Tokyo-based Metaplanet reported report Bitcoin (BTC) Revenue Era revenues in its third-quarter outcomes for fiscal 12 months 2025, with income surging 115.7% in comparison with the earlier quarter.

Moreover, the corporate revealed it has already exceeded its annual BTC accumulation goal. Given this efficiency, Metaplanet additionally raised its full-year income and working revenue forecasts.

Metaplanet Q3 Bitcoin Income Jumps 115.7%, Doubles Full-Yr Forecast

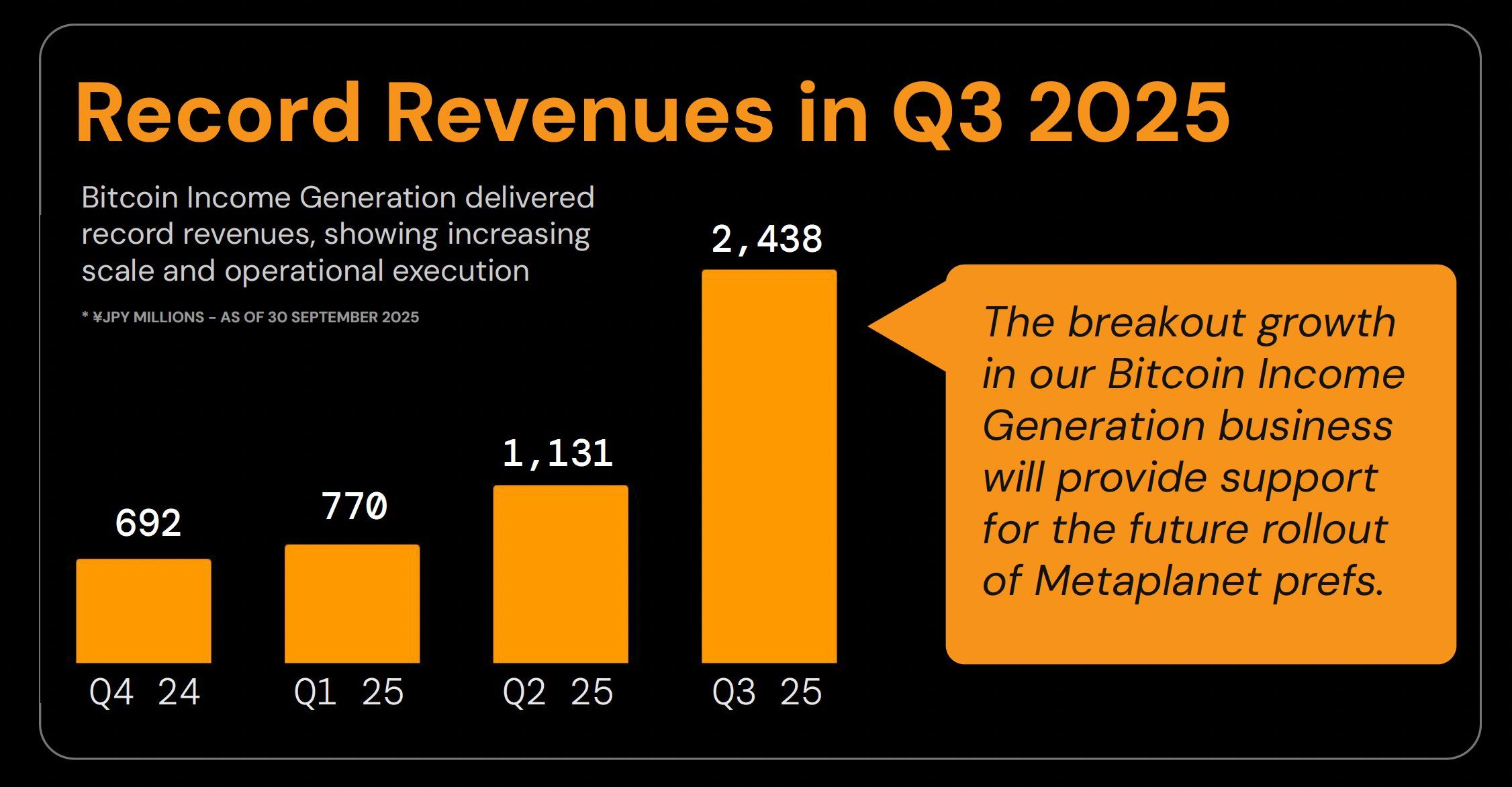

CEO Simon Gerovich revealed that in Q3 the agency pulled in ¥2.438 billion ($16.56 million) from its Bitcoin Revenue Era section. This was greater than double the ¥1.131 billion (7.69 million) recorded in Q2. Moreover, when in comparison with Q1, the agency’s income has a notable 216.6% enhance.

Metaplanet’s Bitcoin Income. Supply: X/Simon Gerovich

On the again of those outcomes, the Tokyo-based agency doubled its full-year income forecast to ¥6.8 billion, up from ¥3.4 billion beforehand projected. It additionally raised its working revenue steering to ¥4.7 billion from ¥2.5 billion.

The revisions characterize a 100% enhance in anticipated income and an 88% soar in projected revenue in comparison with earlier estimates. This alerts rising confidence within the firm’s core technique of positioning Bitcoin on the heart of its monetary mannequin.

“Q3 outcomes exhibit operational scalability and strengthen the monetary basis for our deliberate Metaplanet most popular share issuance, which helps our broader Bitcoin Treasury technique,” Gerovich wrote.

