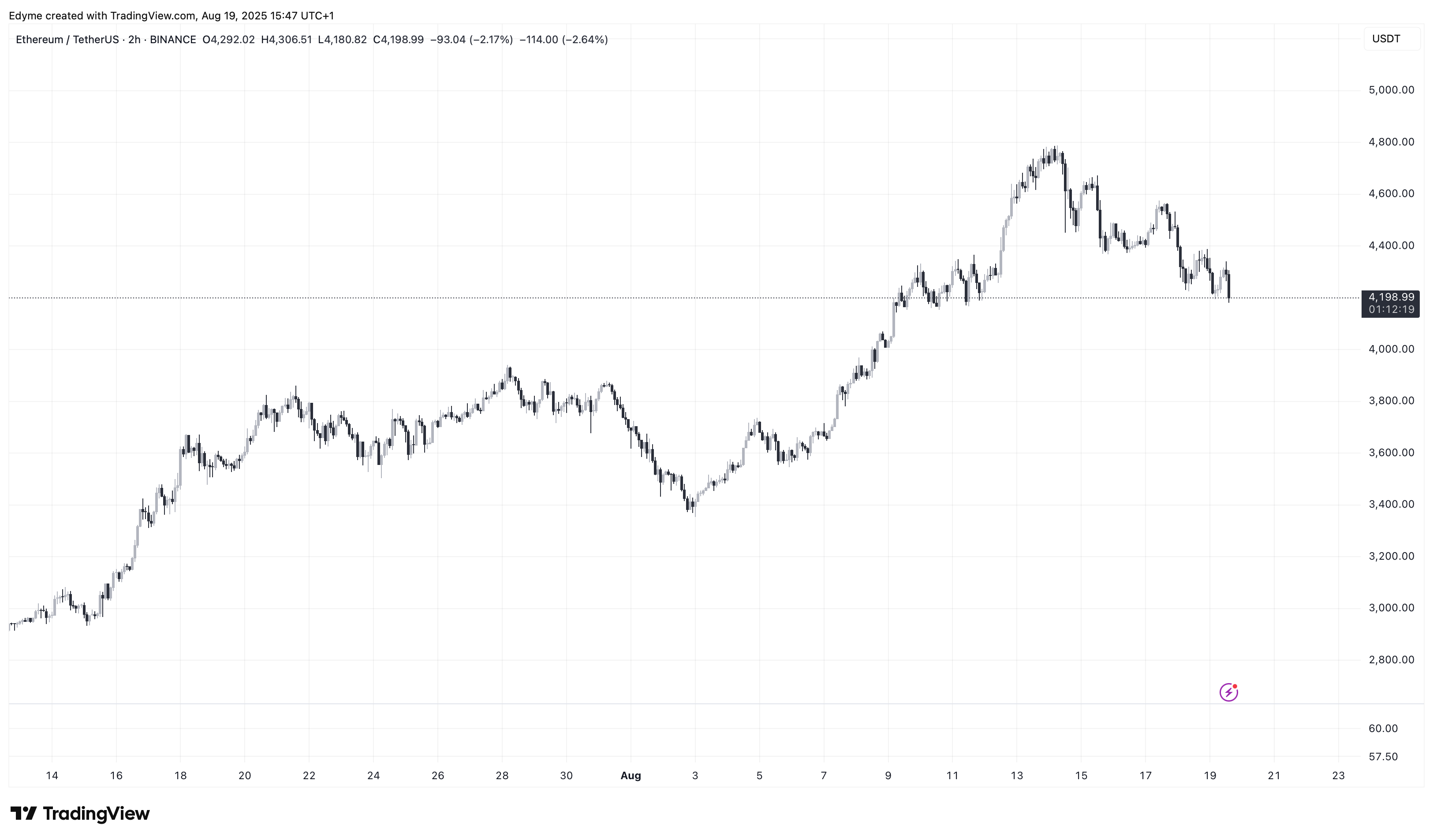

Ethereum (ETH) has maintained upward momentum in current weeks, with the asset briefly touching $4,774 final week, simply shy of its 2021 all-time excessive of over $4,800. Though ETH has since corrected to round $4,306, the asset stays optimistic by way of weekly efficiency, displaying a 0.7% enhance.

