Ethereum is exhibiting indicators of power once more because it makes an attempt to reclaim key resistance ranges after a pointy early-October drop. The bounce from the decrease boundary of the descending channel has introduced it again towards $4,150. Momentum is constructing, however the market stays cautious forward of key resistance ranges.

Technical Evaluation

By Shayan

The Day by day Chart

On the every day chart, the asset is retesting a provide zone slightly below the highest of the descending channel. The rejection wicks from final week confirmed clear vendor curiosity, however as we speak’s candle is pushing again into that area, suggesting a possible breakout try.

The 100-day shifting common, situated round $4,150 mark, is performing as resistance for now, whereas the 200-day shifting common sits a lot decrease, across the $3,300 mark. If ETH manages to shut above $4,200 and the upper boundary of the sample, the following take a look at will doubtless be round $4,600. But, consumers nonetheless want stronger affirmation.

The 4-Hour Chart

On the 4-hour chart, ETH pierced into the orange provide zone at $4,200, however is going through a fast rejection. This zone is slightly below the highest of the descending channel, including extra confluence.

The RSI additionally printed an overbought sign and has turned down from these elevated ranges, indicating a possible short-term pullback or consolidation. Nevertheless, greater lows are nonetheless forming, and the latest rally from $3,600 has been sharp, exhibiting aggressive consumers stepping in on dips.

Sentiment Evaluation

Funding Charges

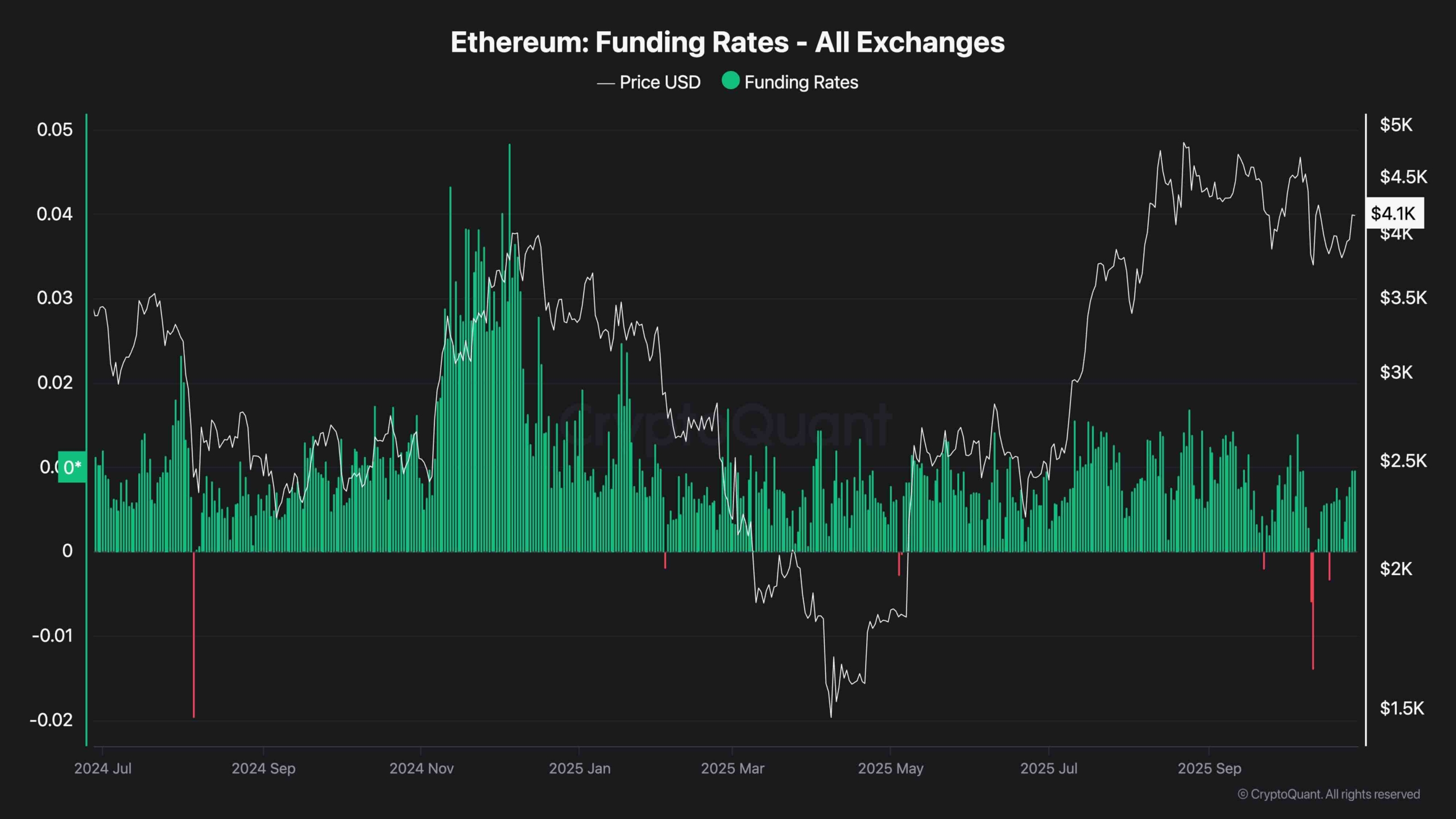

Sentiment throughout the Ethereum futures market is exhibiting indicators of rising optimism, however it has not but reached a harmful degree. Funding charges have turned persistently constructive after some important unfavorable prints, particularly throughout the September and early October dip.

This means that extra merchants are positioning lengthy, anticipating additional upside. Nevertheless, funding isn’t excessively excessive, that means the market hasn’t but entered a euphoric or over-leveraged section. That’s a wholesome signal for continuation, particularly if the worth manages to interrupt above the present resistance vary.