Ethereum (ETH) closed August on a robust word, gaining greater than 23% in the course of the 31-day interval.

The main altcoin now seems poised to increase its rally into September, with on-chain information exhibiting a decline in selloffs and a surge in market confidence about its near-term efficiency.

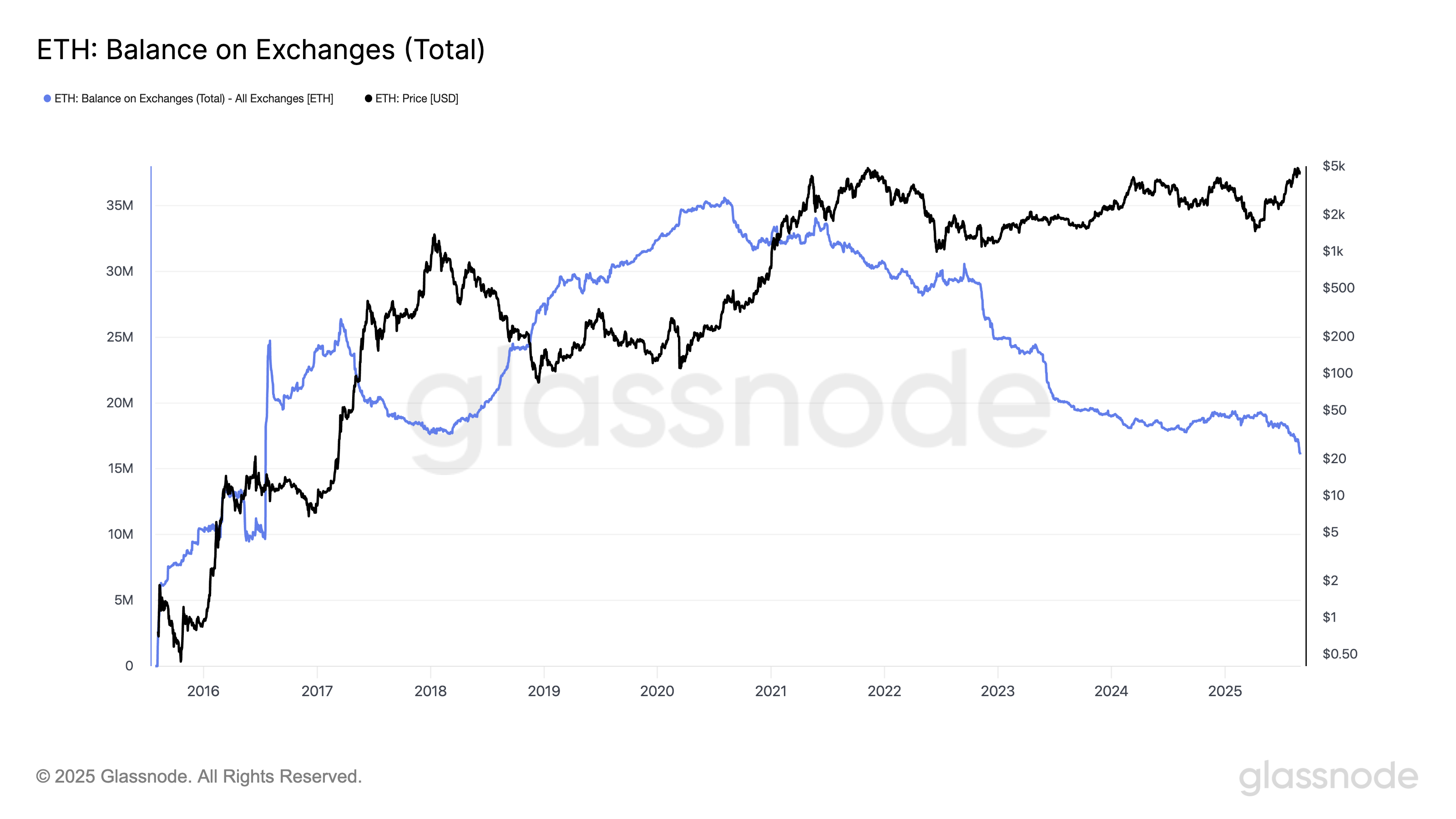

Ethereum Alternate Balances Crash to 2016 Ranges

In accordance with Glassnode, the full quantity of ETH held on change addresses has dropped to its lowest stage since 2016. As of this writing, 16 million ETH valued at round $70.37 billion are held on change pockets addresses.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

ETH Stability on Exchanges. Supply: Glassnode

A decline in change balances means that buyers are transferring their holdings into personal wallets relatively than retaining them on buying and selling platforms, a shift linked to decreased promote strain.

