BTC takes a extra sturdy place towards gold and can purchase 28 ounces. The change occurred as spot gold dipped below $4,000, whereas BTC recovered to over $115,000.

One BTC now buys slightly over 28 ounces of gold, after the valuable metallic dipped below $4,000. Spot gold traded at $3,987.28, extending its slide from the previous week. Whereas each BTC and gold are seen as a part of the ‘debasement commerce’, the belongings additionally noticed speculative buying and selling close to their latest peaks.

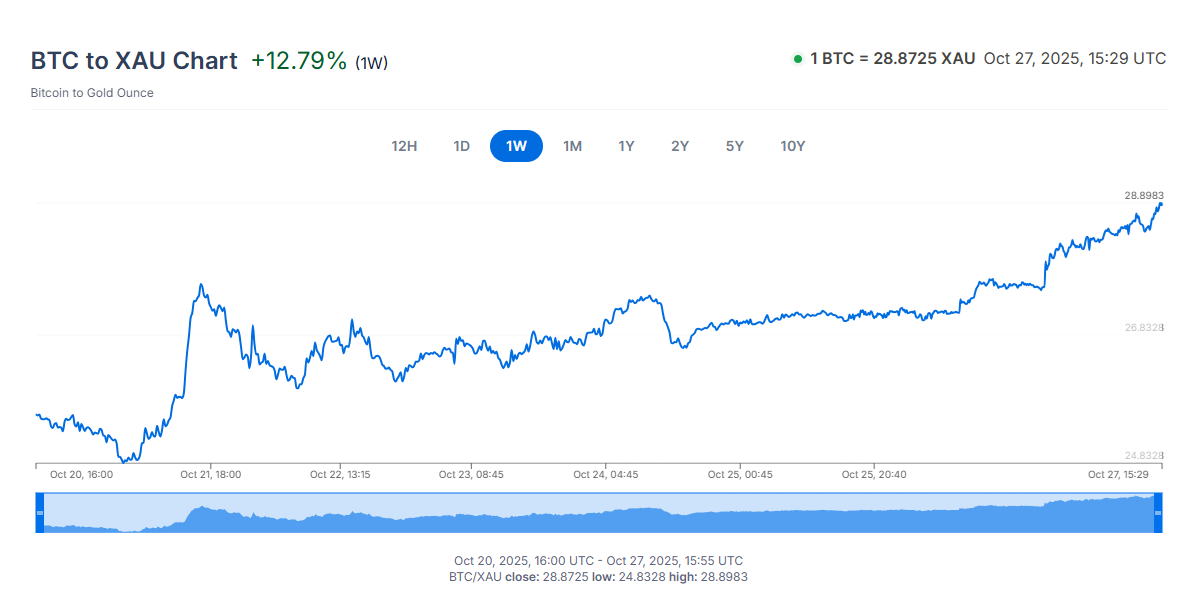

BTC superior towards gold, returning to the degrees of November 2024. | Supply: XE

As Cryptopolitan reported earlier, gold’s rally was seen as a hedge towards different unstable belongings, however the worth information held important dangers. Gold was down 9% from its latest peak, however misplaced over 12% towards BTC previously week.

In the course of the newest market downturn, BTC was thought of undervalued towards gold. Now, the 2 belongings could rebalance their market capitalization. The whole market cap of gold can be seen as a possible goal for BTC, particularly if extra broadly adopted as a reserve asset.

Following a interval of turbulence for each gold and BTC, the belongings returned to a ratio not seen since November 10, 2024. BTC remains to be down on a month-to-month foundation, after shopping for as much as 32 ounces of gold as of October 5. Nonetheless, the latest pattern reversal reveals gold is not the highest focus, and BTC could reply with a much bigger rally.

Gold expects a much bigger correction within the coming week

Because the hype round gold subsides, analysts anticipate a continued correction within the coming weeks.

‘I feel lots of people within the business would truly welcome a deeper correction than we have now in the intervening time,’ stated John Reade, market strategist on the World Gold Council, cited by the Monetary Occasions.

Gold was at one level anticipated to broaden to $5,000, however the rally’s irrationality meant the climb was not sustainable.

Tokenized gold additionally retreated, with most tokens falling to the $3,800 vary. The one exception was the UGOLD token, which continued to commerce above $4,300, although with low volumes and small market depth.

BTC stays the 12 months’s greatest winner

BTC is now up 69% for the 12 months up to now, with a small internet acquire in October. There is no such thing as a clear consensus on whether or not BTC is a safe-haven asset, an inflation offset, or a dangerous asset.

BTC remains to be forward of all different conventional belongings, because the digital asset expanded towards gold. | Supply: WickedSmartBitcoin

The main digital coin was at one level briefly surpassed by silver. Now, BTC is as soon as once more forward of treasured metals.

Gold is up a internet 45.9% for the 12 months up to now, whereas silver gained a internet 37.5%. The short-term demand for bodily treasured metals was additionally not sufficient to maintain the growth of metals. The latest correction in gold and the drop in silver to $ 46.40 are seen as potential components redirecting liquidity to different belongings, together with BTC and cryptocurrencies.