- Bitcoin value drives a mid-term sideways development with an increasing channel sample.

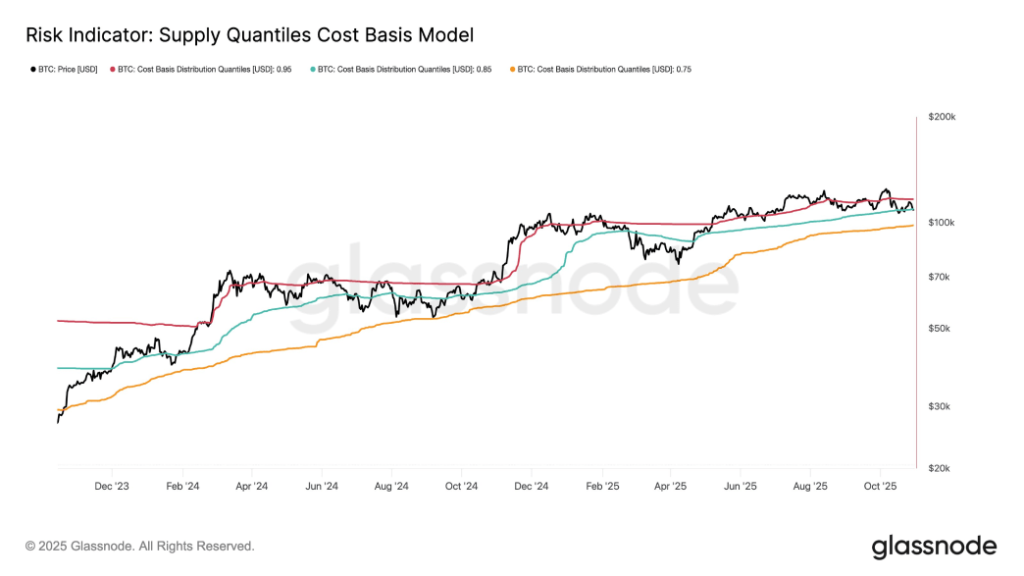

- BTC is again to the 0.85 cost-basis band close to $109K, a area traditionally considered as a important pivot zone.

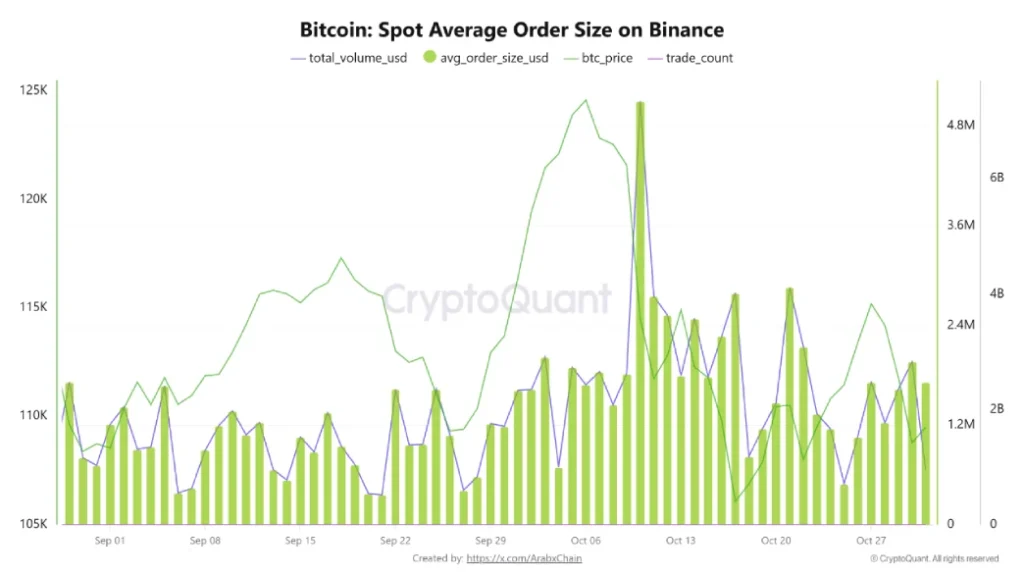

- October recorded one of many highest common order sizes in current months, marking an uptick in whale-driven trades.

The pioneer cryptocurrency, Bitcoin, jumped practically 1.5% on Friday to commerce at $109,870. The shopping for stress doubtless got here as a reduction rally after a notable sell-off earlier this week. An extended rejection wick hooked up to the day by day candle indicators an intact overhead provide and a danger of additional correction. Whereas the downward trajectory should create concern amongst retail buyers, the bigger BTC holders are persevering with to build up extra cash, signaling their conviction for a bullish rebound within the close to future.

Whales Step In as Bitcoin Value Assessments $109K Ground After October Slide

October 2025 proved to be an sudden outlier for buyers, shattering the historic optimism usually tied to this month. The Bitcoin value is on observe to shut October with a 3.5% loss, as the worth at the moment trades at $109,476, and the market cap is at $2.18 trillion.

The worth pullback could be attributed to a number of components, together with geopolitical commerce conflict escalation, historic deleveraging of the crypto market on October tenth, technical breakdowns, and the current hawkish flip by the Federal Reserve.

Following this correction, the Bitcoin value retested the 0.85 cost-basis band round $109K, a zone that has repeatedly acted as a make-or-break stage. As shared evaluation from Glassnode information signifies, the coin value may resume a bullish rally if this stage holds. Nonetheless, a bearish breakdown beneath this ground may bolster an prolonged correction to the 0.75 band round $98,000.

Bitcoin’s current decline has pushed it again right down to a key on-chain value level of round $109,000—an space that has traditionally been the hallmark of main modifications in its market cycle. Knowledge collected by Glassnode has proven that this stage belongs to the 0.85 cost-basis band, which has traditionally divided intervals of strong recoveries from extra extreme corrections. There’s a lengthy historical past of the inventory falling beneath the band and persevering with to retrace right down to the .75 stage, which might be round $98,000.

Parallel market costs counsel growing institutional participation all through October. The typical spot commerce measurement of Bitcoin within the spot commerce pairs on Binance elevated dramatically to virtually $1.96 million, as measured by a CryptoQuant analyst. This determine is without doubt one of the largest seen in current months and signifies that high-cap buyers have been taking extra direct positions within the spot market.

Binance additionally noticed this institutional bias, with whole Bitcoin spot buying and selling quantity reaching round $2.82 billion. The rise in each commerce measurement and whole circulation signifies that bigger entities have been energetic regardless of contained value volatility.

Bitcoin Value to Prolong Correction Inside Channel Sample

This week, the Bitcoin value reveals a notable reversal from $116,381 to a present buying and selling value of $109,502, registering a lack of 5.91%. This pullback, backed by growing size of crimson candles and rising buying and selling quantity, accentuates the conviction from sellers to drive a protracted correction. Even the inexperienced candle in the present day reveals an 8.86% decline in buying and selling quantity, accentuating the weak arms from patrons.

At present, the BTC value challenges the assist of the 200-day exponential shifting common, with a possible breakdown looming. If materialized, the promoting stress would speed up and push the worth down by one other 5.3% to check the underside trendline of an increasing channel valued at $102,560.

Theoretically, the chart sample is characterised by two diverging trendlines, which create a better swing in value every cycle, reflecting market uncertainty. A possible breakdown beneath this stage would additional intensify the bearish correction in value beneath the $100k stage.

BTC/USDT -1d Chart

Quite the opposite, if the patrons handle to carry their assist, the Bitcoin value may rebound for a possible renewed restoration.