Hyperliquid now controls roughly 80% of the decentralized perpetual futures market, highlighting its speedy dominance over rivals. Nonetheless, this focus raises considerations about sustainability and potential dangers if buying and selling volumes decline.

Abstract

- Hyperliquid has shortly turn into the main decentralized perpetual futures platform, dealing with as much as $30 billion in day by day trades.

- Its lean, self-funded workforce constructed a quick, execution-focused blockchain with fee-sharing incentives that entice merchants and builders.

- Regardless of speedy progress, dangers like validator focus, transparency gaps, and reliance on excessive buying and selling volumes go away its future unsure.

In simply over a 12 months, Hyperliquid has grown into the dominant participant in decentralized perpetual futures, with Redstone estimating it controls about 80% of the market, buying and selling volumes on par with huge centralized exchanges, and contemporary considerations over how lengthy such concentrated exercise can final.

At its peak, the platform processed as a lot as $30 billion in day by day trades. That milestone, only some decentralized exchanges have ever reached, regardless of being run by a lean workforce of simply 11 individuals.

The platform, co-founded by Jeff Yan, a former Hudson River Buying and selling quant and Harvard graduate, selected from the begin to keep away from enterprise capital, a choice that, mixed with timing, gave Hyperliquid a gap it exploited quicker than rivals.

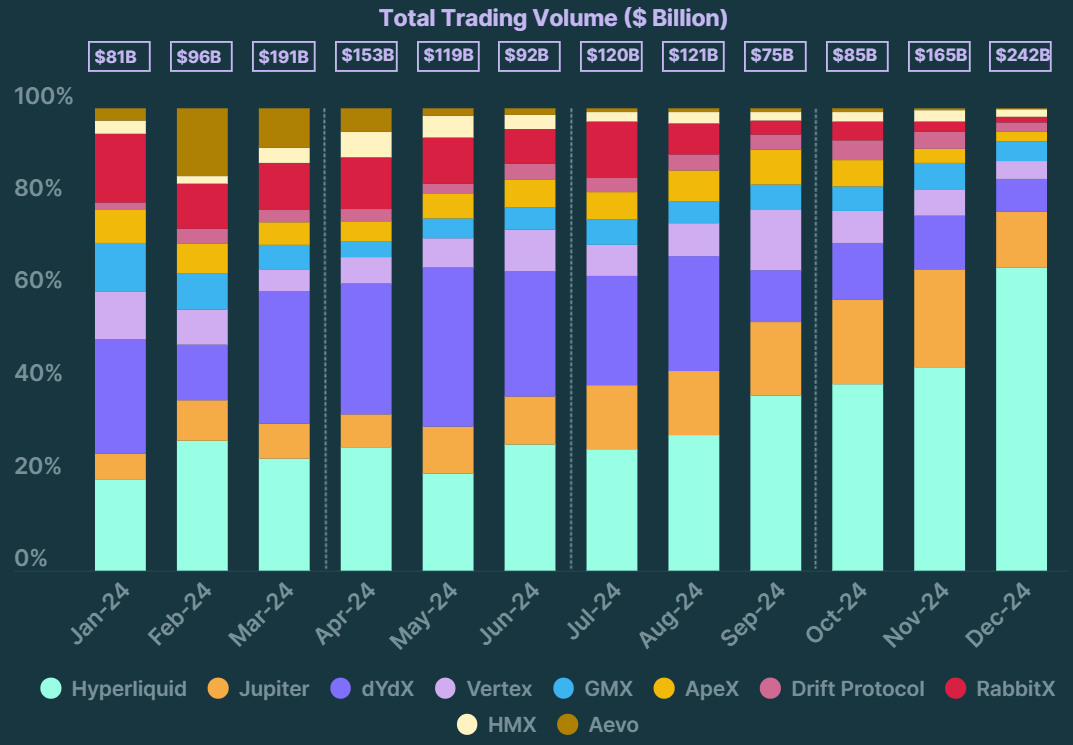

At first of 2024, decentralized alternate dYdX had roughly 30% of buying and selling quantity throughout decentralized exchanges. By the tip of that 12 months, its share had fallen to round 7%, whereas Hyperliquid’s share stabilized above 65%, per CoinGecko’s knowledge.

A lot of Hyperliquid’s progress appears tied to execution. One-click buying and selling, zero gasoline charges, and sub-second order finalization make it really feel nearer to a centralized alternate than most DEXs, which has helped entice each retail {and professional} merchants.

