After coming near its all-time excessive close to $4,878 simply days in the past, the Ethereum worth is now buying and selling under $4,300. Regardless of the dip, it has managed to carry onto sturdy month-to-month positive factors of 15.3%, displaying some resilience.

However whereas many short-term holders are leaping in to “purchase the dip,” issues aren’t all good for near-term merchants. A key bearish sign is beginning to present up on the 4-hour chart.

Quick-Time period Consumers Are Rising, Whereas Reserves Keep Close to Lows

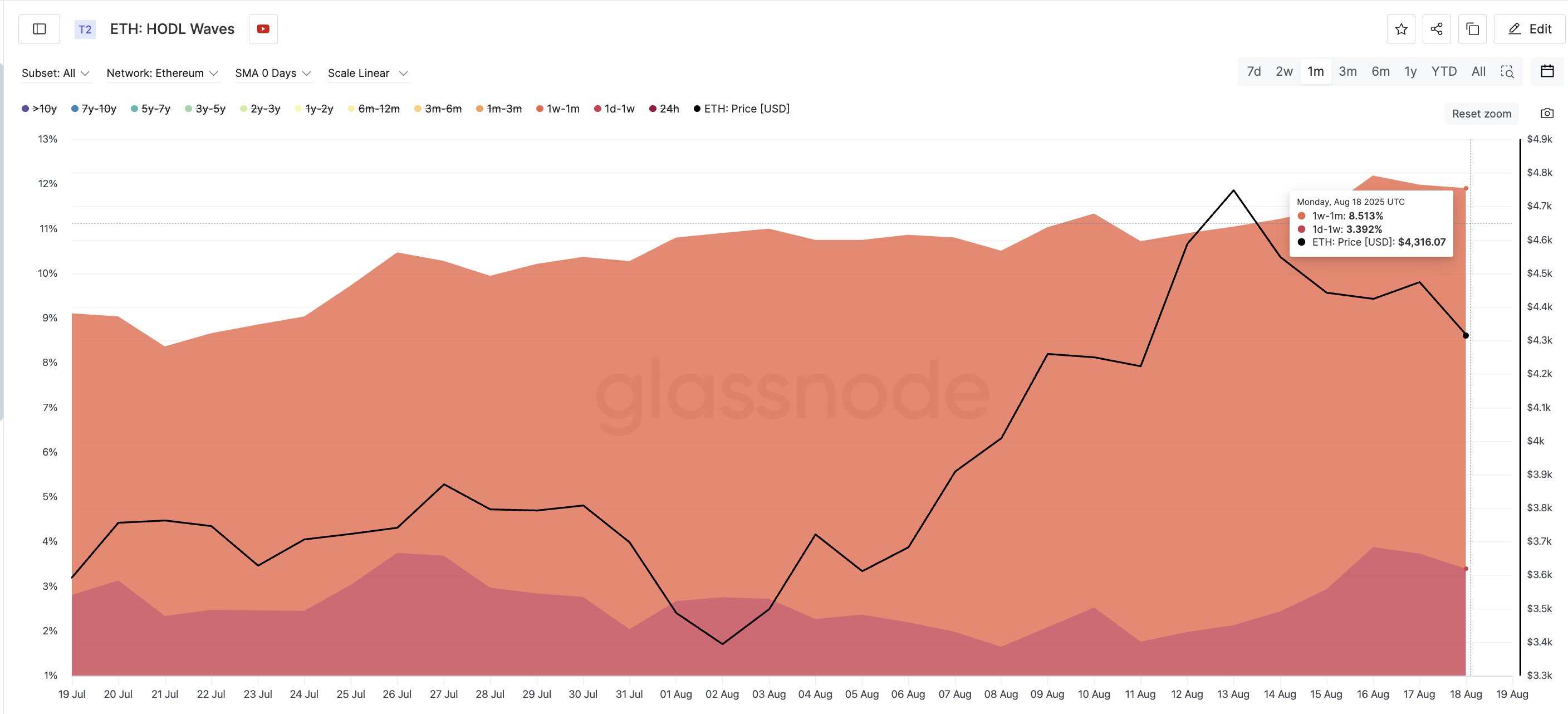

The Ethereum HODL wave chart reveals that new consumers have been slowly loading up over the previous 30 days.

Ethereum worth and HODL waves: Glassnode

Two key short-term cohorts — wallets that held ETH for 1 day to 1 week, and 1 week to 1 month — have elevated their share of provide:

- 1d–1w cohort grew from 2.8% to three.39%

- 1w–1m cohort jumped from 6.3% to eight.5%

That’s a transparent signal of recent shopping for. It suggests dip-buying exercise is selecting up from merchants who probably entered in the course of the current pullback. HODL Waves present the proportion of cash held over completely different time intervals, serving to establish shifts between long-term and short-term holders.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Ethereum trade reserves close to the lows: Cryptoquant

On the similar time, Ethereum’s trade reserves are nonetheless hovering round 9-year lows. Even after whale-led ETH inflows, the reserves moved solely barely from 18.389 million ETH on August 15 to 18.404 million ETH at press time. That’s nonetheless extraordinarily low, which means recent shopping for retains taking place each time the Ethereum worth dips.

