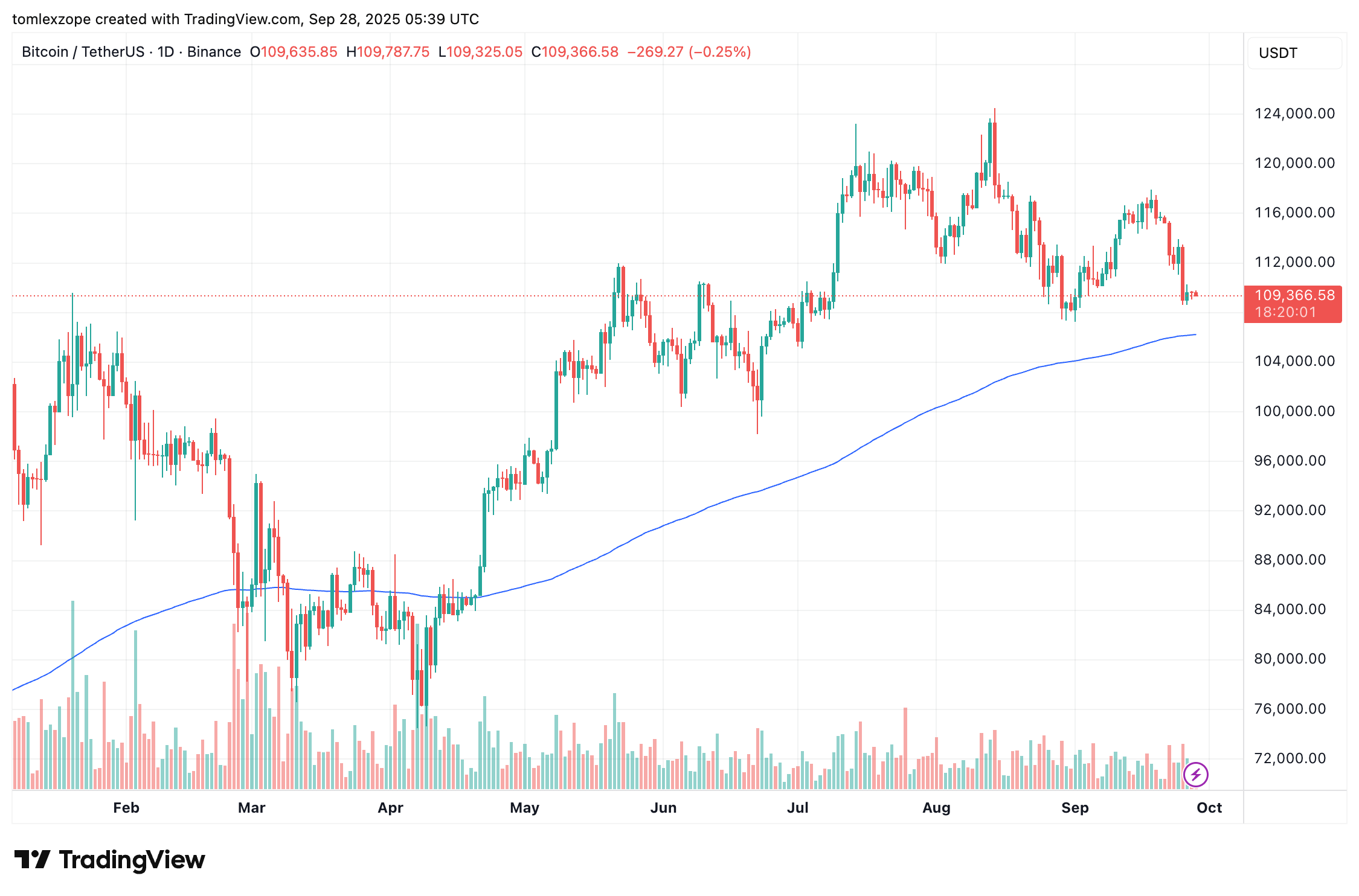

The previous week was considered one of intense volatility for the crypto market, because the Bitcoin worth skilled a pointy nosedive from as excessive as $116,000 to a swing low of about $108,600. Whereas this current decline has led to worries in regards to the begin of a bearish rally, current on-chain information means that the market could also be reaching a state of calm.

LTHs’ Promoting Tempo On The Decline

In a current put up on social media platform X, Alphractal revealed what could also be excellent news for Bitcoin’s bullish onlookers. In keeping with the on-chain analytics agency, there appears to be a shift within the habits of the premier cryptocurrency’s long-term holders (LTH).

This on-chain revelation relies on the Coin Days Destroyed (CDD) A number of Metric, which measures the depth of coin spending in relation to historic averages.

As defined by the agency, the metric calculates what number of “coin days” are destroyed when outdated cash are moved. In different phrases, it seems at when long-term holders resolve to spend their cash, thereby monitoring a shift within the Bitcoin LTH exercise.

Supply: @Alphractal on X

As identified by Alphractal, members of this investor class have continued to maneuver their outdated cash, however the tempo of their gross sales has dropped considerably. In comparison with 2024, the motion of Bitcoin long-term holders available in the market has been sluggish over the previous few months. In the end, this dip in CDD A number of additionally alerts decreased promoting strain from Bitcoin’s seasoned buyers.

What This Means For Value

As of this writing, Bitcoin is buying and selling inside a unstable market simply above the week’s swing low of $108,500. Nonetheless, the skilled buyers appear to not be in a rush to unload their holdings. As a substitute of continuous to promote, the long-term holders appear to have began preserving their cash once more.

“This decline in coin day destruction exercise means that many skilled buyers are selecting to carry their positions, ready for stronger market strikes,” the analytics agency stated.

Traditionally, any such habits among the many cryptocurrency’s earliest holders has preceded intervals of accumulation, the place the arrogance of those buyers affords stability available in the market, stopping additional decline in worth.

If historical past is something to go by, the decreased CDD A number of might be an indication that the groundwork for Bitcoin’s subsequent large growth is being laid. Strikes across the final swing low ought to subsequently be watched intently, alongside CDD exercise, earlier than funding choices are made.

On the time of writing, Bitcoin is price about $109,630, reflecting no important motion prior to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.