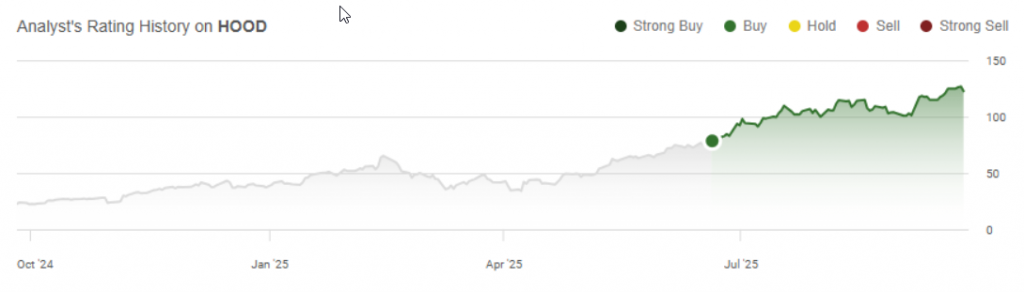

HOOD inventory jumped 12% on September 29, 2025, as Robinhood Markets introduced it’s really processed over $4 billion in prediction market trades. The rally pushed HOOD inventory to $136.72, and this was pushed by robust Robinhood prediction trades together with enlargement into new markets. This Robinhood inventory run signifies roughly 260 % good points thus far this 12 months, and HOOD inventory is demonstrating elevated investor trustfulness at the moment.

HOOD Inventory Jumps 12% Amid $4B Prediction Trades and Market Progress

This milestone was introduced by CEO Vladimir Tenev in a put up on X, and he identified the quick development of the corporate. The noticed viral nature of the platform with over two billion {dollars} of Robinhood prediction commerce occurring within the third quarter of 2025 alone.

Tenev additionally mentioned that:

Robinhood clients have now transacted greater than 4 billion of such occasion contracts, 2 billion of which have been within the third quarter alone.

Prediction Markets Drive Efficiency

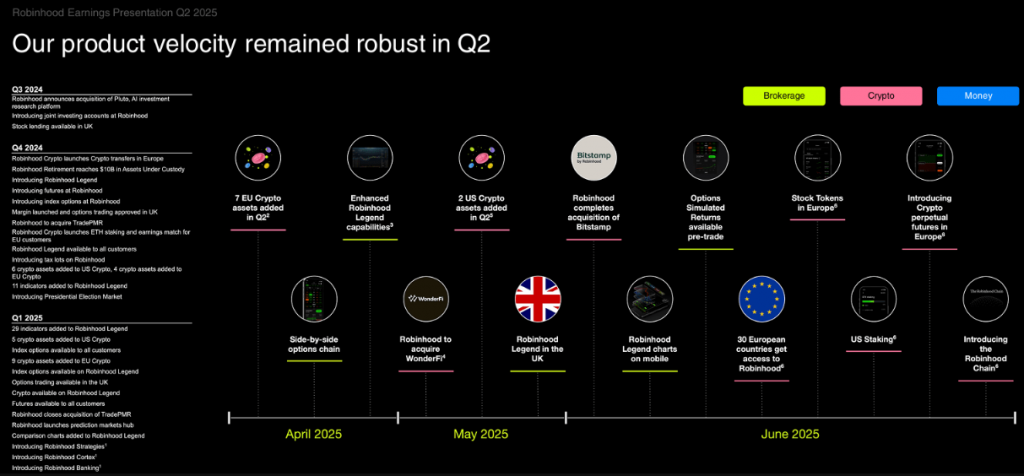

The HOOD inventory advance was triggered by Robinhood’s partnership with Kalshi, which is a CFTC-regulated platform. The corporate rolled out soccer contracts in August, tapping into the area between monetary markets and wagering. This Robinhood market development technique’s confirmed profitable at this level.

Q2 outcomes confirmed clients hit 26.5 million, whereas Gold subscribers reached 3.48 million. Platform belongings climbed to $279 billion. These numbers spotlight Robinhood fintech enlargement past conventional buying and selling.

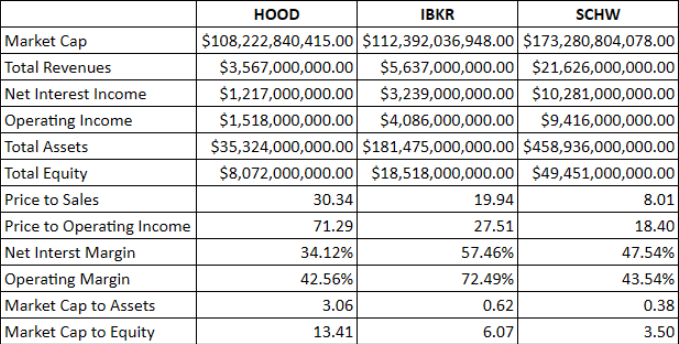

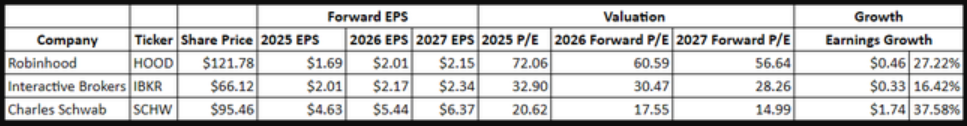

HOOD inventory joined the S&P 500 in September 2025. Having deposits of as much as $13.8 billion and working revenue of $1.518 billion, Robinhood has demonstrated good efficiency and its market development, Robinhood market.

It has a market capitalization of about $108.2 billion. HOOD inventory is climbing as Robinhood rolls out new options. In line with some analysts, the online curiosity margin of 34.12 is an effective signal.

The momentum behind HOOD inventory seems backed by fundamentals. Robinhood prediction trades generate substantial volumes even now. The Robinhood fintech enlargement positions the corporate properly for development within the aggressive area.