Low reserves normally imply much less ETH obtainable for quick promoting; one other good signal if merchants are going lengthy.

One Chart Sample Might Ship The Ethereum Value All the way down to $4,000

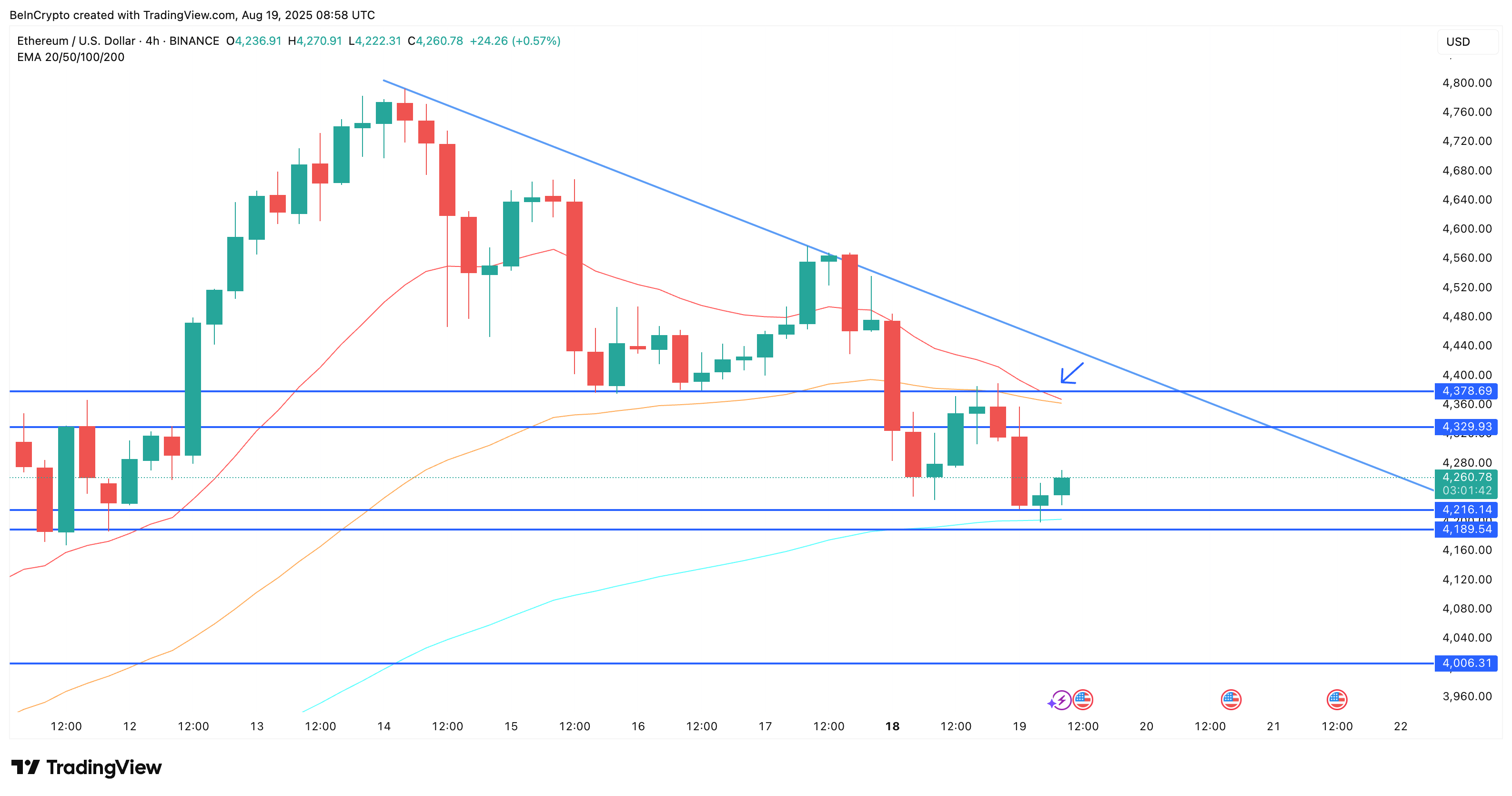

Regardless of the bullish indicators from consumers and trade flows, the short-term chart reveals a possible drawback.

On the 4-hour chart, the 20-period EMA or Exponential transferring common (crimson line) is about to cross under the 50-period EMA (orange line) — a bearish “demise” crossover. If this occurs, it’s normally seen as an indication of incoming promoting strain.