This worth motion exhibits ongoing investor curiosity at a time when Ethereum’s relative efficiency towards Bitcoin is attracting consideration. Analysts have pointed to Ethereum’s rising energy in each spot and derivatives markets, the place ETH is displaying resilience towards BTC.

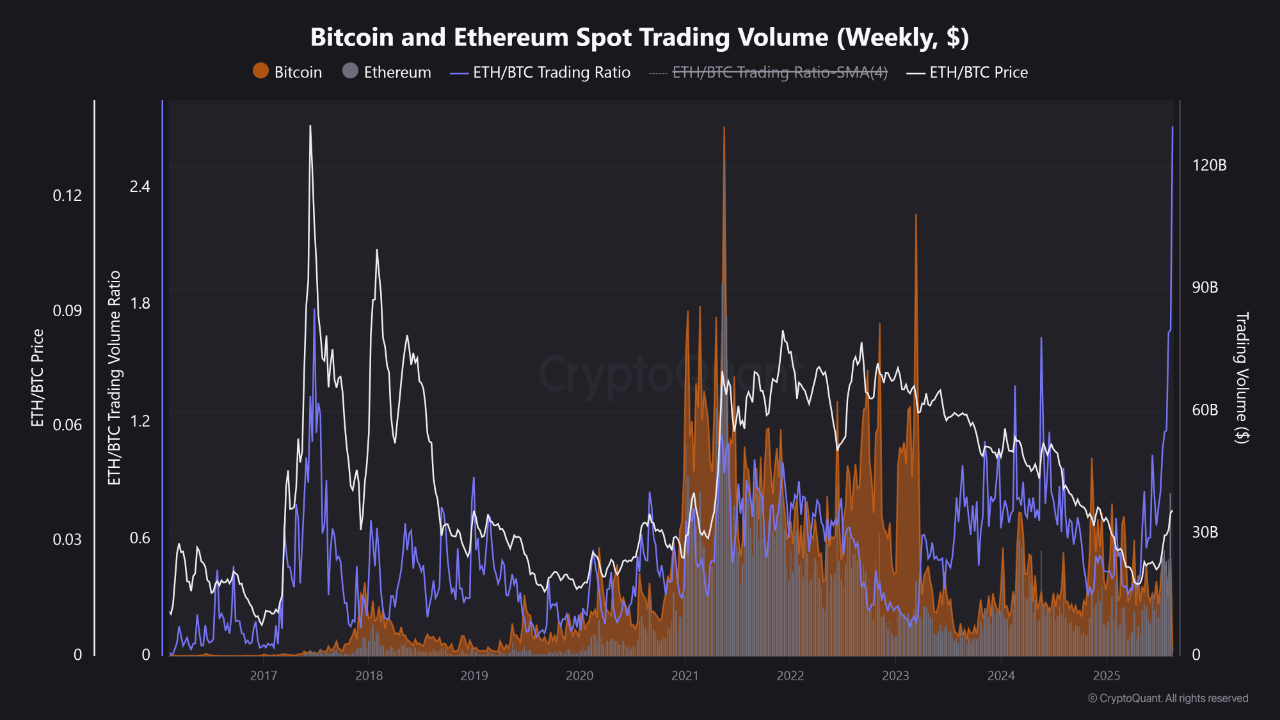

On CryptoQuant’s QuickTake platform, contributor EgyHash famous that the ETH/BTC buying and selling pair has reached ranges not seen for the reason that starting of the yr, with spot buying and selling volumes climbing to document highs.

This shift in participation highlights Ethereum’s increasing function throughout the broader crypto market, significantly as institutional exercise continues to extend.

