Ethereum (ETH) exchange-traded funds (ETFs) are set to shut August 2025 with whole internet inflows exceeding $4 billion, considerably outpacing their Bitcoin (BTC) counterparts, which recorded greater than $600 million in outflows throughout the identical interval.

Ethereum ETFs Outshine Bitcoin ETFs

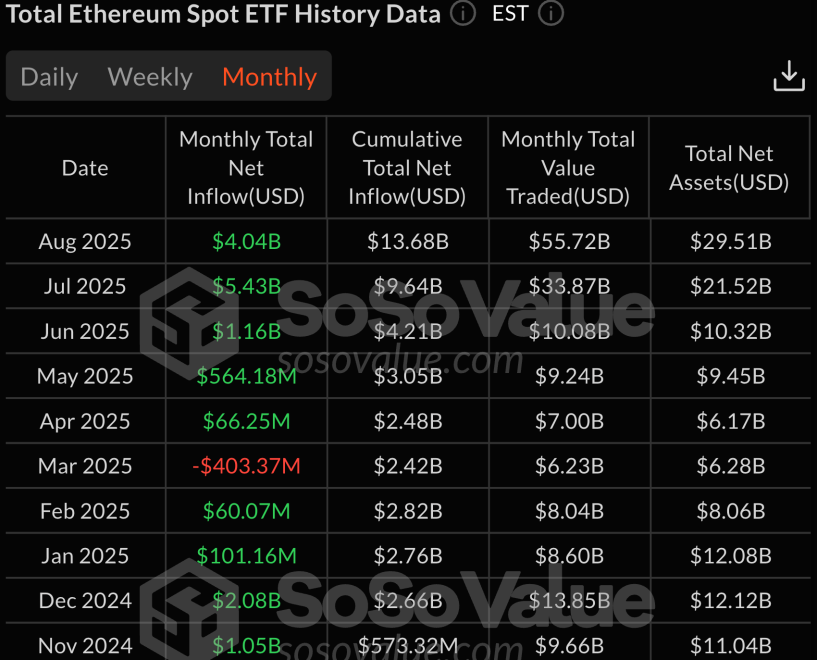

Based on information from SoSoValue, spot Ethereum ETFs have attracted $4.04 billion in internet inflows to date this month. In distinction, spot Bitcoin ETFs noticed $628 million in internet outflows in August.

Amongst Ethereum-focused funds, BlackRock’s ETHA ETF leads the market with $16.88 billion in internet property as of August 28. Grayscale’s ETHE follows with $4.80 billion, whereas Constancy’s FETH holds $3.56 billion.

The whole internet property tied in spot ETH ETFs at the moment stands barely above $29.5 billion. This determine represents nearly 5.5% of Ethereum’s whole market cap.

On the Bitcoin aspect, BlackRock’s IBIT stays the chief with $83.8 billion in internet property, adopted by Constancy’s FBTC at $22.45 billion and Grayscale’s GBTC at $20.01 billion.

Though BTC ETFs nonetheless dominate in general worth, the most recent information suggests the hole between Bitcoin and Ethereum funding merchandise is narrowing. If the present momentum continues, August 2025 might mark the month when ETH ETFs outperformed BTC ETFs by their widest margin but.

One of many main components driving Ethereum ETF inflows is ETH’s rising enchantment as a stability sheet asset. Company adoption of ETH has accelerated this 12 months, bolstering confidence in its long-term position in institutional portfolios.

This 12 months, a number of notable firms introduced plans so as to add ETH to their stability sheets. As an example, SharpLink Gaming not too long ago doubled down on its ETH guess, including one other 56,533 ETH to boost its ETH reserves.

Equally, ETHZilla – an Ethereum treasury firm – not too long ago elevated its whole ETH holdings to greater than 102,000 ETH. Knowledge from CoinGecko reveals that, at the moment, BitMine is the main publicly-listed firm with the biggest ETH reserves – holding over 1.7 million ETH.

Will ETH Surge Previous $5,000?

Institutional sentiment towards ETH continues to strengthen. VanEck CEO Jan van Eck not too long ago described ETH as “the Wall Avenue token,” highlighting its rising position in enabling stablecoin transfers throughout monetary establishments.

Regardless of its current rejection from near $5,000, the general demand for ETH stays vehemently robust. In consequence, ETH reserves on trade proceed to dwindle at a speedy tempo, which can result in fast worth appreciation for the digital asset within the near-term. At press time, ETH trades at $4,340, down 4% up to now 24 hours.

Featured picture from Unsplash.com, charts from SoSoValue, CoinGecko and TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.