Matt Hougan, Bitwise’s Chief Funding Officer, posted a quick, bullish notice on social media on Oct 6, 2025, writing “$1 trillion inbound….”

Primarily based on reviews, that brief message kicked off recent protection and debate about how giant Bitcoin-focused funds may get if present traits proceed. Bitcoin was buying and selling close to a recent excessive on the time, which helped the remark unfold shortly.

Context Round The Declare

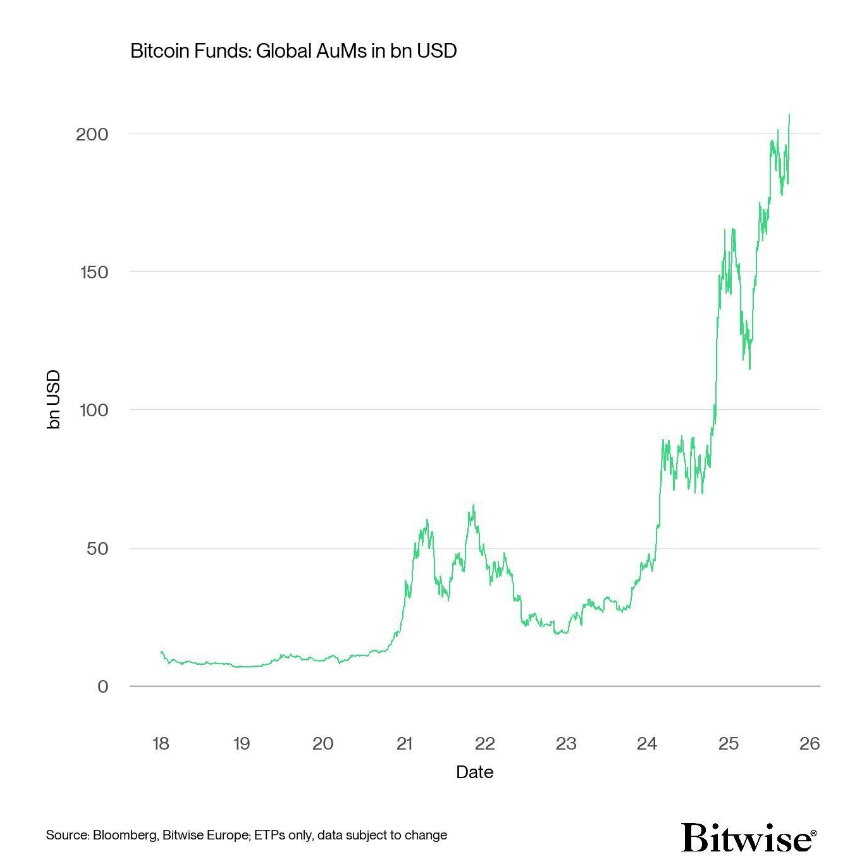

Bitcoin hit a brand new all-time excessive of $126,080 on Oct 7, 2025. On the similar time, information cited by a number of retailers put international Bitcoin fund belongings underneath administration at about $200 billion.

These two figures had been utilized by many market watchers to offer the $1 trillion comment context: greater costs + rising fund flows = a a lot bigger marketplace for managed Bitcoin merchandise.

$1 trillion inbound…. https://t.co/6qTb3cOqg9

— Matt Hougan (@Matt_Hougan) October 6, 2025

Hougan’s submit was not an in depth forecast. It was brief and casual. In keeping with protection, many crypto websites merely reposted the message and tied it to latest ETF inflows and renewed institutional curiosity.

The submit didn’t embody a timetable or the assumptions required to get from roughly $200 billion to $1 trillion, and the shortage of element left room for analysts to disagree.

Market Reactions And Warning

A number of mainstream retailers handled the comment as bullish however urged warning. Reuters and different retailers identified that institutional adoption continues to be restricted when in comparison with conventional asset lessons.

In keeping with some analysts, attending to $1 trillion in Bitcoin fund AUM would imply an enormous, sustained shift by giant buyers similar to pension plans and massive wealth managers, not solely short-term retail shopping for or a single robust month of inflows.

Easy Math, Large Gaps

If international fund AUM is about $200 billion now, reaching $1 trillion would imply a development of 5 instances that stage. That suggests including roughly $800 billion in belongings to crypto funds.

These aren’t small sums. They might require constant flows over many months or years, plus decisions by huge establishments to allocate significant parts of their portfolios to Bitcoin.

What Wants To Occur

Analysts say a number of issues must occur for that state of affairs to play out. Primarily based on reviews, regulators would want to remain predictable, extra giant cash managers must supply and scale Bitcoin merchandise, and main institutional buyers must shift a part of their capital towards these funds.

Hougan’s brief message has, at minimal, renewed a public dialog about how huge Bitcoin funding merchandise would possibly grow to be.

Featured picture from Wallpapers.com, chart from TradingView