A majority of institutional and non-institutional traders preserve an optimistic outlook on Bitcoin for the subsequent three to 6 months. This discovering comes from a joint report launched Monday by Coinbase and the on-chain knowledge platform Glassnode.

The report signifies a “cautiously optimistic stance” for the cryptocurrency market within the fourth quarter of 2025.

Close to-Time period Good points, However an Finish in Sight?

The report identifies a number of tailwinds supporting a Bitcoin upswing. These embody strong world liquidity, a powerful macroeconomic background, and favorable regulatory dynamics.

Nonetheless, the authors mood this optimism by pointing to the necessity for a cautious market strategy. This warning follows the large $19 billion leverage flush occasion on October 10.

A key investor focus, the US Federal Reserve’s rate of interest coverage, is anticipated to see two additional price cuts this yr. Coinbase tasks that these two cuts might appeal to roughly $7 trillion at the moment held in Cash Market Funds (MMFs) again into risk-on belongings.

Liquidity Squeeze Forward

On the liquidity entrance, the worldwide M2 cash provide index, a key measure of worldwide liquidity, confirmed optimistic indicators initially of the quarter. Nonetheless, the state of affairs has since shifted.

The report warns {that a} liquidity contraction is anticipated in early November. That is because of the mixed results of the US authorities shutdown and the Federal Reserve’s Quantitative Tightening (QT).

Beware the Macroeconomic Headwinds

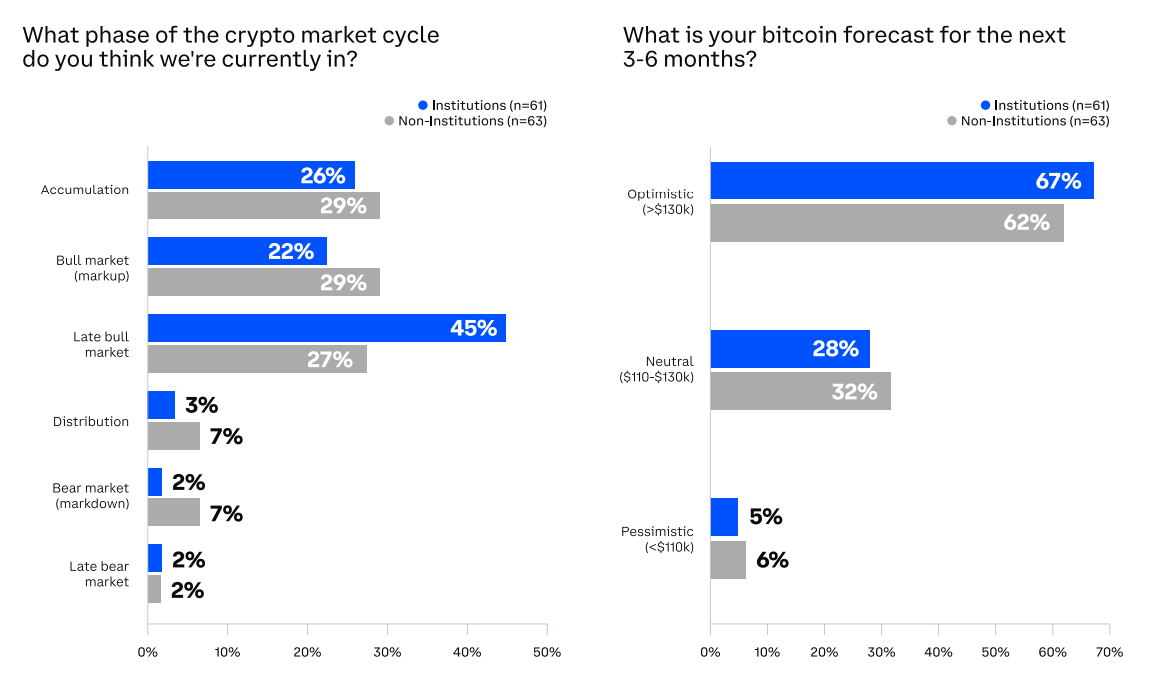

The report cites a survey of 120 world traders, revealing that 67% of institutional traders and 62% of non-institutional traders are optimistic about Bitcoin’s prospects over the subsequent 3 to six months.

Nonetheless, a transparent distinction emerges concerning the cycle’s sustainability. Practically half (45%) of institutional traders imagine the market is within the “late-stage bull.” That is signaling an expectation that the expansion cycle will quickly conclude. In distinction, solely 27% of non-institutional traders share this view.

When requested concerning the main “Tail Threat” for the crypto market within the close to time period, each institutional (38%) and non-institutional (29%) respondents cited the macroeconomic setting. This means a shared concern amongst totally different investor teams.

Then again, it’s also essential to notice that this survey was performed between September 17 and October 3, earlier than the October 10 crash.

Analysts Stand By Lofty Yr-Finish Forecasts

The “Uptober” rally that many traders anticipated seems to be faltering amid the sudden escalation of US-China tensions. Consequently, year-end Bitcoin value forecasts from main monetary establishments are below intense scrutiny.

In early October, Citigroup projected a year-end Bitcoin value of roughly $133,000, conditional on continued ETF inflows and elevated demand from DAT corporations. Normal Chartered provided a fair increased forecast, predicting Bitcoin might hit $200,000 if weekly ETF inflows preserve the $500 million stage.

Equally, JPMorgan projected a year-end value of $165,000, arguing that Bitcoin was undervalued relative to gold. Goldman Sachs additionally appeared to gold for a reference level, suggesting that if gold had been to succeed in $5,000 per ounce, Bitcoin might probably surge to $220,000.

The put up Establishments Keep Optimistic, However Bitcoin’s Bull Run Could Be Nearing Its Peak appeared first on BeInCrypto.