As Ethereum continues to garner investor curiosity, outpacing Bitcoin in key metrics, the second-largest cryptocurrency by market capitalization has continued to take care of the world’s largest cryptocurrency on the CME derivatives market.

In line with current information shared by the CME Group, Ethereum futures have considerably surpassed Bitcoin futures in derivatives buying and selling exercise.

Ethereum Futures units new document in open curiosity

Knowledge supplied by the supply exhibits that Ether futures on the main derivatives alternate have outpaced Bitcoin futures in month-to-month common each day quantity (ADV) since April 2025.

Whereas Ethereum has been within the highlight this yr, with establishments diverting from Bitcoin to proudly owning an Ethereum treasury, its excellent efficiency on the CME derivatives alternate additional signifies rising institutional demand for Ethereum publicity.

Amid the rising curiosity amongst establishments, CME additional revealed that open curiosity in ETH futures has reached a large 53,183 contracts, whereas Micro Ether futures climbed to a document 335,016 contracts as of October 28, each setting new all-time highs.

The Bitcoin and Ether futures “month-to-month common each day quantity (ADV)” disclosed by the alternate present that ETH’s buying and selling quantity broke above BTC’s for the primary time in April 2025, and it has continued to guide the crypto king since that point. Notably, the transfer indicators a rising divergence in market focus from Bitcoin to Ethereum.

Whereas Bitcoin futures exercise has leveled off after a powerful first half of the yr, Ethereum’s momentum has remained resilient because it continues to construct—attributable to the expansion in DeFi, staking yields, and surging optimism of additional institutional adoption of the main altcoin.

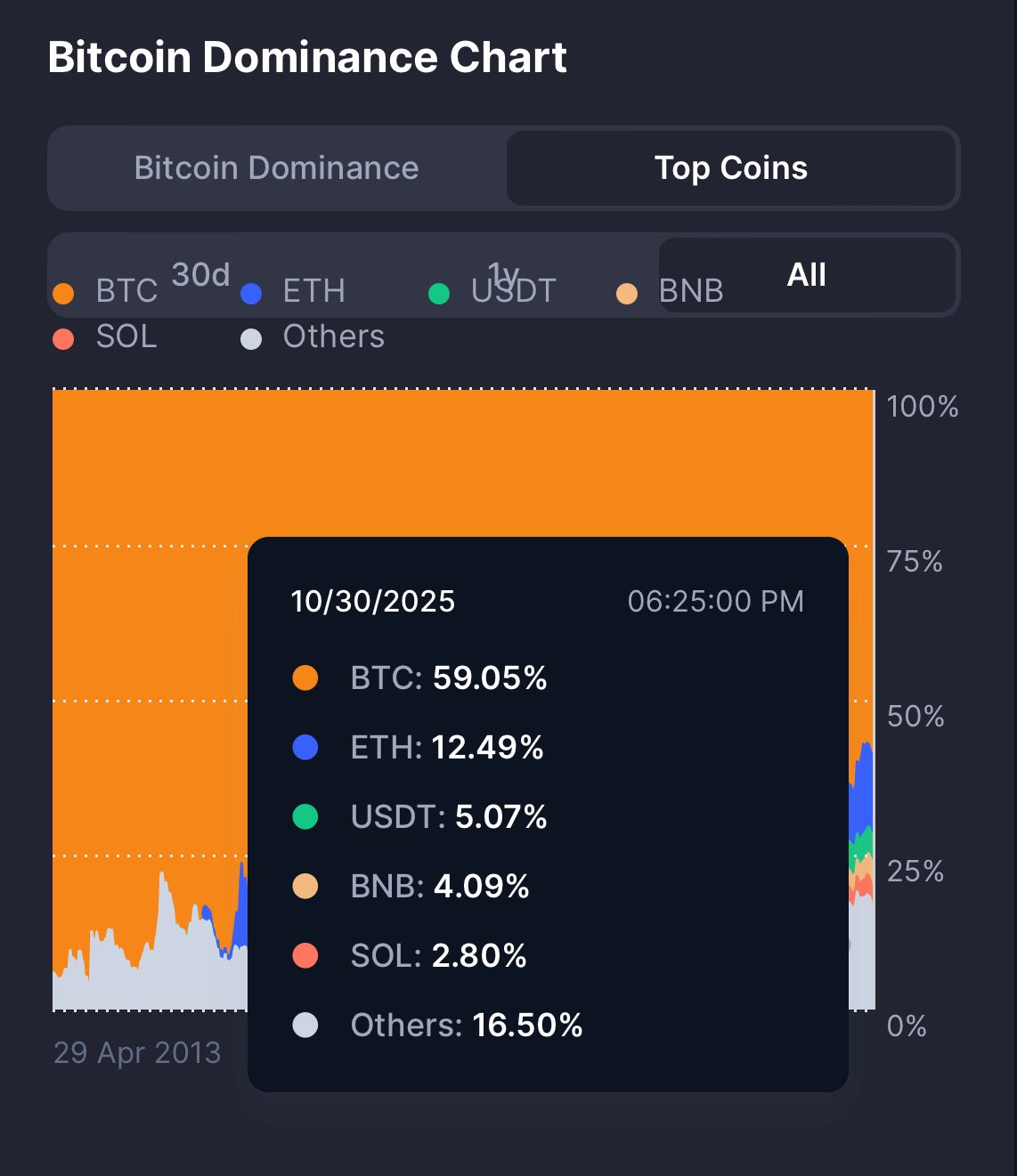

Bitcoin maintains dominance

Regardless of the spectacular efficiency witnessed in Ethereum’s futures exercise, Bitcoin nonetheless maintains its dominance throughout the broad spot buying and selling market.

Knowledge supplied by CoinMarketCap exhibits that Bitcoin nonetheless holds the very best market share within the broad cryptocurrency market. As such, Bitcoin’s whole market capitalization is at the moment greater than the whole market capitalization of all cryptocurrencies mixed by a large 59.2%.

This exhibits that Bitcoin has seen a light enhance of 0.87% in its dominance charge during the last 24 hours regardless of the recurring value corrections.