The EMA is a sort of transferring common that provides extra weight to current costs, serving to merchants react sooner to current market modifications. An EMA crossover happens when a shorter-period EMA crosses above or under a longer-period EMA, typically signaling a shift in worth development course.

Ethereum worth evaluation: TradingView

Moreover, the ETH worth is at the moment forming a descending triangle, a bearish continuation sample. It’s now testing two necessary assist ranges: $4,216 and $4,189. A break under these might set off a sharper selloff.

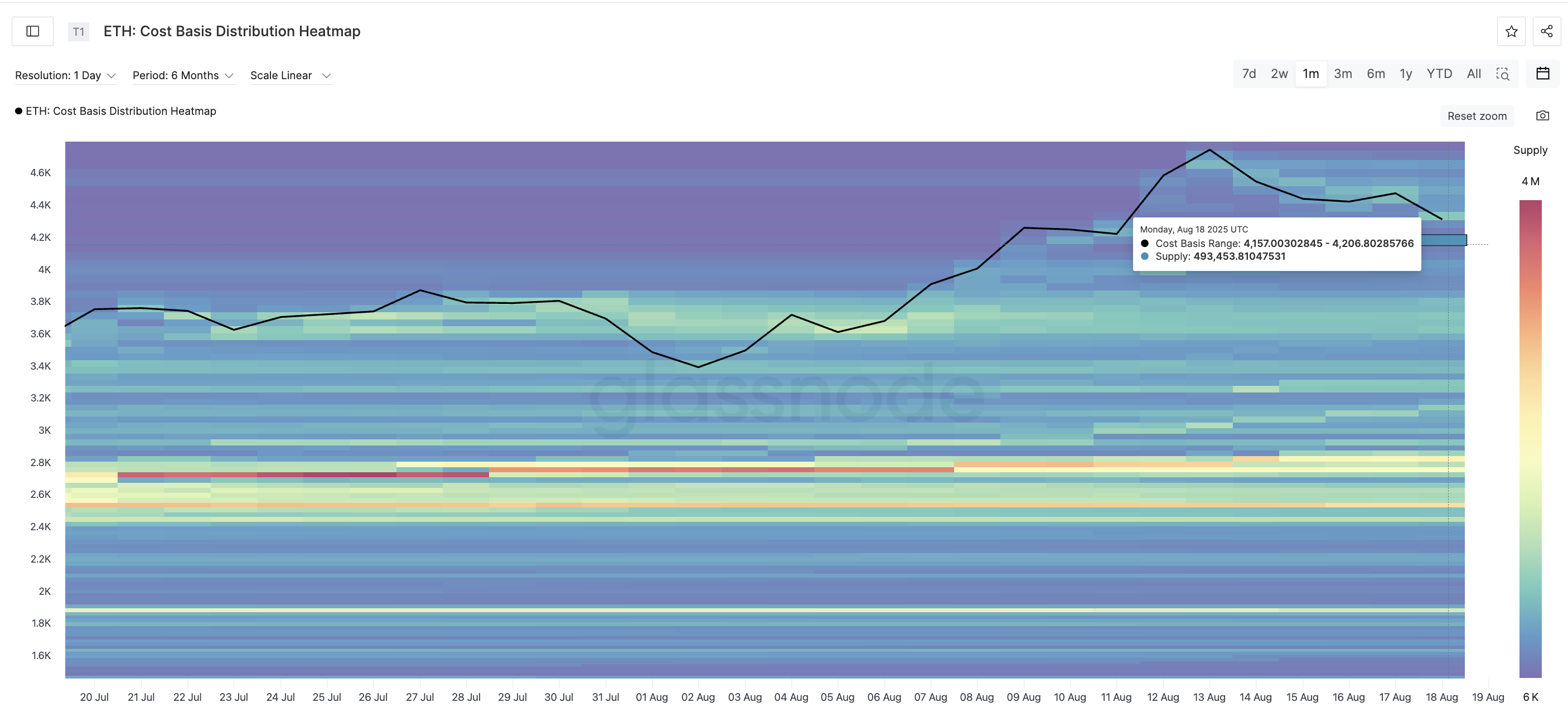

The heatmap additional reveals weak demand zones just under these ranges. There isn’t a lot sturdy assist at these ranges, which means ETH would possibly fall shortly to $4,006 if sellers take management.

Ethereum worth heatmap: Glassnode

The bearish outlook would simmer down a bit if the Ethereum worth manages to reclaim $4,378. In doing so, it would invalidate the bearish crossover and switch the 20-EMA and 50-EMA strains into assist.

The submit Ethereum Value Eyes Restoration as New Consumers Step In, But One Main Danger Looms appeared first on BeInCrypto.