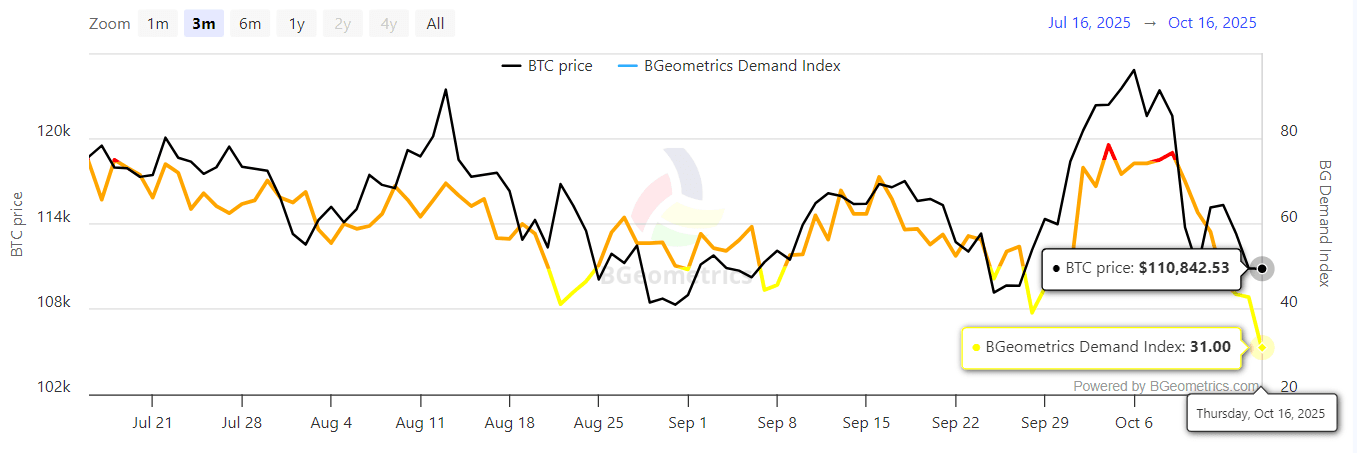

Bitcoin Demand Falls Sharply

Current knowledge from BGeometrics exhibits a major drop in $Bitcoin demand, with the BGeometrics Demand Index falling to 31, its lowest degree in weeks. This decline coincides with Bitcoin’s worth slipping to round $110,842, reflecting a rising disconnect between curiosity and worth assist.

BTC demand index – BGeometrics

The demand curve, which measures community and buying and selling exercise relative to market urge for food, usually acts as a number one indicator. When demand weakens, it suggests merchants are much less keen to purchase at present ranges — a warning signal that always precedes deeper worth corrections.

Understanding the Provide and Demand Dynamics

Bitcoin’s worth is in the end set by the steadiness between provide and demand — one of many core rules of market economics.

- When demand rises (extra consumers than sellers), the value will increase as consumers compete for restricted provide.

- When demand falls (extra sellers than consumers), costs drop till equilibrium is restored.

Not like conventional property, Bitcoin’s provide is fastened at 21 million cash, making demand fluctuations the dominant driver of short-term volatility. Due to this fact, sharp declines in demand indices can have an outsized influence on BTC’s worth path, as fewer individuals are keen to soak up promote strain.

