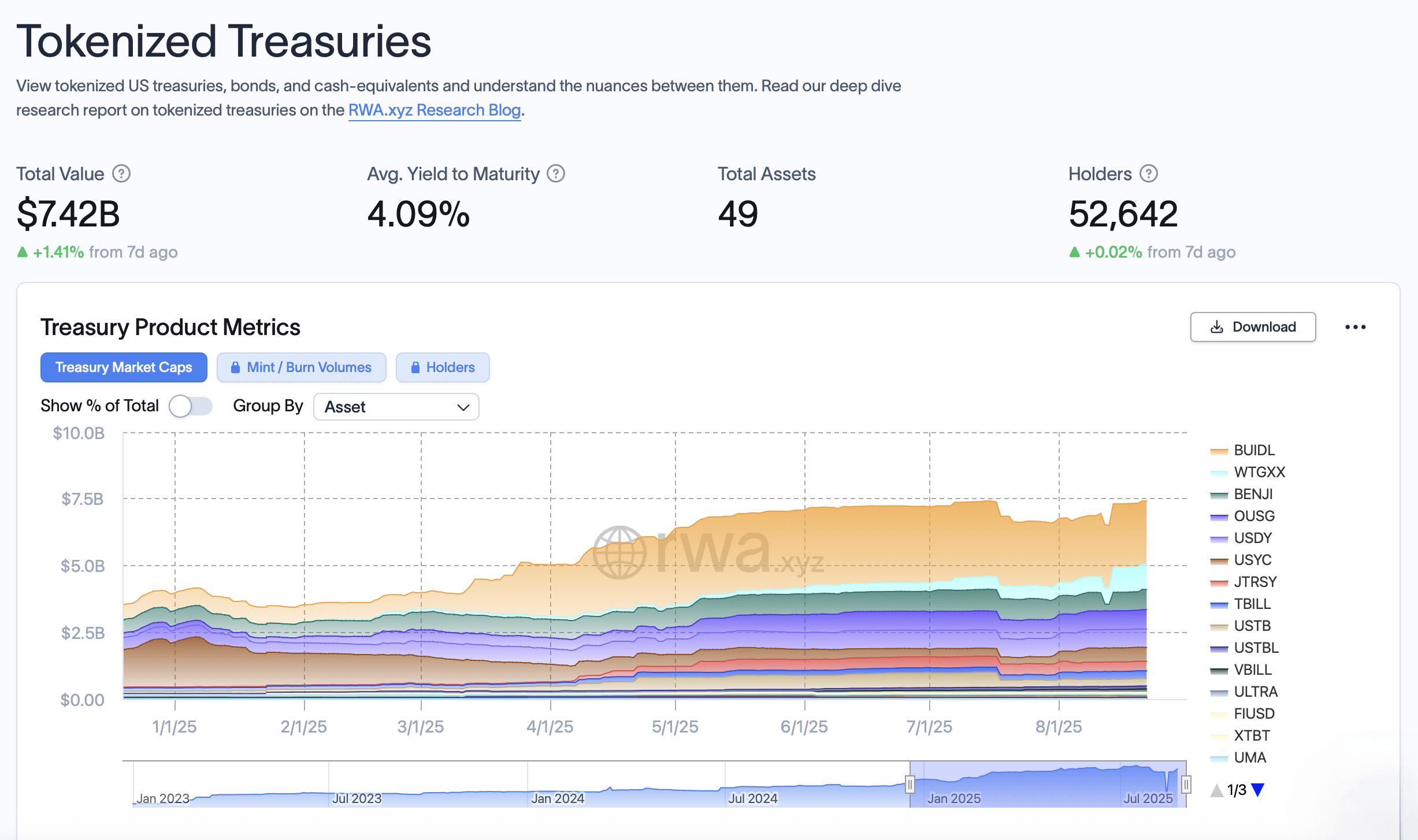

The overall worth locked (TVL) in tokenized U.S. Treasuries has climbed again to its peak, hitting $7.42 billion on Aug. 23, barely above the earlier report of $7.41 billion set on July 16.

Institutional U.S. Bond Tokens Hit $7.42B Throughout 49 Merchandise

The most recent figures from rwa.xyz present development of 1.41% from every week in the past, with tokenized bond merchandise persevering with to draw traders searching for onchain publicity to government-backed belongings. At the moment, the market spans 49 separate belongings throughout a number of issuers and protocols, with a median yield to maturity of 4.09% and greater than 52,600 distinctive holders.

Supply: rwa.xyz stats on Aug. 23, 2025.

Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL), issued by means of Securitize, stays the biggest tokenized Treasury product with a market cap of $2.38 billion. Wisdomtree’s Authorities Cash Market Digital Fund (WTGXX) follows with $931 million throughout Ethereum, Stellar, Solana, Avalanche, and Arbitrum. Franklin Templeton’s Onchain U.S. Authorities Cash Fund (BENJI) ranks third at $748 million, hosted on a number of chains together with Ethereum, Stellar, and Polygon.

Rounding out the highest 5, Ondo’s Quick-Time period U.S. Authorities Bond Fund (OUSG) holds $732 million, whereas Ondo’s U.S. Greenback Yield (USDY) carries $688 million in market worth. Circle’s USYC sits shut behind at $519 million and is accessible throughout Ethereum, Solana, and different networks.

The remaining three within the prime ten embody Janus Henderson’s Anemoy Treasury Fund (JTRSY) at $357 million, Openeden’s TBILL Vault at $290 million, and Superstate’s Quick Period U.S. Authorities Securities Fund (USTB) at $276 million. Spiko’s U.S. T-Payments Cash Market Fund (USTBL) closes the group at $110 million, whereas the eleventh-place contender, Vaneck’s VBILL, holds $75 million.

By blockchain, Ethereum dominates the sector with $5.3 billion of the full market cap. Stellar accounts for $511 million, BNB Chain $345 million, Solana $304 million, Arbitrum $160 million, Avalanche $139 million, and XRP Ledger $132 million. Collectively, these networks have witnessed a speedy growth of tokenized bond markets, particularly Ethereum, but in addition diversifying liquidity throughout a number of chains.

Internet flows over the previous 30 days reveal shifting investor allocations. Wisdomtree’s WTGXX noticed the biggest inflows at $444 million, adopted by Circle’s USYC at $275 million and Openeden’s TBILL Vault at $102 million. However, Franklin Templeton’s BENJI skilled outflows of $103 million, alongside $51 million leaving Anemoy’s JTRSY and $22 million from Blackrock’s BUIDL.

The return to report TVL ranges indicators ongoing demand for blockchain-based Treasuries as traders search digital, liquid, and yield-bearing belongings. With institutional gamers reminiscent of Blackrock, Wisdomtree, and Franklin Templeton anchoring the market, tokenized bonds stay one of many fastest-growing segments in real-world asset (RWA) finance.