When fewer cash are available on the market, it creates a provide squeeze that may enhance upward worth momentum if demand stays sturdy.

For ETH, this sample displays rising conviction amongst holders who seem extra inclined to carry their cash in anticipation of latest beneficial properties, strengthening the chance of a sustained rally this month.

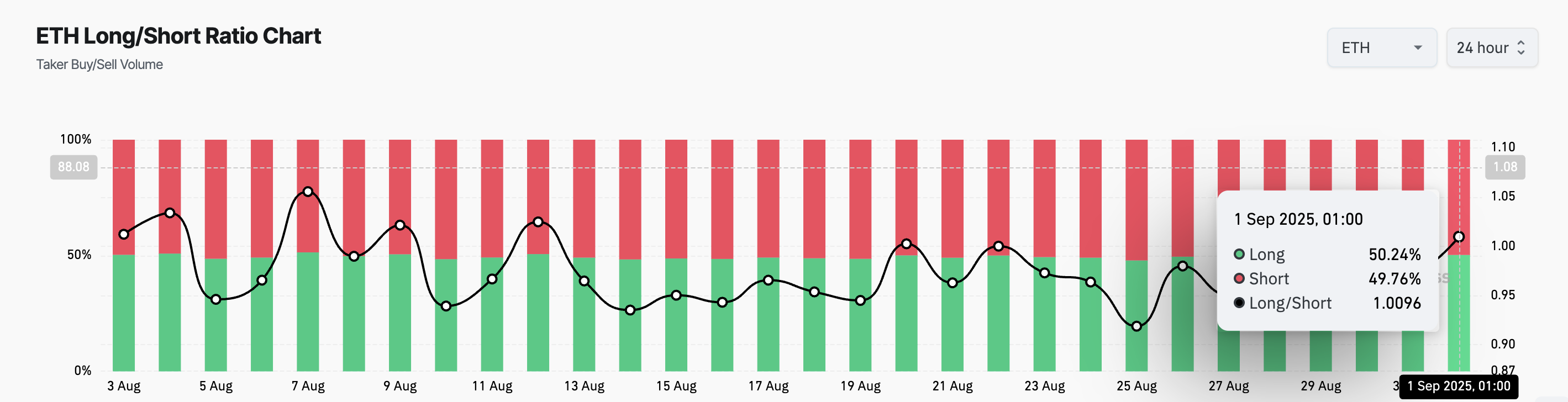

Furthermore, the coin’s rising lengthy/brief ratio helps this bullish outlook. In accordance with CoinGlass, the ratio is at present at 1.0096, exhibiting that extra merchants at the moment are starting to take lengthy positions than brief ones.

ETH Lengthy/Quick Ratio. Supply: Glassnode

The lengthy/brief ratio measures the proportion of merchants betting on an asset’s worth rising (lengthy) versus these anticipating it to fall (brief). A ratio above 1 signifies that lengthy positions outnumber shorts, signaling stronger bullish sentiment, whereas a ratio under 1 suggests bearish dominance.

ETH’s climbing ratio highlights a rising tilt towards optimism amongst market members. This implies that merchants are more and more assured within the coin’s capacity to maintain an upward pattern over the approaching weeks.

$5,000 Inside Attain or Pullback to $4,221?

If buy-side strain continues to climb, ETH might try a breakout above the fast resistance at $4,664. A profitable breach of this stage would open the trail towards its all-time excessive of $4,957.

Sustained bullish dominance might make a transfer above the $5,000 mark more and more probably.

ETH Worth Evaluation. Supply: TradingView

Nevertheless, if demand slows, this bullish projection may very well be invalidated. In such a state of affairs, the coin’s worth dangers retracing to $4,211.

The put up Ethereum Alternate Holdings Hit 9-Yr Low as $5,000 Breakout Looms appeared first on BeInCrypto.