ETH/BTC Ratio and Market Participation

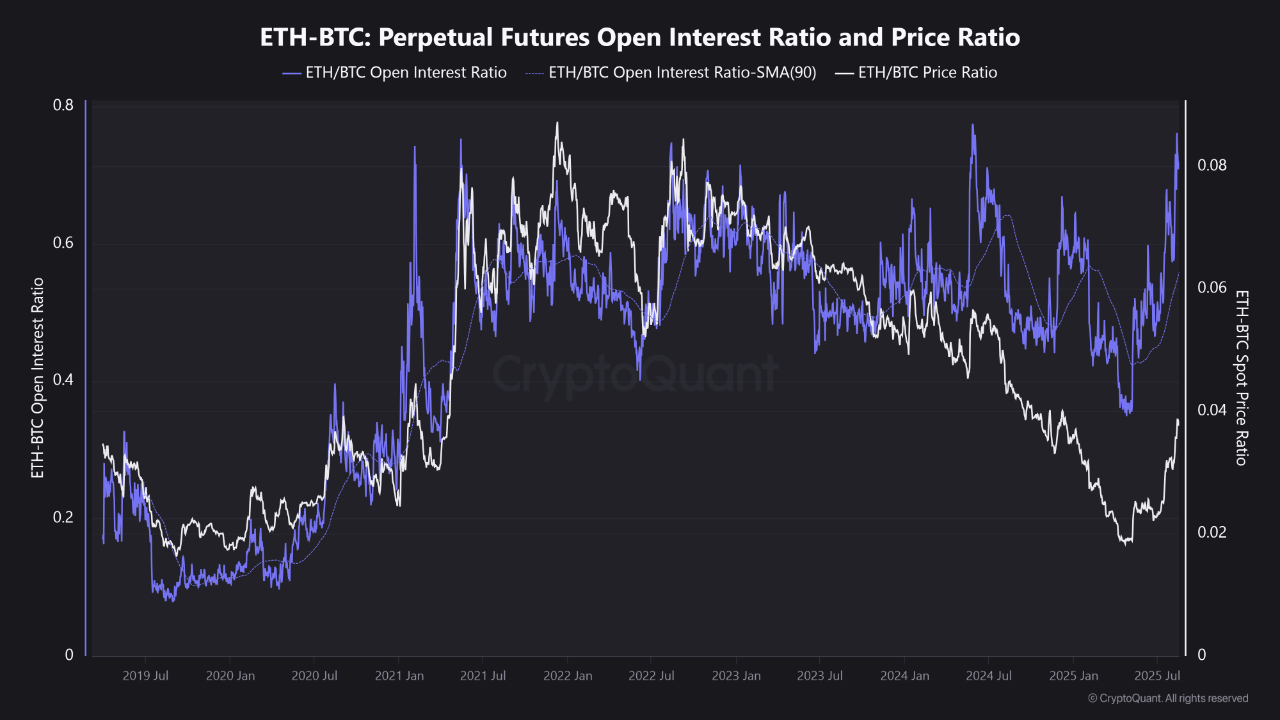

Based on EgyHash, Ethereum has recovered considerably after reaching a six-year low towards Bitcoin earlier this yr. The ETH/BTC pair now trades at 0.0368, its highest degree in 2025, although nonetheless properly beneath previous cycle peaks.

Notably, weekly spot buying and selling volumes for ETH relative to BTC reached an all-time excessive, with Ethereum buying and selling practically thrice the amount of Bitcoin final week. This alerts an adjustment in market choice, as merchants and traders more and more allocate towards ETH.

The derivatives market has additionally mirrored this development. Information exhibits that ETH/BTC perpetual futures open curiosity has risen to 0.71, its highest level in 14 months.

This rise suggests stronger speculative positioning round Ethereum. EgyHash emphasised that such will increase typically sign short-term energy but in addition warned that Ethereum’s long-term standing towards Bitcoin will depend upon sustained adoption and continued investor conviction.

Ethereum Institutional Demand and Coverage Context

Past spot and derivatives exercise, institutional demand for Ethereum has been rising steadily. One other CryptoQuant analyst, writing below the pseudonym OnChain, highlighted that funding funds now maintain roughly 6.1 million ETH.

This represents a 68% enhance in comparison with December 2024 ranges and a 75% rise from April 2025. Alongside these holdings, the fund market premium for ETH has expanded considerably, climbing to a two-week common of 6.44%, far greater than throughout earlier cycle peaks.

OnChain famous that such institutional accumulation displays each monetary and psychological market results, with entities like BlackRock’s Ethereum ETF increasing publicity. The analyst additionally prompt that after staking turns into out there inside ETH-based ETFs, institutional flows might enhance additional.

This growth might coincide with broader US regulatory readability, as laws such because the proposed CLARITY Act seeks to formally classify each Bitcoin and Ethereum as digital commodities below federal regulation.

Featured picture created with DALL-E, Chart from TradingView