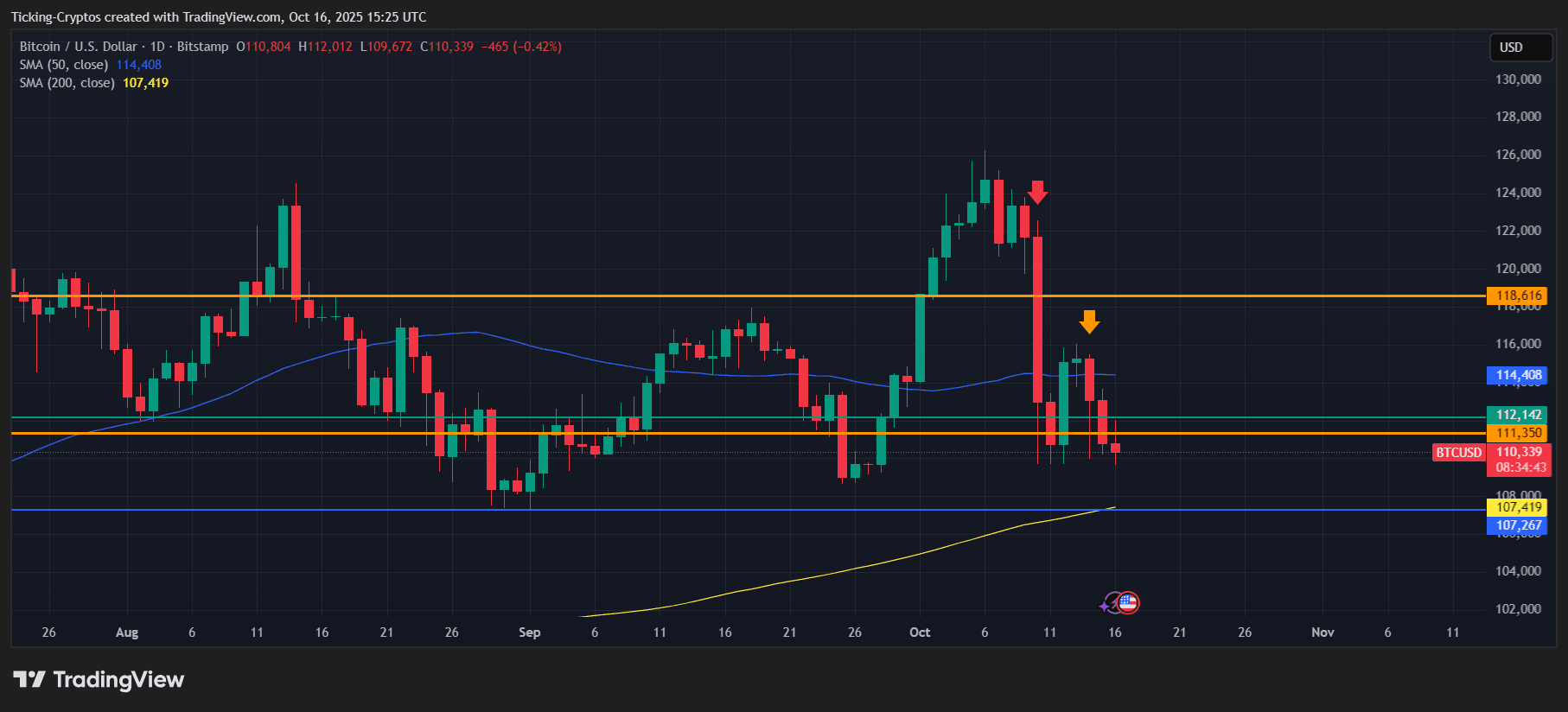

Bitcoin Worth Evaluation: BTC Struggles Close to $110K

The most recent Bitcoin day by day chart displays this weakening demand:

- $BTC is buying and selling round $110,339, hovering simply above the 200-day SMA at $107,419 — a vital long-term assist degree.

- The 50-day SMA at $114,408 now acts as sturdy resistance, capping any makes an attempt to interrupt larger.

- Worth repeatedly didn’t reclaim the $112,000–$114,000 zone, indicating waning bullish momentum.

- A sustained shut beneath $111,000 might open the door to a retest of $107,000, and even $104,000 if market sentiment deteriorates additional.

BTC/USD 1-day chart – TradingView

For now, Bitcoin’s restoration relies on a resurgence of shopping for curiosity. With out renewed demand, any short-lived bounce is prone to face promoting strain across the $114K resistance.

Bitcoin Future: What to Count on Subsequent

If the BGeometrics Demand Index continues to pattern downward, Bitcoin might stay beneath bearish management within the quick time period. Nevertheless, if the index stabilizes close to present ranges and rebounds, it would mark the start of a consolidation section earlier than the following main transfer.

Merchants ought to watch:

- Demand Index restoration above 50 → potential bullish reversal

- Break beneath 107K assist → seemingly continuation towards 102K

For now, the shortage of demand suggests the market stays cautious, presumably awaiting clearer macro alerts earlier than committing to new positions.