In addition to the income milestones, in Q3, Metaplanet additionally accomplished its goal of accumulating 30,000 Bitcoins by 2025. As of September 30, the corporate held 30,823 Bitcoins.

The most recent buy of 5,268 BTC for roughly $615.67 million pushed the agency’s holdings previous the goal. Moreover, the stack positions Metaplanet because the fourth-largest publicly listed Bitcoin holder globally.

🪜Metaplanet is now the 4th largest publicly-traded Bitcoin treasury firm on this planet pic.twitter.com/kg8quw2JYR

— Simon Gerovich (@gerovich) October 1, 2025

Now, it solely trails behind (Micro) Technique, Tesla, and XXI, in response to business tracker BitcoinTreasuries. Furthermore, Metaplanet’s Bitcoin treasury represents over 0.1% of the cryptocurrency’s complete provide.

The corporate’s year-to-date Bitcoin yield now stands at 497.1%, with an total common acquisition value of $107,912 per Bitcoin throughout its holdings.

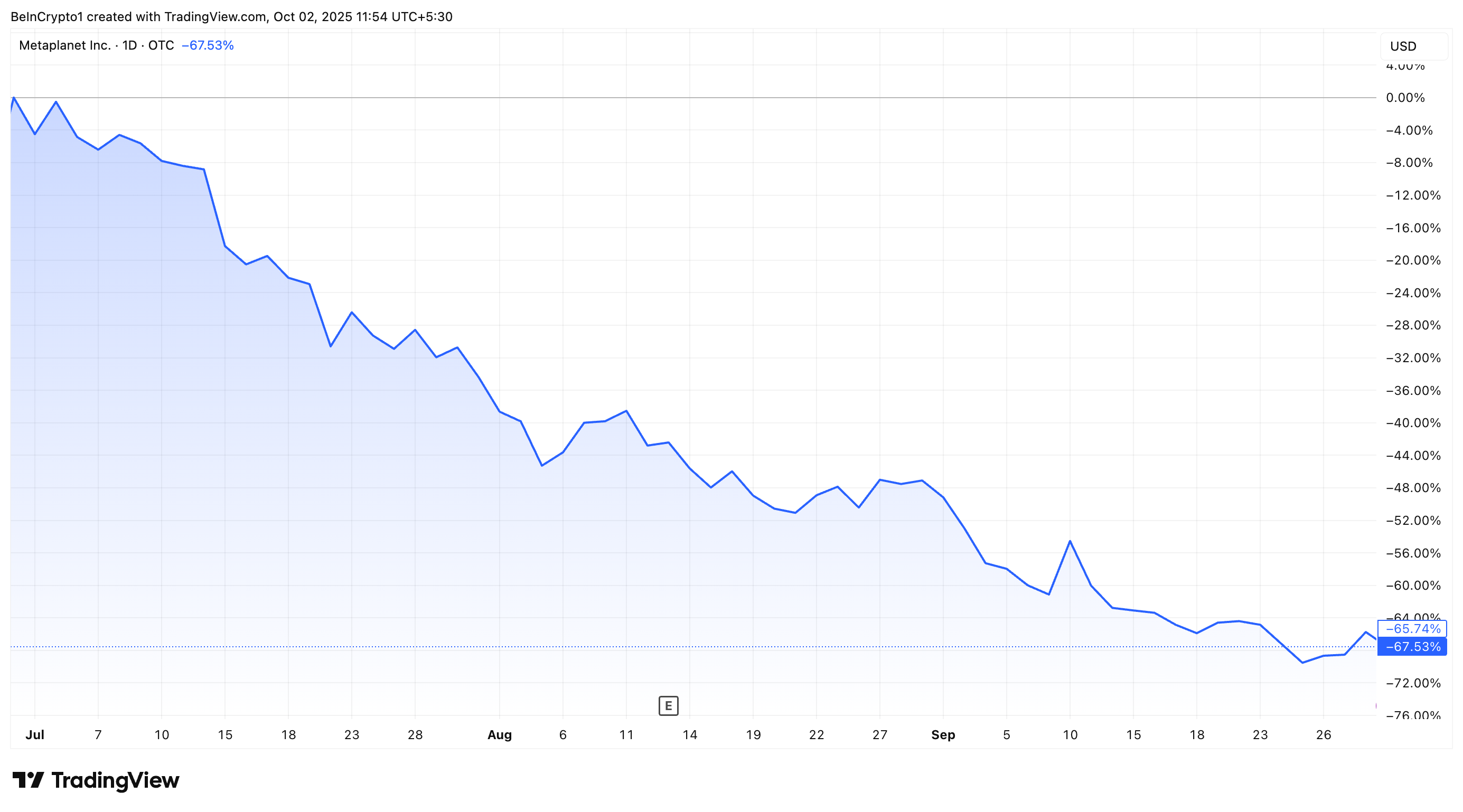

Regardless of operational success in Q3, the inventory efficiency revealed a very completely different image. Market information revealed that inventory costs dipped 67.5% between July and September.

Metaplanet Inventory Efficiency In Q3. Supply: TradingView.

In distinction, Coinglass information confirmed that Bitcoin itself closed Q3 with a 6.31% acquire. The sharp sell-off underlines the problem Metaplanet faces in aligning its operational achievements with investor confidence, even because it cements its position as one of many world’s largest company Bitcoin holders.

The submit Metaplanet Bitcoin Income Jumps 115.7% as Inventory Plunges 67.5% in Q3 appeared first on BeInCrypto.