Bitcoin transaction charges have plummeted to their lowest ranges in over a decade, as social sentiment round Federal Reserve fee cuts reaches a fever pitch, elevating questions on market sustainability.

Abstract

- Bitcoin charges fall to lowest ranges since 2011 at 3.5 BTC every day common

- Fed rate-cut hype hits 11-month excessive, echoing previous euphoric market tops

- Alternate BTC balances up 70K since June, signaling potential promote stress

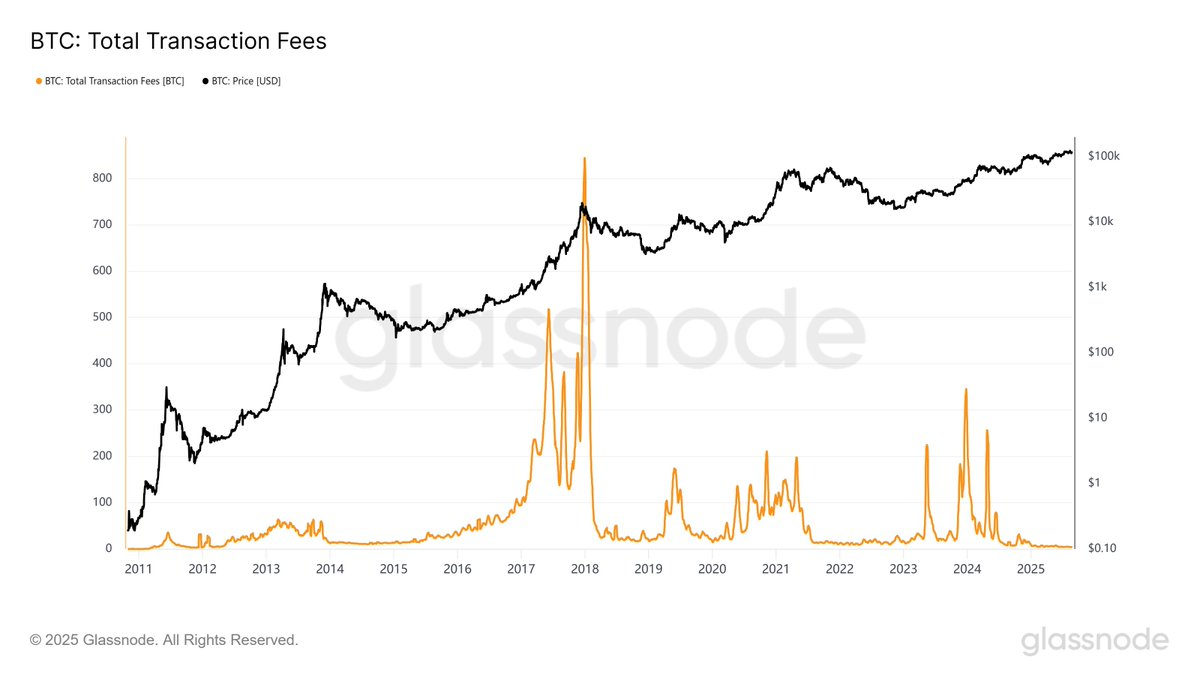

In response to Glassnode information, every day transaction charges on the Bitcoin (BTC) community (14-day SMA) lately dropped to three.5 BTC. That is the bottom degree since late 2011.

The first driver behind current market power was Fed Chair Jerome Powell’s speech at Jackson Gap, the place he hinted at potential fee cuts by stating that the “shifting steadiness of dangers might warrant coverage changes.”

Glassnode information

Social sentiment reaches harmful territory for bulls

Mentions of key phrases resembling “Fed,” “fee,” and “minimize” throughout social media platforms have surged. Santiment information reveals that this surge is the best within the final 11 months.

This large spike in dialogue round a single bullish narrative traditionally signifies that euphoria could also be getting too elevated.

When social sentiment round a particular catalyst reaches excessive ranges, it usually coincides with native worth tops.

You may also like: Crypto VC Funding: DigiFT secures $11m, Irys baggage $10m

Glassnode’s evaluation is a regarding setup for Bitcoin holders. A dense cluster of provide gathered between $113,000 and $120,000 since early July belongs to traders holding lower than three months.

The SOPR by Age metric for these short-term holders presently ranges from 0.96 to 1.01. This information signifies a light decline in recognition.

Alternate inflows paint a worrying image for Bitcoin

One regarding pattern is Bitcoin’s rising provide on exchanges. Since early June, the quantity of BTC held on exchanges has elevated by almost 70,000 cash.

This reverses the long-term pattern of cash shifting into chilly storage and suggests extra holders are positioning to promote.

Bitcoin alternate stream evaluation: Santiment

Traditionally, rising alternate balances have preceded promoting stress, as traders transfer cash to platforms in preparation for liquidation.

Bitcoin’s on-chain well being metrics present a neutral-to-cautious image, with every day lively addresses and transaction quantity cooling off from current highs.

The long-term MVRV ratio sits at 18.5%, which is a barely dangerous zone for brand new investments.

Learn extra: NFT gross sales drop 25% to $134m, CryptoPunks plunge 59%