“Constructed by a lean, self-funded workforce that refused to just accept VC traders’ cash, they’ve confirmed that technical excellence and community-first economics can outcompete well-funded rivals.”

RedStone

You may additionally like: Hyperliquid API outage causes freeze on buying and selling, HYPE down 5%

The platform runs by itself blockchain with HyperBFT, a consensus system designed to course of a whole bunch of 1000’s of orders per second with settlement finality underneath a second. By focusing first on pace and reliability earlier than increasing infrastructure, Hyperliquid seems to have earned credibility amongst merchants quicker than most friends.

Incentives and Income

The platform splits buying and selling charges with its neighborhood. Individuals who listing new spot markets can preserve as much as half of the charges these trades generate. Builders who construct person interfaces earn a share that may even exceed the protocol’s personal reduce. And those that launch perpetual markets share their charges with the traders who stake behind them.

This setup has pushed exterior builders to construct on the platform with no need grants or subsidies. They’ve already created instruments to fill gaps like letting merchants use one steadiness throughout totally different positions or borrow towards their belongings. The result’s a rising ecosystem that competing decentralized exchanges haven’t been capable of replicate.

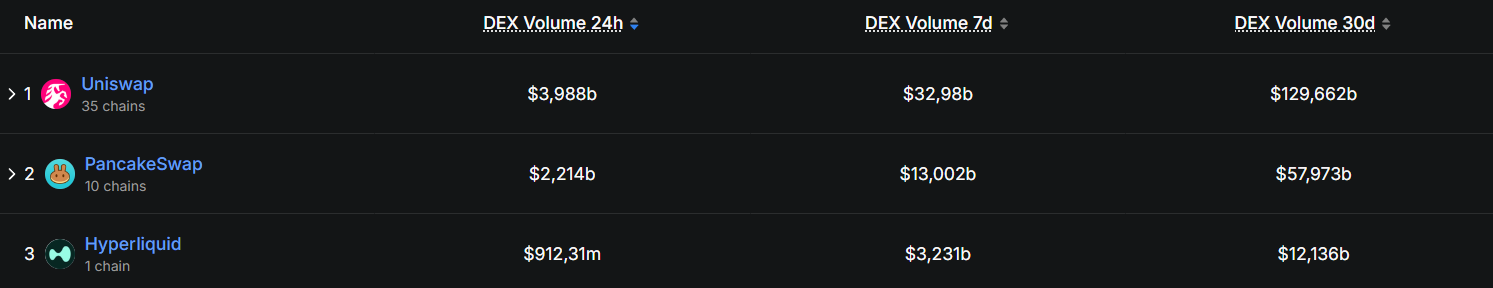

Decentralized exchanges by buying and selling quantity | Supply: DefiLlama

DefiLlama knowledge exhibits Hyperliquid ranks third amongst decentralized exchanges by weekly buying and selling quantity, producing over $12 billion, behind solely PancakeSwap and Uniswap. That surge has helped Hyperliquid produce greater than $1 billion in annualized income, translating to an estimated $102.4 million per worker.

As beforehand reported by crypto.information, that determine exceeds Tether at $93 million, OnlyFans at $37.6 million, Nvidia at $3.6 million, and Cursor at $3.3 million.

Dangers forward

A joint report from OAK Analysis and GL Capital notes that regardless of Hyperliquid’s speedy progress, “a number of key milestones should nonetheless be met to validate [the valuation] thesis.”

“Centralization stays a priority, with solely 16 validators, and the dearth of transparency within the codebase might deter third-party builders. Whereas full management over the infrastructure is a robust mannequin, it additionally exposes the platform to vulnerabilities, as demonstrated by the HLP incident.”

OAK Analysis and GL Capital

The platform’s reliance on sustained buying and selling quantity additional amplifies threat. A protracted bear market might briefly depress returns and problem the token buyback system that helps a lot of the HYPE ecosystem.

From a valuation perspective, analysts describe the chance as “uneven threat/reward,” with HYPE’s honest worth estimated between $32 and $49 underneath conservative assumptions, which is about 86% of the highest of that vary, provided that HYPE is buying and selling at $42.

Hyperliquid has demonstrated speedy adoption, however it nonetheless faces a number of structural and market dangers. Validator focus, transparency gaps, reliance on excessive buying and selling volumes, and execution-dependent progress all imply that outcomes stay delicate to each inside selections and exterior market situations.

Learn extra: Circle chooses Hyperliquid as its subsequent USDC stronghold amid $5.5b AUM increase